The Near Protocol ($NEAR) price has surpassed its previous swing high of $5.5 and was eying upward for further advancement in the coming sessions. It ranked 17th globally among the top 20 cryptocurrencies at press time.

It had a market cap of $6.769 Billion, and a spot volume of the past 24 hours was $410.621 Million. The price appeared to have low to moderate liquidity, as the ratio between its 24-hour volume-to-market cap stood at 6.01%.

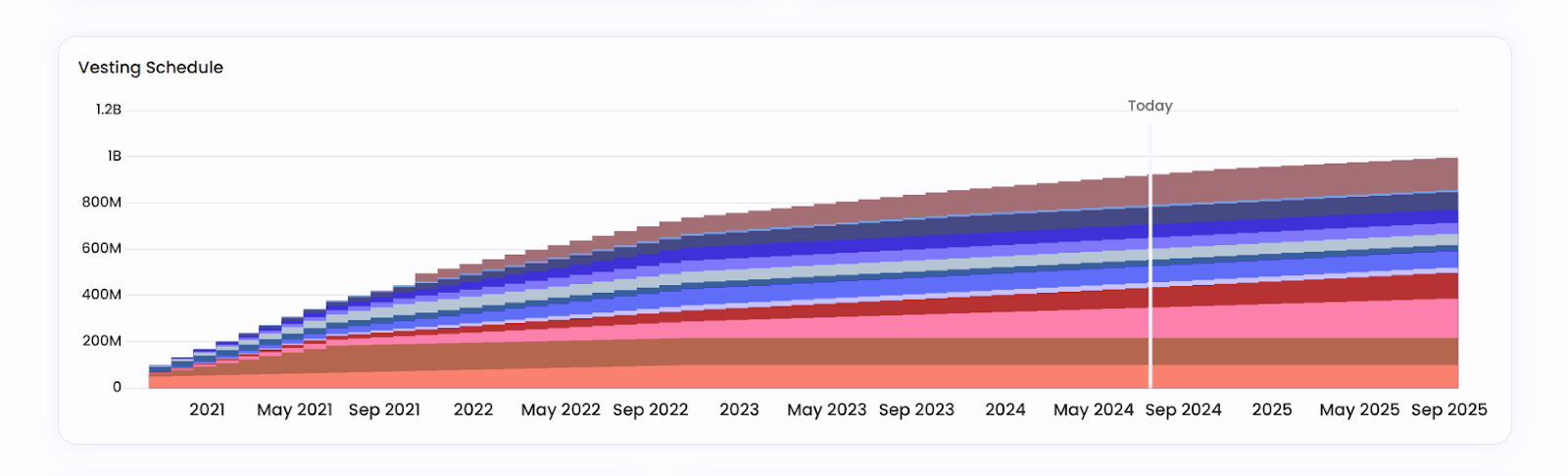

As per the tokenomics of Near Protocol, 1.102 billion coins (nearly 92%) were circulating in the market out of the total supply of 1.2 billion coins.

According to the daily chart, $NEAR marked an all-time high (ATH) of $9.0 on March 15th, 2024. Its current price traded nearly 30% below the peak level.

Meanwhile, the all-time low (ATL) was recorded on October 15th, 2024, where the low was at $0.970. Comparatively, the current price traded 500% above the ATL.

