In this article, we compare two leading blockchains in the cryptographic sector: Solana vs Ethereum.

Both have very developed DeFi ecosystems and a wide range of successful applications built within them.

The two networks work together to create the most thriving web3 environment possible, with the goal of becoming the premier layer of the on-chain future.

The challenge is also played out on the token level, with ETH and SOL trying to offer the best return on the market.

Let’s see everything in detail below.

Summary

Solana vs Ethereum: the main differences on the technological level

We are talking about one of the most heated and intense clashes on the technological front of the last decade, as well as the most discussed in the crypto landscape: the Solana vs Ethereum war.

Everyone knows by now that these two blockchains have been in conflict for years to win the title of dominant web3 infrastructure.

In fact, however, they are quite different in many aspects: Ethereum is an EVM network built with the programming language Solidity while Solana is SVM built with C, C++ and Rust.

This alone is enough to distinguish two poles in which the development of decentralized applications takes place according to different coding rules.

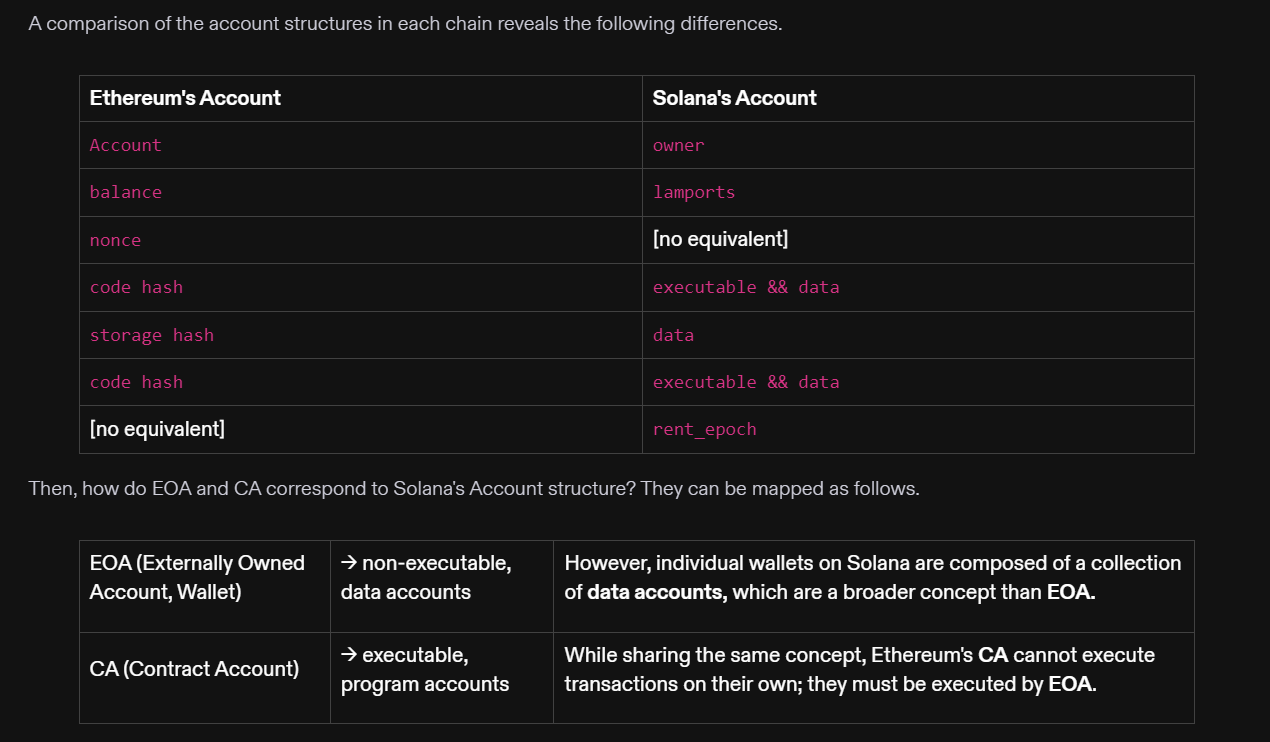

Furthermore, the concept of “account” also changes significantly depending on the context, whether it is used in an Ethereum or Solana environment.

In fact, on Ethereum the term account is used to describe an entity that owns ether (ETH) and can initiate transactions. It is classified as follows:

- EOA (Externally Owned Account): account in possession of a private key, conceptually similar to a wallet;

- CA (Contract Account): account for smart contracts not in possession of a private key.

Simplifying, we can say that EOA does not have storage space and therefore cannot be used as a contract for carrying out operations (except for exceptions with ERC-4337).

The CA, on the other hand, is simply a software program executable by EVM with a code (contract) that distinguishes it. An EOA can therefore execute a call through CA but not vice versa!

