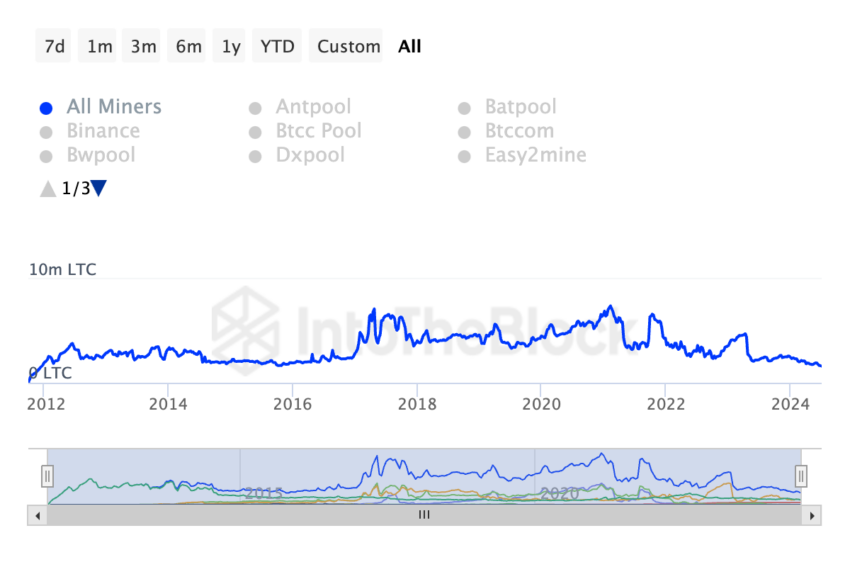

Miners on the Litecoin ($LTC) network have steadily sold their coin holdings since March 28. At press time, 1.61 million $LTC was held in miner reserves, which has since dropped by 29%.

This marks the lowest number of coins held by miners across Litecoin mining pools since December 2011.

Litecoin Miners “Offload” Their Bags

Litecoin miner reserves measure the amount of LTCs held in affiliated miners’ wallets. Its value indicates the reserve that miners have yet to sell.

When it declines, it suggests that miners on the Litecoin network are distributing their coins for profit or to sort mining costs. At 1.61 million $LTC at press time, the market value of coins held by Litecoin miners is $120 million.

Interestingly, the decline in Litecoin’s miner reserve since March has occurred alongside an uptick in the network’s hashrate. In fact, as of this writing, the network’s hashrate is at an all-time high of 1.07k TH/s.

Read More: Litecoin: A Complete Guide to What it is And How it Works

A network’s hashrate refers to the computational power used to mine and process transactions on a blockchain.

The uptick in Litecoin’s hashrate while its miner reserves decline could be due to a number of reasons.

Firstly, there might be an influx of new miners who are not yet selling their coins while established miners are selling a larger portion of theirs.

Also, existing miners on the network might be anticipating a spike in $LTC’s price and are holding onto a portion of their mined coins while selling some to cover mining costs.

$LTC Price Prediction: Altcoin Bucks Trend

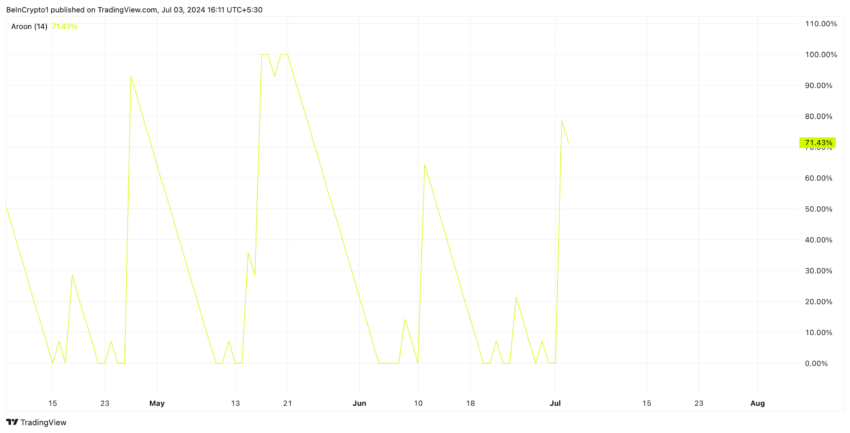

A large-scale sell-off by miners could put downward pressure on $LTC’s price in the short term. However, this has not been the case for the altcoin recently. Its value has rallied to form an ascending channel since June 24.

Trading at $74.13 at press time, the coin’s price has since climbed by 6%.

$LTC’s rising Aroon Up Line confirms the strength of the current uptrend. At press time, the indicator’s value is 71.43%.

An asset’s Aroon indicator measures its trend strength and potential price reversal points. When the Up Line is close to 100, it indicates that the uptrend is strong and that the most recent high was reached relatively recently.

If this uptrend continues, $LTC’s price may rally to $74.40.

If selling pressure gains momentum, $LTC’s price may fall to $73.09.

beincrypto.com

beincrypto.com