Shiba Inu’s ($SHIB) price is noting the potential for recovery since investors, frustrated with losses, could be reinitiating accumulation.

This could result in the meme coin reentering the zone of consolidation it has been in for months and even breaking past it.

Shiba Inu Investors Could Begin the Accumulation

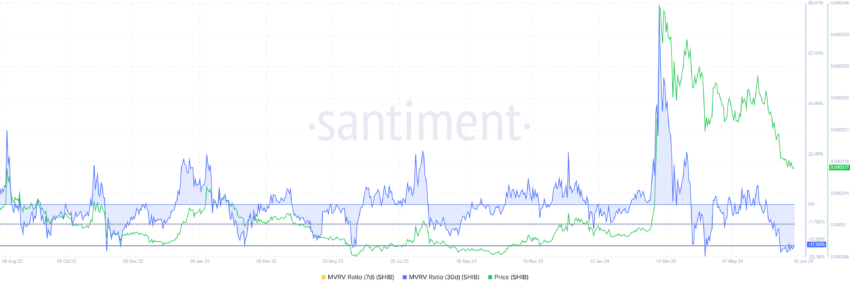

Shiba Inu’s price could begin accumulation again since the drawdown has resulted in the meme coin dropping to a point from where buying appears profitable. This is evident in the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit and loss. Currently, Shiba Inu’s 30-day MVRV stands at -17%, indicating losses that may lead to buying pressure. Historically, $SHIB MVRV between -8% and -18% usually signals the start of recoveries and rallies, marking an opportunity zone for accumulation.

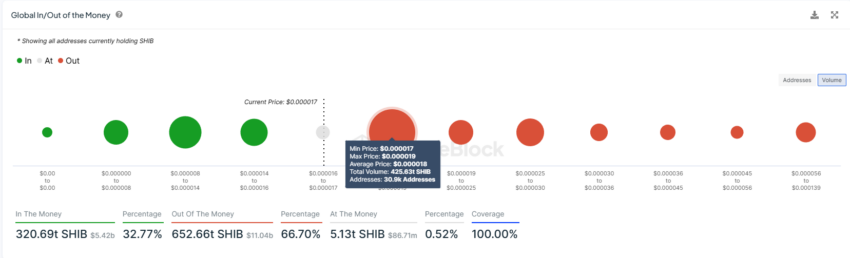

This is a likely outcome since billions of dollars worth of profits are currently on the line for $SHIB investors. According to the Global In/Out of the Money (GIOM) indicator, about 425 trillion $SHIB worth more than $7.3 billion are awaiting a trigger.

This supply was bought between $0.00001700 and $0.00001900. Thus, a massive price surge is necessary for it to become profitable again, which will keep the investors motivated to accumulate.

Read More: How To Buy Shiba Inu ($SHIB) and Everything You Need To Know

$SHIB Price Prediction: Bounceback is Necessary

Shiba Inu’s price, trading at $0.00001696, is suffering the bearish cues of the near 40% drawdown noted throughout June. As the meme coin fell out of the consolidation zone between $0.00002584 and $0.00002267, it created room for losses.

$SHIB investors intend to take those gains back and are likely acting accordingly. With their help, the meme coin could climb back into consolidation, potentially even breaching the upper limit.

Read More: Shiba Inu ($SHIB) Price Prediction 2024/2025/2030

However, if the barrier at $0.00002093 fails, the same consolidation could occur within this resistance level and the support of $0.00001473, invalidating the bullish thesis.

beincrypto.com

beincrypto.com