- Chainlink has noted accumulation by large wallet investors for the past two weeks.

- Nearly $110 million in LINK has been withdrawn from exchanges in this time period.

- LINK sustained above $13 on Sunday, extending gains by nearly 1%.

Chainlink (LINK) holders have consistently realized losses in July. On-chain trackers have identified accumulation by large wallet investors, however the overall trend is whales shedding their holdings.

LINK trades at $13.088 at the time of writing.

Three on-chain metrics that support a bullish thesis for LINK

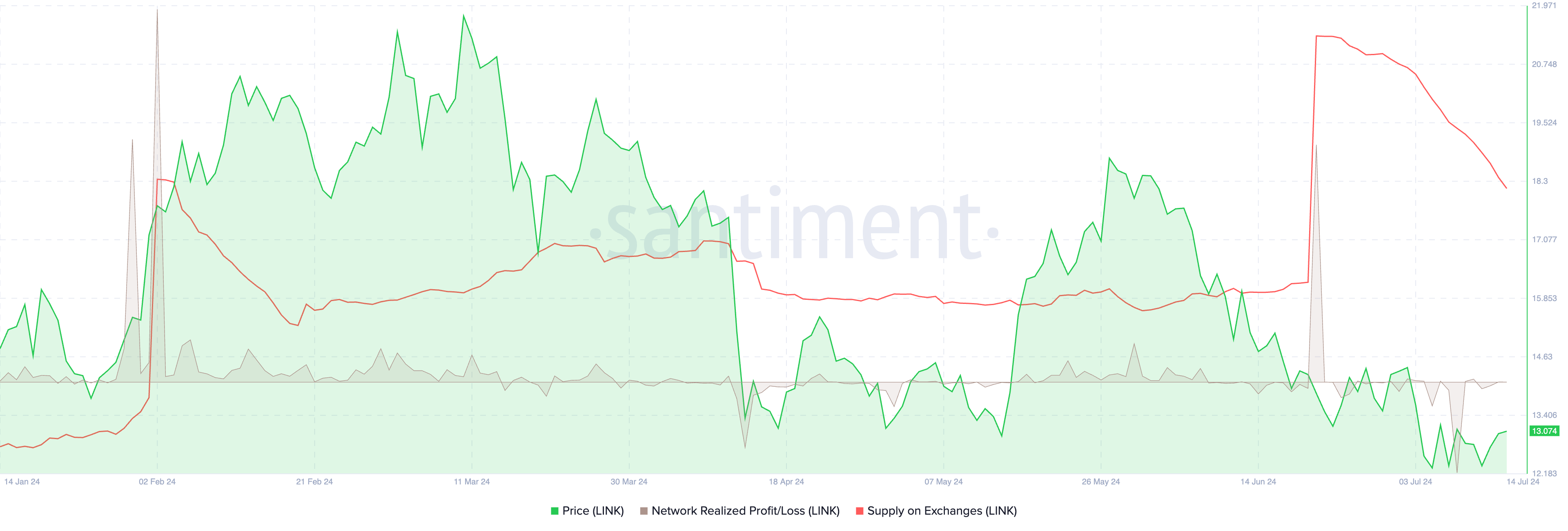

Data from crypto intelligence tracker Santiment shows that Chainlink holders have realized over $80 million in losses since the beginning of July. Large volume of loss realized by traders is typically considered consistent with capitulation. This supports a thesis of gains in LINK price.

LINK Network Realized Profit/Loss

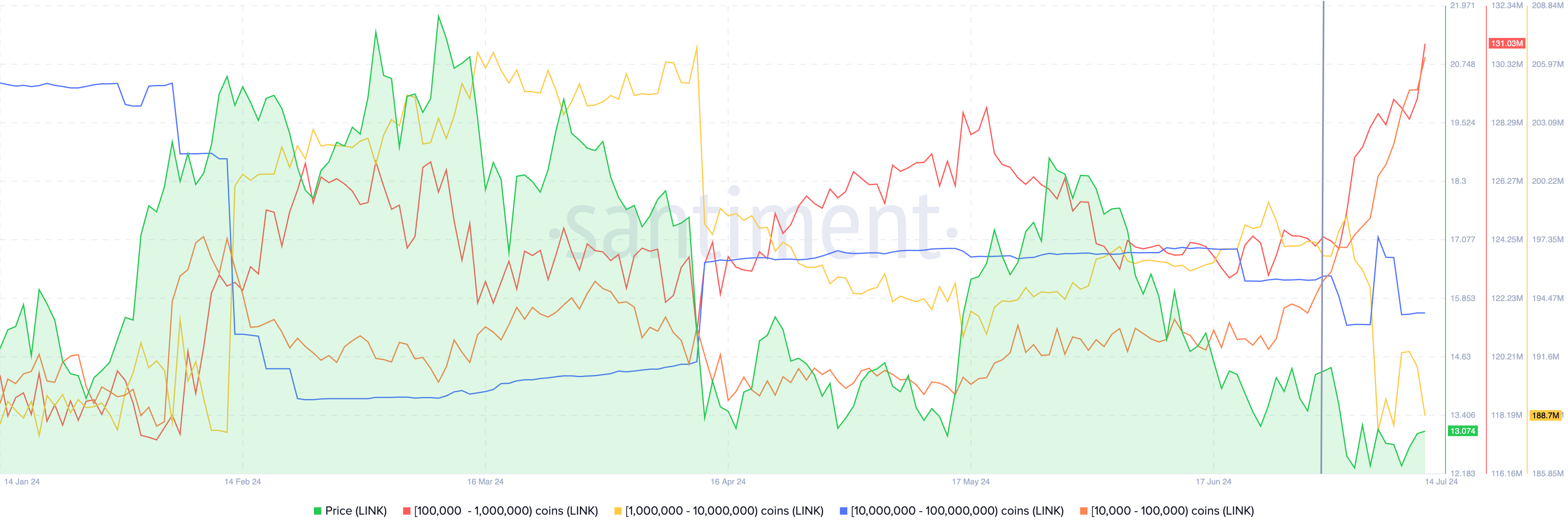

The supply distribution data shows that whales holding between 1 million and 10 million and 10 million and 100 million LINK tokens have distributed their token holdings since the beginning of July while small wallet investors with under 1 million tokens are accumulating.

Accumulation could help LINK resist a mass sell-off.

LINK supply distribution

IntoTheBlock data shows that exchange netflows for LINK have been negative for the past two weeks, with roughly $110 million worth of LINK being withdrawn from exchanges during the last fifteen days.

As LINK leaves exchanges, it is indicative of an accumulation phase, meaning LINK is leaving exchange wallets and being converted to long-term holdings.

LINK accumulation phase

LINK trades at $13.119 at the time of writing, the altcoin gained nearly 1% in the past day.

fxstreet.com

fxstreet.com