Following the bullish revival in the cryptocurrency market, the Theta Network token ($THETA) has contributed to the gains and rolled over 35% this week. Signs of pullback were observed, and the token moved across the 20-day EMA mark.

Still, the token was traded in a downtrend, and lower low swings were noted. A falling wedge pattern was observed on the chart, and buyers anticipate a breakout ahead.

The token has been in a downtrend for the past weeks and has retracted over 50% from its supply region of $3. However, the token completed its correction phase and was ready for a short-term reversal ahead.

Theta token made a double bottom around the $1.20 mark and revived from there. Once the cluster of $1.80 breaks, a potential upmove can be possible.

How Did $THETA Price Perform at Press Time?

The $THETA token was trading at $1.54 with an intraday surge of 3.86%, reflecting a pullback on the chart. It ranked 60th at press time with a total supply of 999.94 Million.

The pair of $THETA/$BTC was at 0.0000237 $BTC, and the market cap was $1.54 Billion. Analysts were neutral and suggested that the $THETA could register a falling wedge breakout and cross the $2 mark.

$THETA Price Action and On-Chain Metrics Insights

Per the daily charts, the $THETA token price retained the 20-day EMA mark and was eyeing to cross the 50-day EMA mark.

However, the short-term trend was bearish, and the bears maintained their grip. They prevented bulls from regaining dominance.

The RSI curve crossed the midline region and plotted a bullish crossover on the chart. The rising RSI meant buyers had gained traction, and the token could pick momentum ahead.

A Tweet by FLASH (@THEFLASHTRADING) indicated that the $THETA token was traded inside a falling wedge. It completed the correction wave and was ready to breach the trendline soon.

GM $Theta pic.twitter.com/IkSBRO8anI

— FLASH (@THEFLASHTRADING) July 17, 2024

A Tweet by @THEFLASHTRADING | Source:X

Per the daily chart, buyers needed to break and close above the cluster of $1.80 to retain their dominance. Uncertainty observed, and a lack of clarity resulted in a dilemma among the investors.

Social Dominance and Development Activity Noted a Dip

Theta Network’s development activity data conveyed weak growth aspects, and the value remained in the negative region around 0.048. It highlighted the short-term negative projections.

Similarly, the social dominance data indicated the investors’ losing interest in social media platforms. Additionally, a decline observed in their online discussion activity.

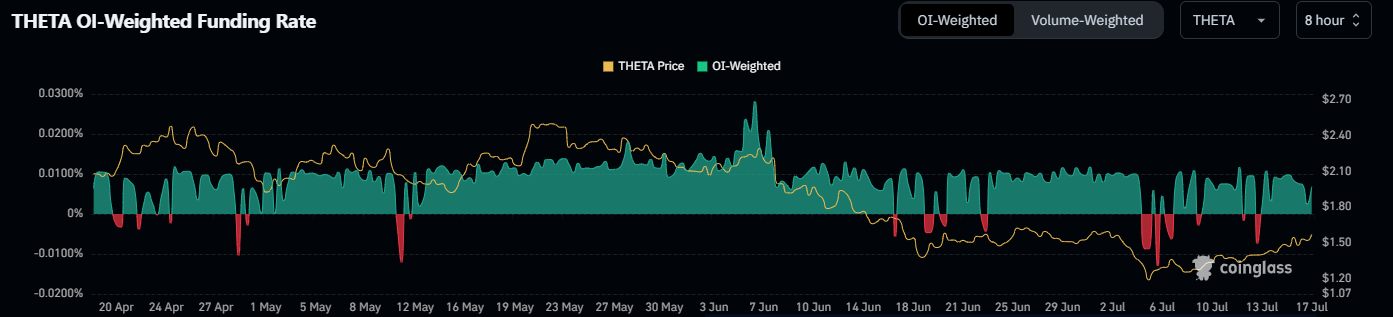

OI-Weighted Funding Rate Displayed a Bullish Outlook

Following the price reversal, the Oi-weighted funding rate observed a significant uptick, and the value stayed in the green, at 0.068%.

The positive value of the funding rate indicated that traders bet more on long trades and anticipated a potential upmove ahead.

The immediate support levels for the $THETA token were $1.20 and $1.00, whereas the key upside hurdles were around $1.80 and $2.

Is the $THETA Price Eyeing a Breakout?

The $THETA token price climbed above the 20-day EMA mark and hovered around the 50-day EMA. The token still traded inside the falling wedge, making lower low swings. Above the $1.80 mark, fresh buying momentum and a breakout might be possible.

thecoinrepublic.com

thecoinrepublic.com