Runes became the Bitcoin version of meme tokens, copying the model of starting at a low price and rising through social media hype. However, they have since fallen from their initial euphoria and are now facing a recovery or a slide to new lows.

The Runes market broke above $1B market cap during its first rally. Now, the market is down to under $700M for all Runes issued. It may also be said that there is only one Rune worth mentioning – DOG, which has a market cap above $600M.

Smaller Runes were even more volatile, easily wiping out up to 30% of their value in a few hours.

Not looking too hot in rune land

— Tom Bibiyan 🇺🇸 (@realtombibiyan) June 24, 2024

Stay strong friends. $btc #runes @RuneSaloon pic.twitter.com/zJAM20YvO9

Rune trading is concentrated on the Gate.IO exchange, which lists obscure tokens. Some of the leading Runes, like DOG and LOBO, have low enough trading volumes to recover from big price slides with relative ease.

Runes show resilience, the ability to bounce

Runes have already revealed a handful of clear winners, at least based on market capitalization. Yet even smaller runes also bounce within hours. Runes like Stupid Silly Cat recovered with 155% growth after their correction.

So far, Runes also behave similarly to the second generation of meme tokens. The launch team was not worried about trading near rock-bottom for a long time for those assets. In the case of Runes, time only helps visibility and hype.

Which runes have been moving the biggest bags?

— Runes Land (@runes_land) June 24, 2024

Here are the top 10 runes by volume:

Standing at number 1, we have DOG•GO•TO•THE•MOON (@DOGTOTHEM00N) with 109 BTC moved just this week!

Then, comes in BILLION•DOLLAR•CAT (@billydollarcat) at a very close second with… pic.twitter.com/TqyznMBuuE

Like meme tokens, Runes has the advantage of hinging on well-established memes. They are not offering any technology or solutions beyond the value of their liquidity and trading opportunities. This also means meme-based Runes have a more difficult time falling into obscurity.

High conviction or degen risk-taking drive the Runes market

The market movements of Runes depend on the style of the project. Some are trying to build ride-or-die communities that pressure newcomers to never sell, while waiting for price appreciation. This strategy has been successful with tokens like PEPE but has also quickly reversed as some whales or buyers finally decide to sell.

‘Degen’ is a slang term derived from the word ‘degenerate’. In the cryptocurrency space, it is often used to refer to individuals who engage in high-risk and speculative trading or investment strategies.

list checks out pic.twitter.com/VQ7dkKBZ3E

— STUPID•SILLY•CAT (@StupidSillyCat_) June 24, 2024

The other type of Runes do not have a requirement to hold, instead stressing their unpredictable nature and the ability to take risk without prior research. Some Runes achieve significant trading volumes and offer opportunities similar to standard tokens.

Due to the volatile nature of Runes, traders are also looking for signs of reaching a local bottom before joining for another opportunity. Instead of technical analysis, Runes also heavily relies on sentiment and the impression they make based on their marketing. Rune analysis often considers a project’s prestige in addition to its size and performance.

WEEKLY RUNE TIERLIST

— Runetoshi Nakamoto (@runetoshi_) June 23, 2024

This tier list is ONLY for runes etched from 06.17 to 06.23

S Tier:

RSM•RUNES•STATE•MACHINE @RSM_Runes

A Tier:

MACKEREL•PACKS @MackerelPacks

B Tier:

SEND•FEET•PICS @sendfeetpicsbtc

PEPEGA•STUPID•MIND @bitcoinpepega

SLEEPY•STONED•CAT… pic.twitter.com/SXJ85AeiEA

Runes are split into multiple probable tiers, with some destined to become top memes. For other Runes, there is a high probability for going to zero. Traders also sift projects for low-priced Runes but can have a small probability of breaking out.

Runes aim to reach 3-5% of BTC market cap

The current Rune market aims to reach 1% of the Bitcoin (BTC) market capitalization. In the case of a bull cycle, the goal is to build up Runes to 3-5% of the BTC value. The big advantage of Runes is their anti-fragility and relatively low price. This means that a market crash would be an opportunity to jump into the market again, though at a relatively low initial cost.

Runes do not hide their cyclical nature and do not promise a guaranteed climb or utility. Instead, buyers must gauge sentiment and choose an entry point.

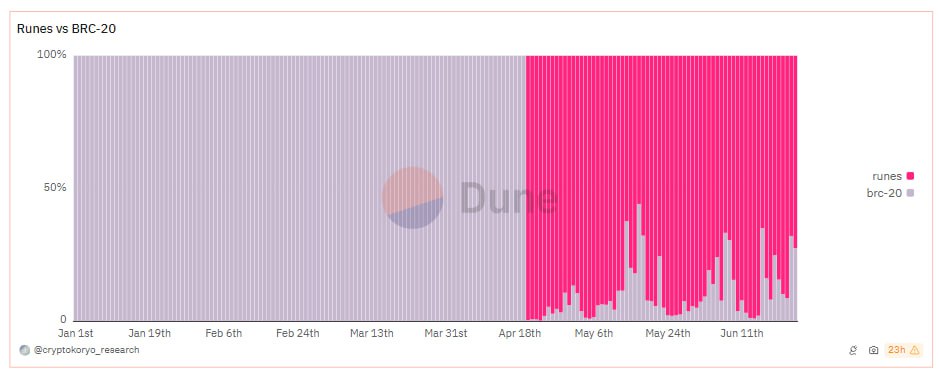

At the same time, Runes have shown they are here to stay. During “Rune June”, as the month was called, Rune activity took up to 60% of Bitcoin traffic. Runes also totally displaced BRC-20 tokens, as well as Ordinals.

Runes have become the go-to tokenization standard on Bitcoin, copying the meme-based model. Source: Dune Analytics

So far, nearly 100K Runes have been etched, paying around 76 BTC in fees. Runes are one of the cheapest protocols in terms of fees, so they can add to the Bitcoin activity, but only partially compensate the miners for the diminished block reward. Runes currently make up about 43% of Bitcoin fees.

Cryptopolitan reporting by Hristina Vasileva

cryptopolitan.com

cryptopolitan.com