Monitoring the $NEAR Derivatives Data Analysis

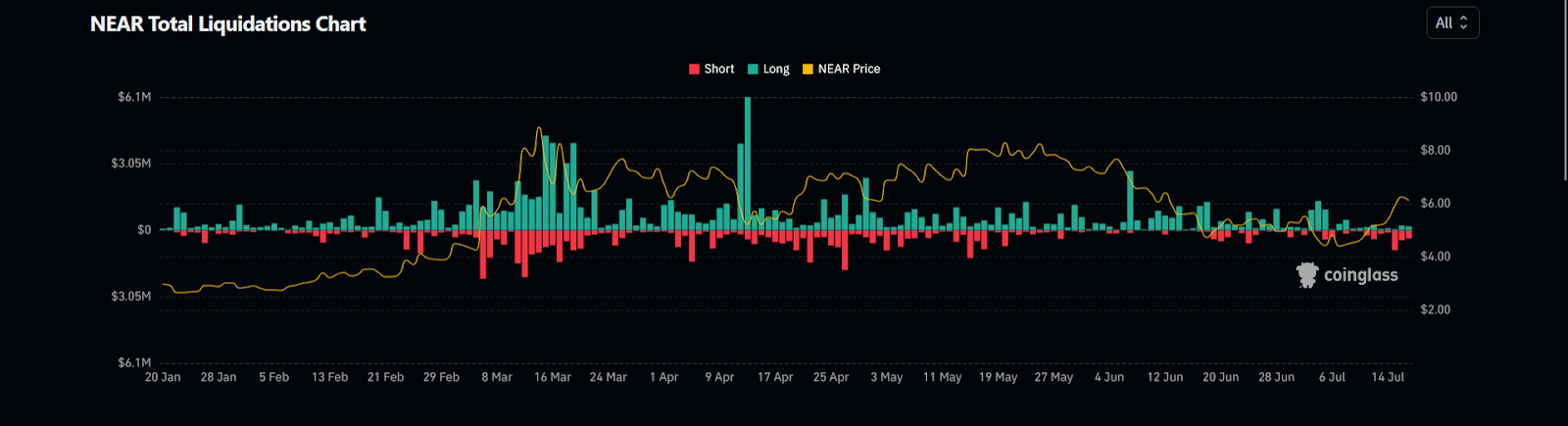

Per CoinGlass, the $NEAR derivatives data analysis highlighted that its open interest (OI) was $207.81M within 24 hours. It showed a 2.13% advancement. Meanwhile, the volume of derivatives was $521.28 Million.

Additionally, the 0.941 long/short ratio of 24 hours signified more shorts than longs in the crypto. The liquidated shorts were more than longs after a long bearish dominance from the last two weeks.

Meanwhile, the volume of derivatives amounted to $521.28 Million.

Additionally, the 0.941 long/short ratio of 24 hours signified more shorts than longs in the crypto. The liquidated shorts were more than long after a long bearish dominance from the last two weeks.

$NEAR">

$NEAR">

The shorts amounted to $558.99K, and the longs amounted to $236.78K. Overall, derivatives data analysis highlighted the continuation of bullish momentum at the time of writing.

$NEAR Protocol Project’s Fundamentals & Other Factors

The platform is built to provide the best possible experience for users and developers. $NEAR Protocol is designed to provide a simple, secure, and scalable blockchain.

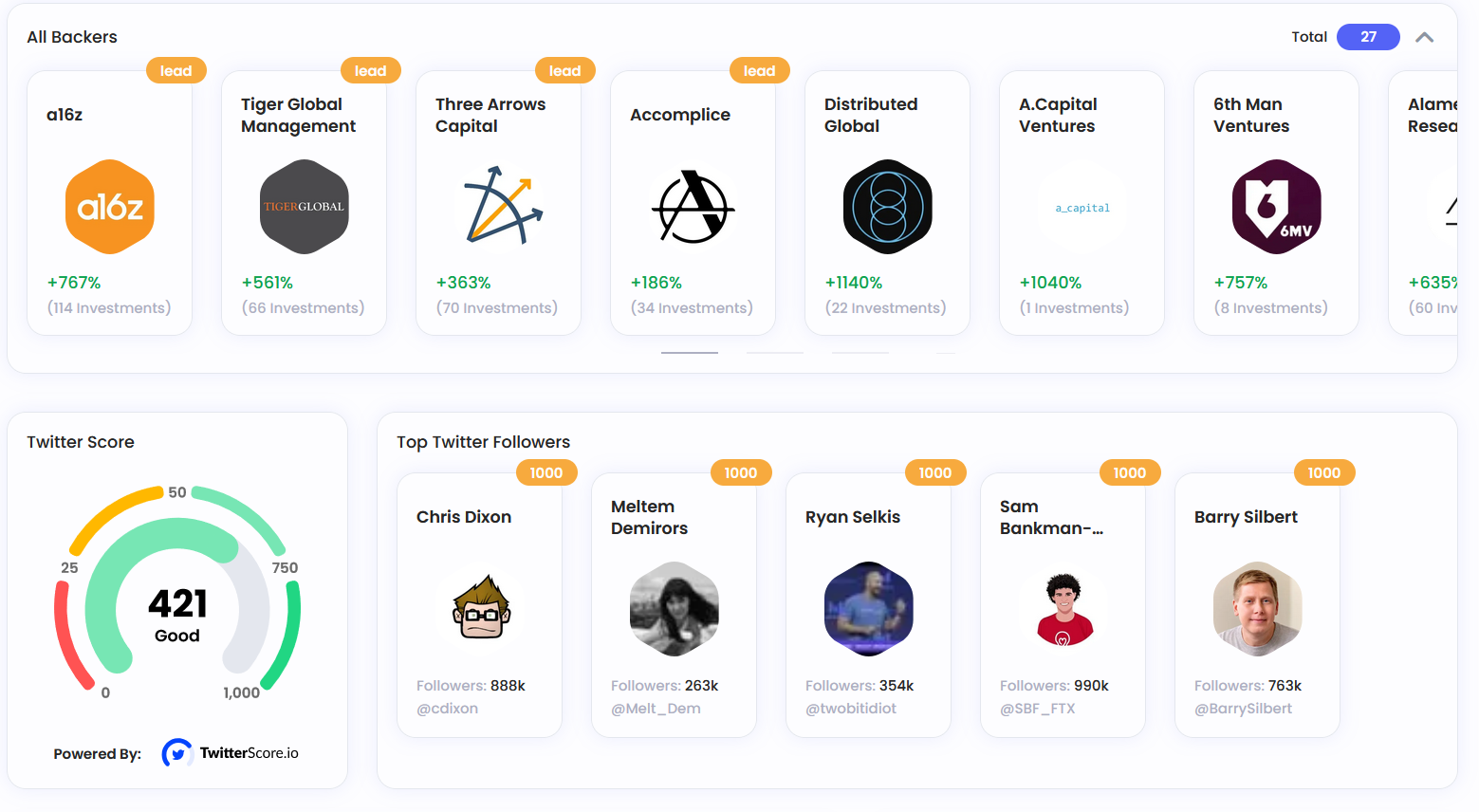

Beyond this, the project’s involvement in its development activity, social community, and online presence scored 10 out of 10. It also had a good Twitter score of 421 out of 1000, with significant followers like @sambankman, @ChrisDixon, and many more.

