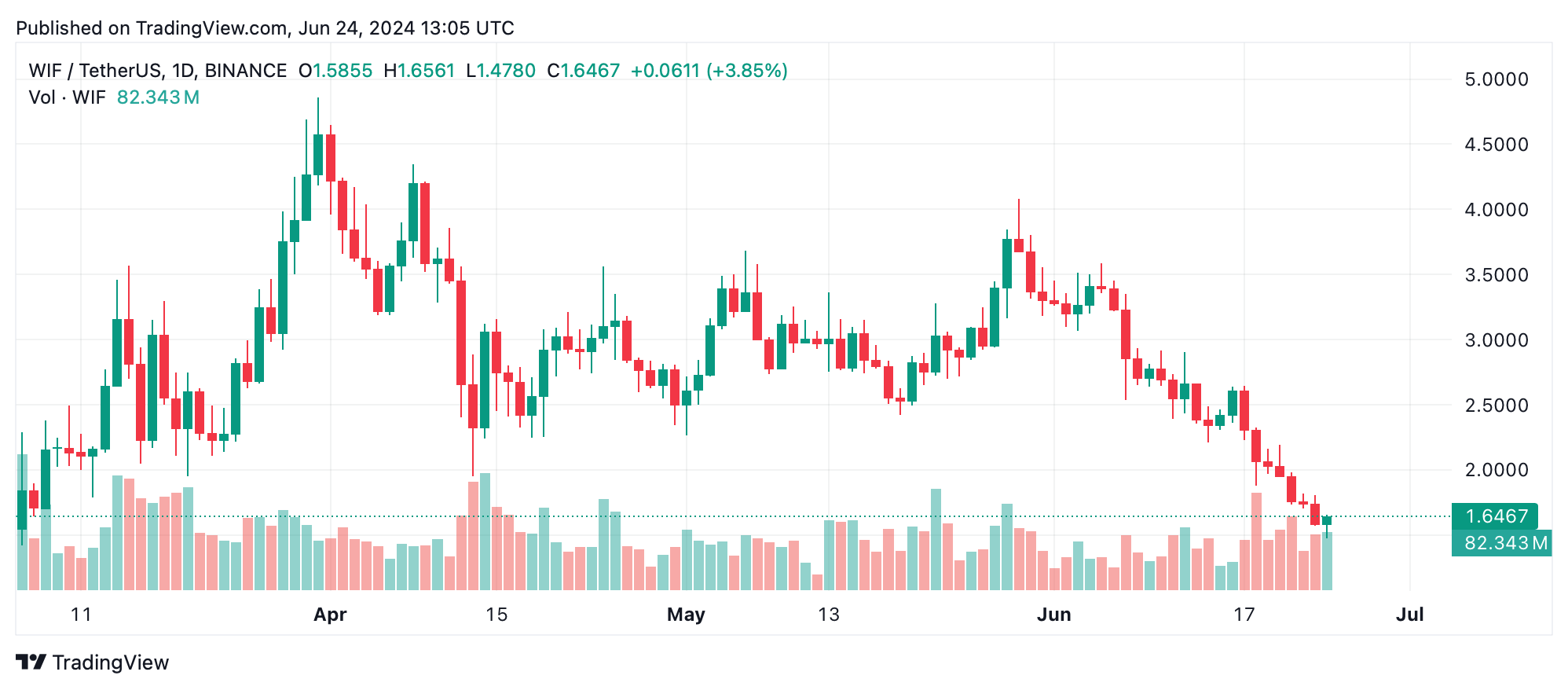

Over the past week, bitcoin has slid 6.6% while ethereum has lost 5.5% against the U.S. dollar, but a large handful of alternative digital assets saw much bigger losses this past week. The meme coin dogwifhat ($WIF) was the week’s biggest loser shedding 31.2% while notcoin ($NOT) lost 24.3% this week.

Cryptocurrency Meltdown: Broad Losses With Only a Few Notable Exceptions

This week over two dozen crypto assets recorded double-digit losses against the U.S. dollar and $WIF saw the deepest loss. The meme coin asset $WIF lost 31.2% over the past week and 5.4% of that drop occurred today. The TON-issued notcoin ($NOT) shed 24.3% during the seven-day period and 10.4% over the 24-hour period. Ethena (ENA) shed 21%, chiliz (CHZ) lost 20.4%, and starknet (STRK) dropped by 19.7% this week.