On the opposite front of Solana, however, the concept of “account” is broader and refers to an entity that can always store and save data.

The state of transactions is therefore saved using accounts in a manner similar to what happens in operating systems like Linux. It is worth noting that Solana natively supports the account-abstraction function, allowing self-calling between programs.

The accounts in Solana are of two types:

- Executable account (program account): smart contracts called “programs” that store the code;

- Non-executable account (data account): entities that can receive tokens or data but cannot execute code.

Below is a map of the main technical differences.

Two different approaches for the development of DeFi environments

Descending to a less technical level, we notice that Ethereum and Solana use different marketing approaches for their respective DeFi environments.

Although both chains are intent on attracting the widest possible base of capital and users, they focus on different segments.

In fact, Ethereum presents a more “institutional” character with its main values oriented towards the security of the network and decentralization.

Solana, on the other hand, has a more “smart” personality, oriented towards the scalability of operations and cryptographic efficiency.

They follow the limits of both blockchains on their own: for Ethereum scalability, for Solana decentralization.

LIVE NOW — Ethereum vs. Solana

— Bankless (@BanklessHQ) June 3, 2024

That’s the debate we’re having today. On Ethereum’s side, we have @Ethereum Researcher @drakefjustin, and on the @Solana side, we have Solana’s Co-Founder @aeyakovenko

They give us the good, the bad, and the ugly of each other’s blockchain,… pic.twitter.com/MlCWd4NtOT

Ethereum presents a TVL of 59 billion dollars, much greater than Solana’s 3.5 billion dollars. For this reason, the Foundation uses a softer communication with the public and with less intention to create engagement.

Solana, on the other hand, focuses entirely on innovation, user experience, and transaction throughput. The latest innovations launched, such as the Saga smartphone and the Blinks, speak volumes about the approach the network uses with retail.

We can say that Ethereum is a less performant blockchain, at times less “convenient”, but more secure and reliable.

Solana is much more “fun” and efficient to use, but less decentralized based on a few clients and less secure.

If you are high-net-worth individuals with a moderate risk exposure, you will surely appreciate Ethereum more.

If you are young, fearless, and have a limited budget, you will probably find the features of Solana more appealing.

The main web3 dapps of the two ecosystems

The war between the two titans Ethereum and Solana continues uniquely in the creation of the best decentralized web3 applications.