$NEAR">

$NEAR">

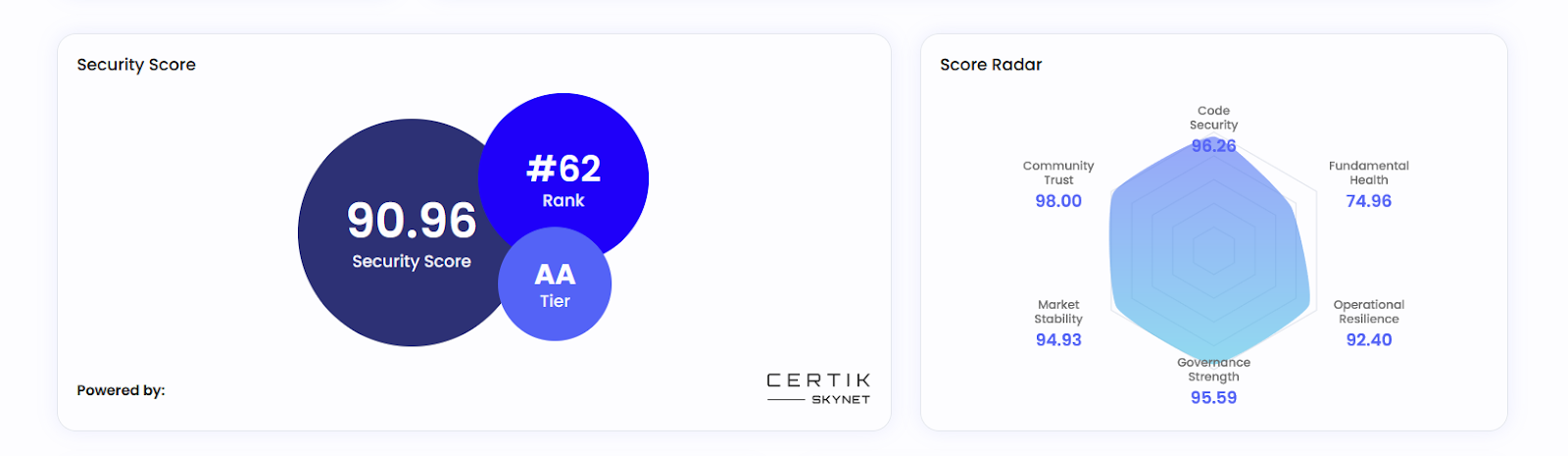

Moreover, the $NEAR coin has 27 backers, and the leading ones are A16z, Tiger Global Management, Three Arrows Capital, Accomplice, and Distributed Global. The security score produced by CertiK Skynet highlighted that $NEAR had an ‘AA’ tier security score of 90.96.

$NEAR">

$NEAR">

After evaluating the $NEAR based on backers’ quality, security measures, and value generation, it received a 9.20 out of 10. The project’s fundamental solidity also contributed to its high rating.

Similarly, its market, financial health, and performance metrics were 9.95 and 10, respectively.

$NEAR ">

$NEAR ">

Additionally, the Vesting Schedule will end next year in September 2025, when it will increase its supply to 1.0 Billion from current circulation.

Decoding the $NEAR Price Technical Chart in Daily Time Frame

From the low of $0.970 on October 15th, 2023, the price peaked more than 800% to $9.0 on March 14th, 2024. Thereon, the Bitcoin price declined, and a broader market followed, resonating with the godfather of global crypto.

In the process of rising and declining, two major zones were developed, where the supply was built around $8.5, and demand was built around $4.0.

The $NEAR pricerecently jumped from the demand zone as $BTC sustained and rose. The gain during the past 12 days from where $BTC showed sustenance was 62%.

At press time, the EMA bands support the price as it moves past them. MACD highlighted a histogram at 0.225, and the RSI was at 62.57. Those indicators were bullish at the time of writing when the price last traded at $6.132.

Therefore, if the price keeps rising, the resistances would be at $7.0 and $9.0, respectively. However, if the price declines, the support would be at $5.5 and $4.5, respectively.

The $NEAR Coin Price Has Been Upward

The Near Protocol coin’s price has increased and reached above its previous high of $5.5. Analysts saw the potential for further growth, with technical indicators suggesting a surge towards $7.0 or even $9.0.

The current $NEAR price was $6.132, with support levels at $5.5 and $4.5 in case of a decline.

thecoinrepublic.com

thecoinrepublic.com