$NEAR price has had an impressive run these past few days, but the altcoin could now face some resistance before continuing its rise.

The intensely bullish cues and weak bearish cues will prove to be contributing factors to the altcoin reclaiming a crucial level of support.

Near Bears Sent Packing

The recent surge will likely benefit $NEAR, as it would result in an increase in price. The sharp uptick in the Chaikin Money Flow (CMF) indicates a sudden rise in inflows for $NEAR. This surge in inflows is a clear sign that demand for $NEAR is on the rise, reflecting growing investor interest and confidence in the asset.

The increasing demand for $NEAR is a positive development, suggesting that more investors are buying into the asset. This trend could lead to a further appreciation of $NEAR’s value as market sentiment becomes more favorable.

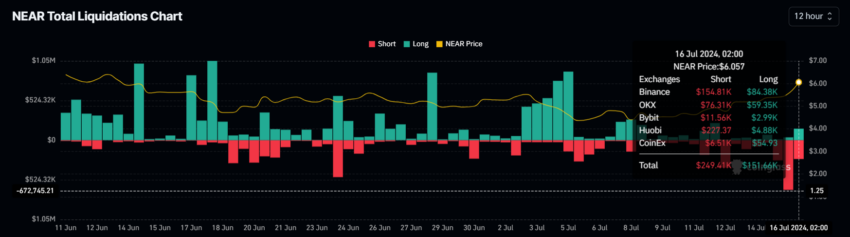

In addition to the rise in demand, short liquidations for the altcoin have nearly reached $1 million over the last 24 hours. This significant level of liquidations shows the intense market activity surrounding $NEAR, as short sellers are forced to cover their positions.

The substantial amount of short contracts being liquidated may discourage further bearish attempts on the asset. As a result, this could lead to greater price stability and potentially foster a more bullish market sentiment for $NEAR in the coming days.

Read More: What Is $NEAR Protocol ($NEAR)?

$NEAR Price Prediction: Breaking the Barrier

Following the 37% rise in the last eight days, $NEAR price has risen to trade at $6.02 at the time of writing. In doing so, the altcoin also nearly breached the resistance at $6.06, coinciding with the 23.6% Fibonacci Retracement level.

This line is also known as the bear market support floor, and securing it would have enabled $NEAR to rally further.

Read More: Near Protocol ($NEAR) Price Prediction for 2024

However, the altcoin has not closed above it and could be seen hovering under it at the time of writing. If a succesful breach fails, $NEAR price could end up falling to the critical support of $5.20. Losing this support would invalidate the bullish thesis completely.

beincrypto.com

beincrypto.com