- 1 Surprise ‘KOLKADOT’ rebrand sparks humor amid $37M marketing concerns.

- 2 Polkadot sees a 42.75% surge in trading volume, hinting at market rebound.

- 3 60% of $DOT staked as traders eye a push from $6.50 to $24.

The Polkadot ($DOT) price has been in bearish momentum in the last 24 hours, dipping over 5% amid an unexpected announcement about a potential rebrand. The official X account of the Polkadot Network hinted at rebranding to “KOLKADOT,” which came as a shock to the community and sparked many reactions.

$DOT/USD 1-day price chart (source: CoinMarketCap)

The rebrand post that followed received a combination of laughter and confusion from the Polkadot community. Some viewed the move as a form of interactive marketing where the company is trying to get people’s attention by making an apparent change of name. The rumors sparked much discussion on the social networks with the members of the community discussing the plausibility of the change and its possible consequences.

community voted, we’re rebranding to KOLKADOT https://t.co/knmF5CihUl

— Polkadot (@Polkadot) July 3, 2024

Although the answers are quite humorous, the rebrand tease occurs at a time when Polkadot has numerous issues. Such problems could have made Polkadot use the rebrand tease to create some form of comedy and distract the audience from the existing issues.

Marketing Challenges and Developer Dissatisfaction

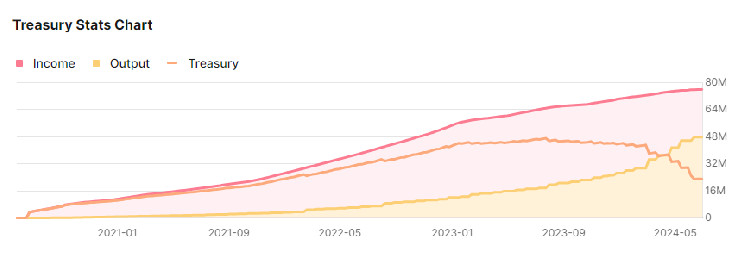

Polkadot has received a lot of backlash for its marketing expenditure. According to the findings, while millions of dollars have been spent on brand marketing, the project’s visibility is still low compared to other similar projects. As of the first half of 2024, Polkadot allocated $37 Million for the outreach to new users, developers, and businesses. This entails $10 Million on ads and sponsorships, $4.4 Million on influencers, and $4 Million on digital ads.

Polkadot spent $37m USD in outreach during the first half of 2024, targeting new users, developers, and businesses

— Ignas | DeFi (@DefiIgnas) July 1, 2024

• $10m on ads/sponsorships

• $4.4m on influencers

• $4m on digital ads

Yet Polkadot still seems invisible on X and elsewhere. pic.twitter.com/pk0haLvuNm

However, these efforts have not yet paid off in terms of market presence. Another major concern in Polkadot is the alleged discrimination of developers within the network. Manta Network founder Victor Ji has also claimed that Polkadot discriminates against Asian developers, particularly those from China.

Other developers in the Polkadot China community agreed with his statements and complained about the apparent prejudice and the absence of real democracy within the ecosystem.

By responding, I hope the core members of the Polkadot team can publicly state whether there is any unfair or even discriminatory behavior towards Asian developers, especially Chinese developers. If I hadn't spoken up yesterday, neither the Polkadot team nor non-Asian developers… pic.twitter.com/sbA0oVHeUR

— victorji.eth ✨🌊✈️EthCC (@victorJi15) July 3, 2024

These allegations have also negatively affected the public perception of Polkadot, along with the other issues it has faced in terms of marketing and community management. The core team’s reaction to these allegations will play a critical role in reassuring the developers and regain their trust in the protocol governance.

Analysts on Polkadot ($DOT) Price Trend

Although the current situation of Polkadot has been rather unfavorable and there are still many difficulties, some analysts still believe in its prospects. In addition, data from Coinglass shows that the trading volume for $DOT derivatives rose by 42.75%, which is a sign of growing interest from traders and possible market fluctuations.

