Dogwifhat ($WIF) broke below the lower line of its ascending channel on July 3 and has since trended within a range.

The break below this line marked a price decline below a resistance level that it maintained since the end of June.

Dogwifhat Consolidates Within a Range

Since breaking below the lower line of its ascending channel on July 3, it has trended within a horizontal channel.

A horizontal channel is formed when the price of an asset consolidates within a range for an extended period. The upper line of this channel forms resistance, while the lower line forms support.

Since July, $WIF has faced new resistance at $2.06 and formed a new support level at $1.59.

An asset trends within a range like this when there is a relative balance between buying and selling pressures, preventing its price from trending strongly in either direction.

This can be gleaned from $WIF’s Moving Average Convergence Divergence (MACD) indicator. Since July 7, the meme coin’s MACD (blue) and signal lines (orange) have crossed back and forth.

Read More: What Is Dogwifhat ($WIF)?

This movement suggests the meme coin’s shorter-term and longer-term moving averages are staying close together. This indicates a lack of strong directional movement in the price, confirming consolidation.

$WIF Price Prediction: Bearish Sentiments Remain High

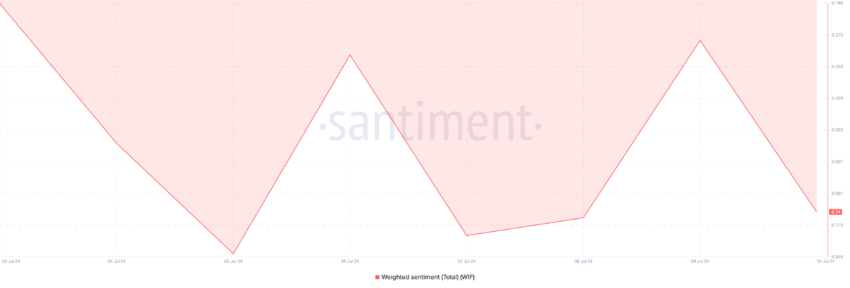

Although market participants are unsure of $WIF’s next price direction, the meme coin is still trailed by a significant bearish bias. As of this writing, the altcoin’s weighted sentiment is -0.74.

This metric tracks the overall mood of the market regarding an asset. It considers the sentiment trailing the asset and the volume of social media discussions.

When an asset’s weighted sentiment value is below zero, most discussions on social media platforms are fueled by negative emotions like fear, uncertainty, and doubt.

If this trend continues, $WIF’s price might fall below its new support level of $1.59.

However, if market sentiment shifts to positive, the token’s price might rise to break above the upper line of the newly horizontal channel.

beincrypto.com

beincrypto.com