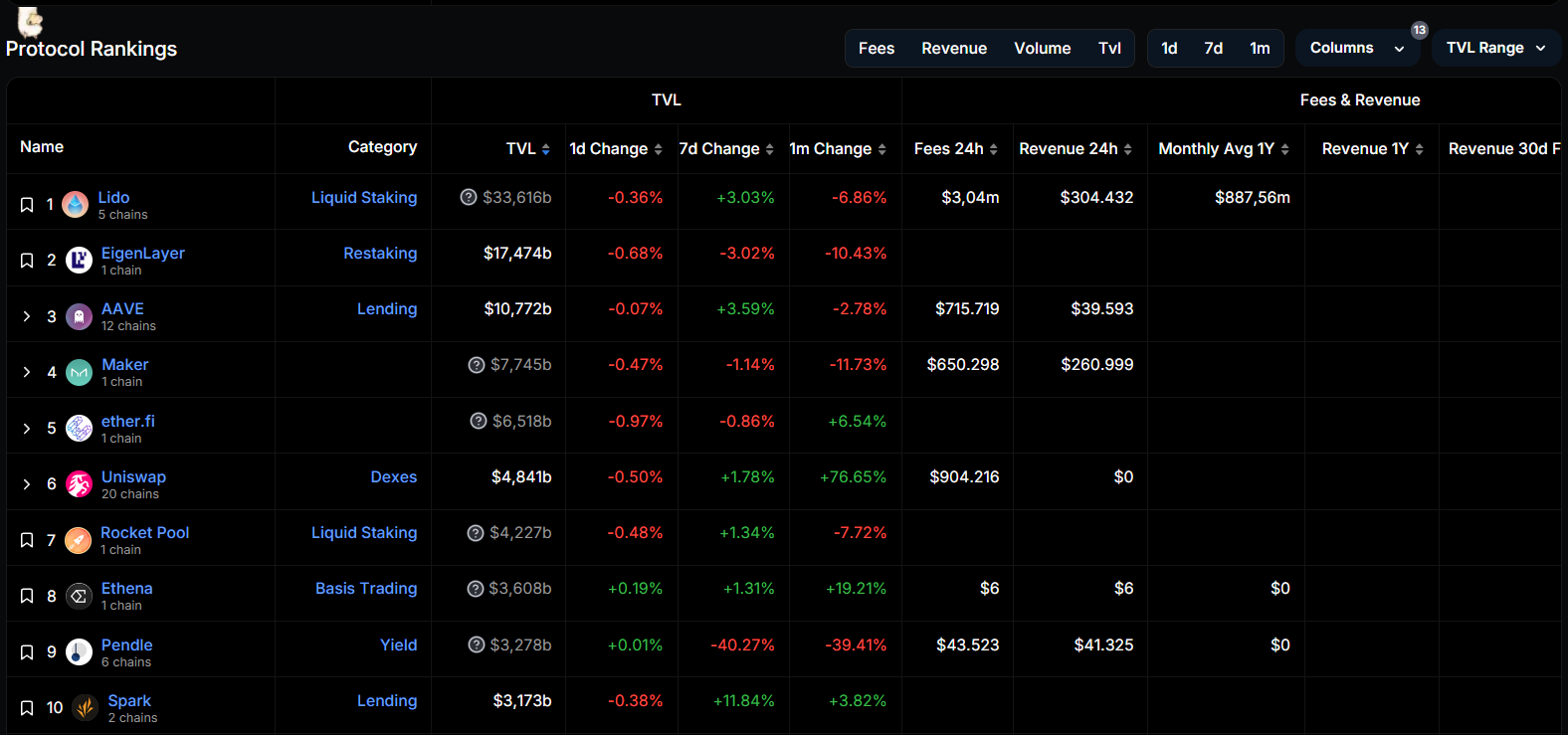

On Ethereum the largest dapp in terms of TVL is the liquid staking platform Lido: it alone attracts almost 10 times the entire capital absorbed by Solana.

Next, we find successful dapps such as EigenLayer, Aave, Maker, Ether.fi, Uniswap, RocketPool, Ethena, and Pendle.

