Polkadot price bounced back this week as cryptocurrencies recovered after falling sharply last week. $DOT jumped to the psychologically important point at $6, higher than last Friday’s low of $4.92.

Weak on-chain metrics

Polkadot is a leading blockchain network started by Gavin Wood, one of the co-founders of Ethereum, the second-biggest cryptocurrency in the world.

Its goal is to provide a platform where developers can build parachains, which are independent chain that runs in parallel with the Polkadot blockchain.

Parachains share security and interoperability with Polkdaot and can be used by developers to build their decentralized applications (dApps).

Polkadot has attracted many developers in the past few years, who love it because of its fast speeds, lower costs, and interoperable features. Some of the most notable parachains in the ecosystem are the likes of Acala, Centrifuge, HydraDX, and StellaSwap.

However, a closer look at most of these parachains shows that they have not gained traction among users. For example, Acala has a total value locked (TVL) of just $6.1 million, which is a tiny amount. It has been passed by other newer networks like Sui, Sei, and Arbitrum.

Moonbeam’s TVL stands at over $37 million while Moonriver has $6 million. Centrifuge is the only Polkadot network that is doing well as it accumulated over $292 million in assets.

Polkadot has also been left behind in other fast-growing industries that have propelled blockchains like Solana and Ethereum higher. For example, there are no big Decentralized Exchanges (DEX) and meme coins on its ecosystem.

Polkadot’s wallet growth

All these factors have contributed to weaker on-chain metrics. Data shows that the number of active addresses in Polkadot has dropped to just 5.6k, down from the year-to-date high of over 20k. As I wrote earlier, a network like Tron has over 2 million active addresses.

Another metric shows that the number of transfers on the Polkadot Relay Chain has dropped from over 30k in January to below 7k. That is a sign that activity in the network is fading.

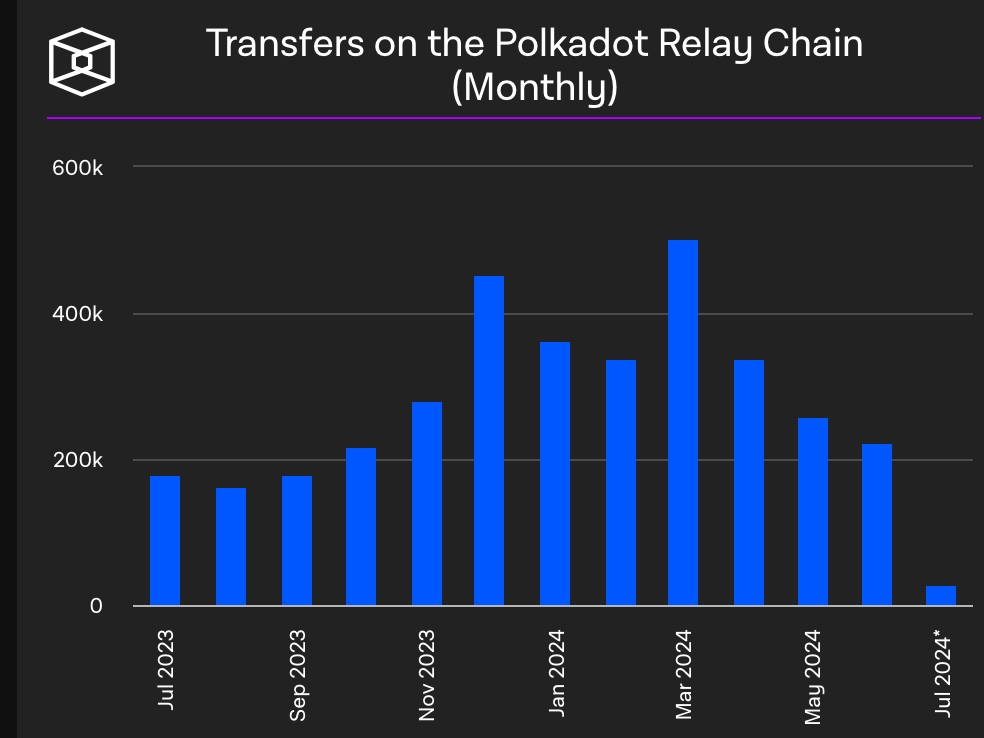

The monthly amount of transfers on the Polkadot Relay Chain dropped to 221.4k in June from the year-to-date high of 500k in March.

Polkadot monthly transfers

Therefore, there are concerns about Polkadot’s valuation considering that the $DOT token has a market cap of over $14 billion, making it the 14th-biggest crypto in the world. It is bigger than coins like Chainlink, Polygon, Uniswap, and Kaspa.

One likely reason for this valuation is that investors love Polkadot’s staking rewards. Polkadot has a staking market cap of over $5.18 billion and yields about 11.4%. Its yield is significantly higher than other cryptocurrencies like Ethereum, Solana, Avalanche, and Aptos.

Also, Polkadot has maintained this valuation because of its correlation with Bitcoin and other coins like Ethereum. In most cases, the $DOT price rises when Bitcoin is rising and vice versa. For example, it jumped to a high of $11.90 in March as Bitcoin soared to a record high.

Polkadot price forecast

$DOT chart by TradingView

The daily chart shows that the $DOT price peaked at $11.90 in March and has now dropped to $5.96. This price is important because it was its lowest swing in January this year.

Polkadot has moved below the 50-day and 100-day Exponential Moving Averages (EMA), meaning that bears are still in control. It has dropped below the 61.8% Fibonacci Retracement level and the descending trendline.

Therefore, there is a likelihood that this rebound is part of a dead cat bounce, which is a temporary rebound when a coin is falling. As such, there is a possibility that it will drop and retest this month’s low of $4.94.

The post Polkadot ($DOT) price at risk amid waning on-chain metrics appeared first on Invezz

invezz.com

invezz.com