$BONK price is seemingly facing a bearish outcome simply due to the lack of support from the investors.

The investors do not appear very bullish, from pulling money out of the asset to straight-up funding the downtrend.

$BONK Investors Push for a Drop

The $BONK price is vulnerable to further decline, as evident from the shift in market cues. The Chaikin Money Flow (CMF) indicator is currently showing a significant increase in selling pressure.

This suggests that investors are pulling their investments out of the coin. The CMF below the neutral line indicates that the coin is experiencing more outflows than inflows. Despite the slight rise, the downtrend continues to dominate the indicator, which could signal a lack of confidence among investors.

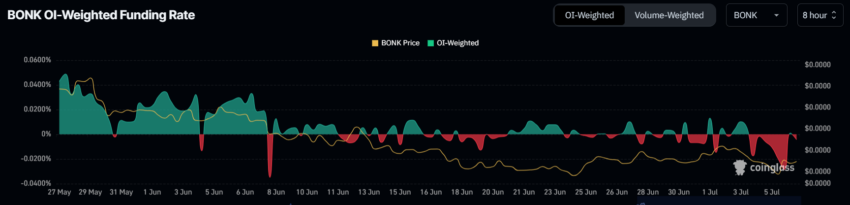

In addition to the increasing selling pressure, there is also a noticeable trend of investors betting on a decline in $BONK’s price. This bearish sentiment is reflected in the meme coin’s negative funding rate. A negative funding rate implies that short positions are dominant, with traders paying a premium to maintain their bearish bets.

The combination of rising selling pressure and a negative funding rate paints a concerning picture for $BONK’s short-term prospects. Investors pulling out their funds and betting against the coin could lead to further downward pressure on its price.

Read More: Bonk Airdrop Eligibility: Who Can Claim and How?

This trend might be a response to broader market conditions or specific issues related to $BONK.

$BONK Price Prediction: Key Support at the Test

$BONK’s price at $0.00002221 is somehow managing to keep above the critical support at $0.00002153. Attempting to fall below it twice now, the meme coin is looking to recover, but the investors are not supporting this.

The aforementioned cues suggest a drawdown is on the cards. If the support of $0.00002153 is broken, the $BONK price could fall to $0.00001375, which would extend the losses.

Read More: 11 Top Solana Meme Coins to Watch in June 2024

But if the meme coin manages to bounce back, it could potentially reclaim $0.00002748 as support. This would invalidate the bearish thesis and even make the investors’ sentiments bullish.

beincrypto.com

beincrypto.com