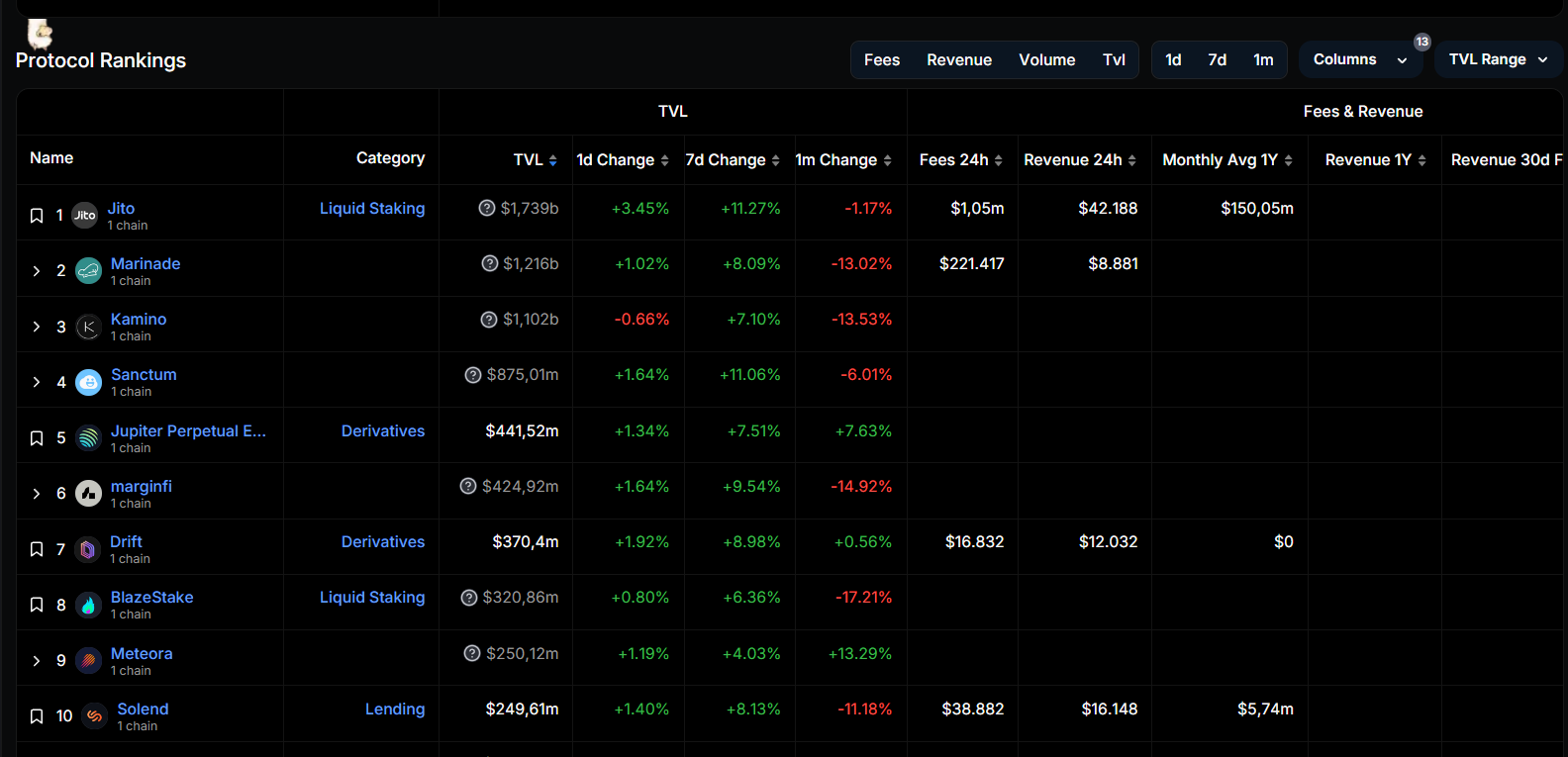

In the suite of protocols of Solana, we find Jito as the top-ranked, with a TVL of 1.74 billion dollars. Then the most used applications are Marinade, Kamino, Sanctum, Jupiter, Marginfi, Drift, BlazeStake, Meteora, and Solend.

The majority of Ethereum dapps are integrated with various layer-2, ensuring greater scalability. At the same time, the differentiation of blockspace requests leads to a fragmentation of liquidity, which is often inconvenient.

For this reason, Ethereum is often criticized by its detractors because as a Settlement Layer it has to rely on external solutions to grow.

On the other hand, the competitor is criticized for the absence of a flourishing and secure DeFi ecosystem: almost all the dapps on Ethereum surpass the total TVL of Solana!

In any case, it is worth noting how Solana is producing very interesting products, such as the recent platform pump.fun.

Proposed as a launchpad for memecoin, in a short time it managed to become the most profitable dapp in the entire cryptographic ecosystem.

On July 1st, it recorded record fees of 2 million dollars, even surpassing the entire revenue of the whole Ethereum blockchain.

Chapeau.

🚨Breaking Big: @pumpdotfun Becomes No. 1 Crypto App Across All Chainshttps://t.co/VS31GZ2FXq has surged to the top spot as the leading crypto app, surpassing Ethereum with a staggering $1.99M in revenue generated over the last 24 hours. pic.twitter.com/59euyqCRWp

— SolanaFloor (@SolanaFloor) July 2, 2024

A speculative war: Solana with SOL vs Ethereum with ETH

The Solana vs Ethereum challenge can only conclude with a focus on their respective gas tokens SOL and ETH.

It is clear that the better these cryptocurrencies perform on a speculative level, the more users are interested in purchasing them and becoming part of the community.

The metric of active addresses and the volume of transactions, in fact, largely depends on the evolution of the price of SOL and ETH.

Both networks are interested in pushing the price of their respective coins upwards, both for a boost in on-chain metrics and for obvious economic reasons.

In 2024 the two coins recorded similar trends, with a growth of about 50% from the January quotations. SOL, however, grew at a faster pace in the last quarter of 2023, attracting more new buyers compared to what Ethereum did.

>>Solana Vs Ethereum in 2024

— hitesh.eth (@hmalviya9) May 30, 2024

Solana is Winning by Huge Data Growth Margin

Growth Metrics(%):

– Price

– Stablecoin Volume/Marketcap

– TVL/Fees

– NFT Trading Volume

– Daily Transactions/ Daily Active Addresses

Ethereum Growth Metrics(%):

– DEX Trading Volume

– Daily Volume pic.twitter.com/Q8GV7mQ9Jy

At the moment both SOL and ETH are close to their respective all-time highs, with the latter seeming slightly advantaged.

The evolution of the prices of the two coins from now until the end of the bull market will be essential to bring more adoption to blockchain technology.

Playing a decisive role in the coming months will also be the upcoming inauguration of the spot ETFs for the two cryptocurrencies. First that of Ethereum, then (perhaps) that of Solana, will contribute to attracting more capital inflows.

At stake is the dominance as a settlement layer for the major financial operations of the cryptographic world.

It is not certain, however, that in the future only one network between Solana and Ethereum will survive, and indeed a coexistence scenario is much more likely.

Obviously, there will be a network that will have a larger market share but without precluding the existence of the other

ETH vs SOL

— Gun (Kingbund.eth) (@KingBund) July 2, 2024

DONT BE A MAXI.

The world is gonna be multi-chains!

Stop wasting time arguing about which one is better, and start learning about all the benefits and use cases each bring.

More ETFs will grow the pie!

ETF products will bring attention and money into the space.… pic.twitter.com/MdtTDdCf7X

Although in a perspective of coexistence, the dispute between the maximalists will continue for many years to come.

As we can learn from the historical Pepsi vs Coca Cola discount that has been ongoing for over 100 years, the fight for supremacy is always around the corner.

en.cryptonomist.ch

en.cryptonomist.ch