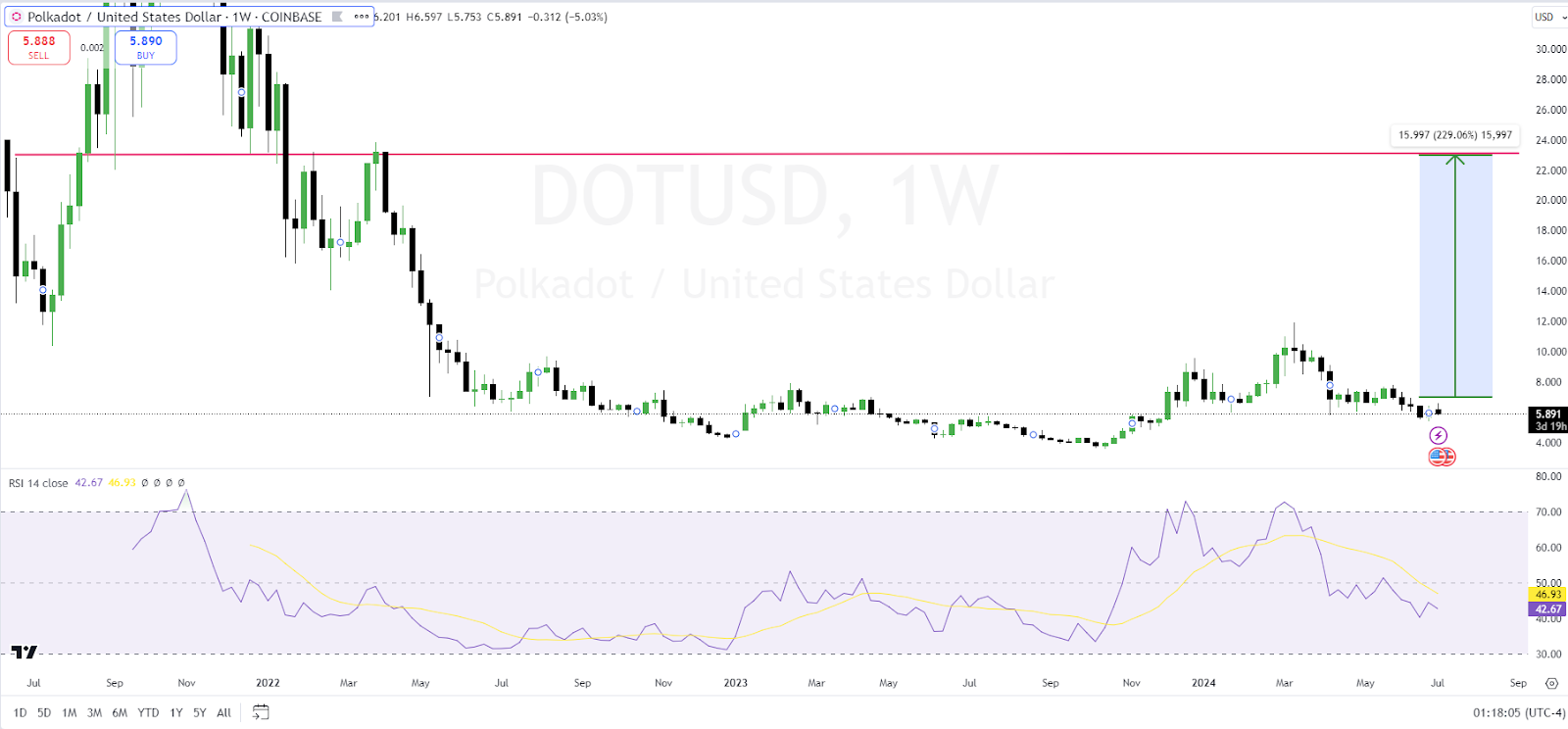

Captain Faibik also shared his thoughts and said, “$DOT #Polkadot Seems like bottomed out & Ready to Fly.” According to him, if $DOT can get back to $6.50, it will be safe for investors to enter the market. Currently, nearly 60% of $DOT is staked, which means that only 40% of the total supply is available in the market. Consequently, there will be increased demand and reduced supply, which could cause the price to skyrocket.

$DOT/USD Price Chart (Source: TradingView)

Technical indicators also show some signs of improvement. If the RSI on the weekly timeframe penetrates through the 53 level and rises up to the 70 level, it can lead to a major price increase. Such a move combined with the scarcity of $DOT in circulation could drive the price to $20 -$24.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational purposes only. They do not establish financial, investment, or any other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

thecoinrepublic.com

thecoinrepublic.com