LayerZero ($ZRO) price is observing the impact of the broader market’s bearish cues as it struggles to rally.

The lack of bullishness among investors is also acting as resistance to any potential recovery $ZRO could witness.

LayerZero Investors Are Skeptical

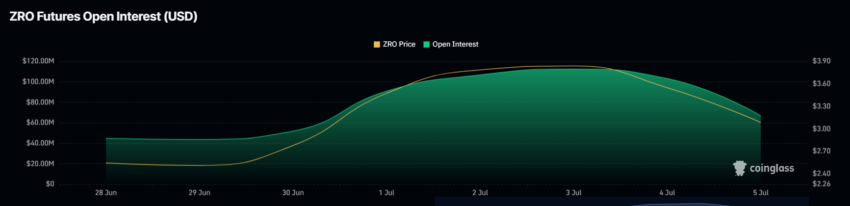

$ZRO’s launch last month was met with considerable bullishness but the recent performance does not relay the same. In the past week, $ZRO’s Open Interest plummeted by nearly 50%, falling sharply from $112 million to $66 million.

This significant decline suggests a reduction in the number of outstanding contracts or positions held by traders, indicating diminished market activity or a shift in sentiment.

Meanwhile, $ZRO’s Chaikin Money Flow, which tracks buying and selling pressure, mirrors this bearish sentiment. The indicator reflects continued selling pressure on $ZRO, implying that more capital is leaving the token than entering it. This trend typically indicates a negative outlook among investors and traders.

The combination of declining Open Interest and a bearish Chaikin Money Flow underscores a challenging period for $ZRO. The substantial decrease in Open Interest indicates reduced market participation or possibly a loss of confidence among traders.

Read More: LayerZero Explained: A Guide to the Interoperability Protocol

Simultaneously, the persistent selling pressure highlighted by the Chaikin Money Flow suggests ongoing bearish sentiment, potentially leading to further downside in $ZRO’s price.

$ZRO Price Prediction: Preventing Further Decline

$ZRO’s price declined by 32% in the span of 48 hours but noted a 15% recovery over the past day. The altcoin trading under $3.42 is still susceptible to a decline as the bearish cues remain persistent. This could result in $ZRO falling through the support at $3.00.

This would not only lower $ZRO’s price to $2.50 but also leave it vulnerable to further decline.

Read More: Top New Crypto Listings To Watch In July 2024

But if the altcoin manages to breach the resistance at $3.44, it could climb back to $3.82. Breaking this barrier would push $ZRO’s price to $4.00, invalidating the bullish thesis.

beincrypto.com

beincrypto.com