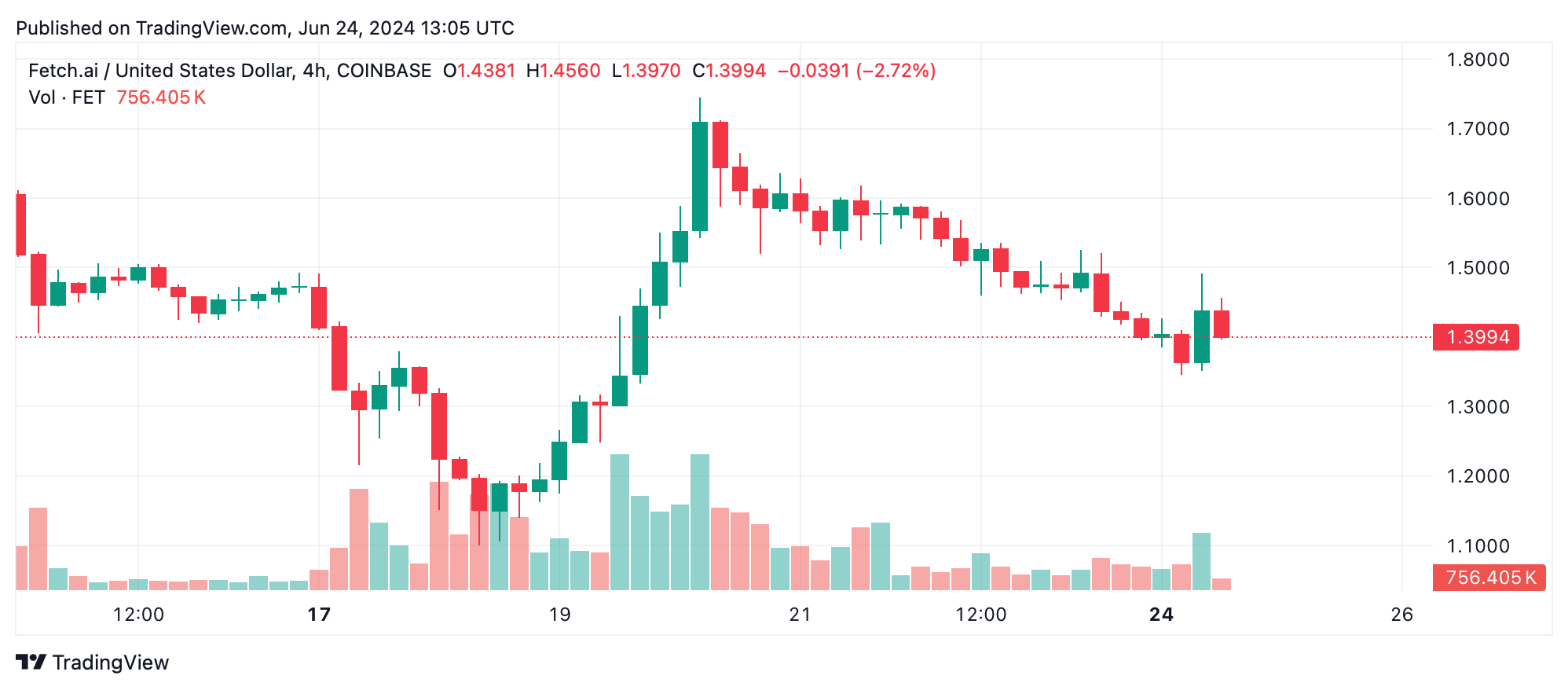

Uniswap (UNI) lost 17.2%, bonk (BONK) is down 16.7%, and floki (FLOKI) shed 16%. Other notable losers this week include SHIB, BEAM, ORDI, FIL, JUP, FLR, and BCH as they lost 14.1% to 15.8%. Nine distinct crypto assets managed to stave off the week’s losses and actually saw gains this past week. The artificial intelligence (AI)-centric coin fetch ($FET) gained 12.1% against the greenback.

Another AI-coin singularitynet (AGIX) rose 10.2% this week and Lido’s DAO token LDO jumped 5.3%. Pendle (PENDLE) is up 4.4%, ONDO gained 2.6%, and TRX jumped 2.1%. The global crypto market cap today is worth $2.24 trillion, after a 4.56% decrease over the last day. The top volumes this week excluding BTC, ETH, and stablecoins include solana (SOL), binance coin (BNB), xrp (XRP), dogecoin (DOGE), and pepe (PEPE).

As the dust settles from a tumultuous week in the cryptocurrency market, traders and enthusiasts are left to ponder the resilience and volatility inherent in this ever-evolving landscape. While significant losses pervaded much of the sector, the modest gains seen in select AI-centric and other coins suggest a nuanced path forward, one possibly guided by emerging technologies and community-driven projects.

What do you think about this week’s downturn in crypto markets? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com