Three days ago, BeInCrypto reported that bears planned to push the Avalanche ($AVAX) price to $25. While the token’s price fell in that direction, recent data suggests it may soon rebound.

The cryptocurrency’s value has fallen by 12.31% in the last seven days while trading at $27.72. Here are the potential targets for the coming days.

Avalanche Holders Plan to HODL

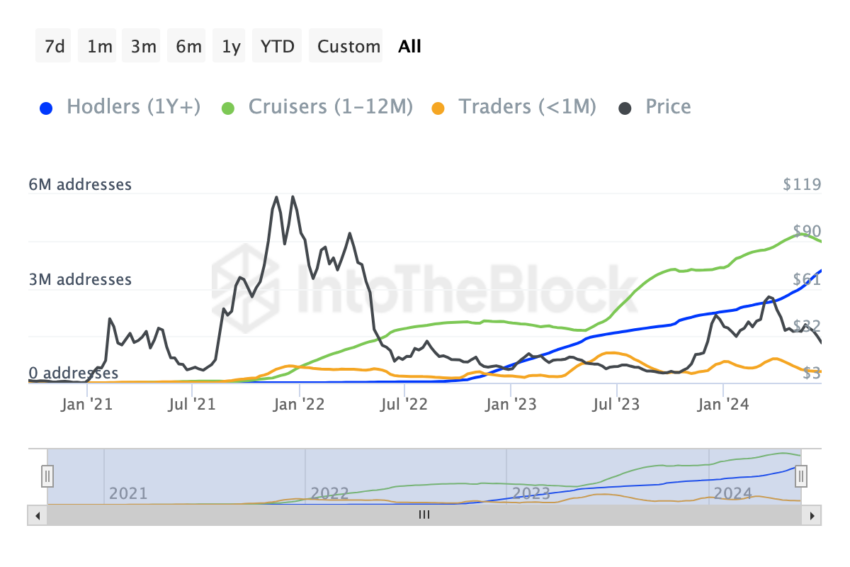

Firstly, we analyzed the Addresses by Time Held, as provided by IntoTheBlock.

- Addresses by Time Held: This metric is divided into Holders, Cruisers, and Traders. Holders are those who have held a token for at least a year. Cruisers are those who have held the token between one to 12 months. Lastly, traders are those who made purchases within the last 30 days.

As of this writing, the number of Cruisers, also called swing traders, decreased in the last 30 days. Short-term speculators also towed a similar path.

However, addresses holding $AVAX for at least a year increased by 16.12% within the same period. Historically, when the number of holders decreases, it means that the bull market is reaching its last stages.

Read More: How to Add Avalanche ($AVAX) to MetaMask: A Step-by-Step Guide

Past cycles, including 2013, 2017, and 2021, show evidence of this. However, an increase in the number of Avalanche holders when the price of a cryptocurrency has gone through a correction is a bullish sign.

Furthermore, if sustained, $AVAX may begin to take steps to erase some of its losses. The addresses by holdings also show evidence of a possible price increase.

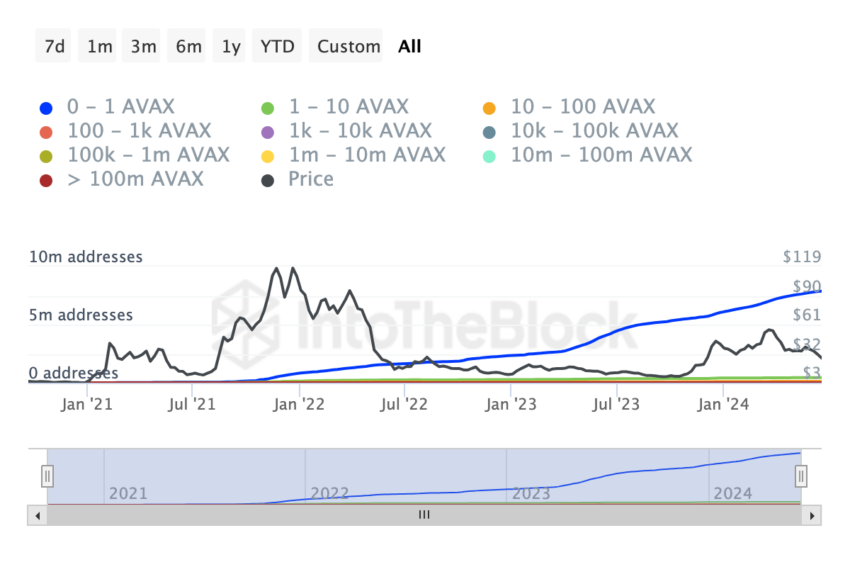

- Addresses by Holdings: It groups addresses based on the number of tokens owned and tells if more market participants are buying more or if existing addresses are selling.

At press time, the number of addresses holding 100,000 to 10 million $AVAX increased. An increasing number of holders with large amounts of tokens is a positive sign of the price. As such, $AVAX may resist further downside and begin to climb.

$AVAX Price Prediction: Challenges Appear Despite Bullish Potential

As seen below, Avalanche’s price has bounced after falling to $26.47 earlier. While it remains sandwiched below $30, bulls seem ready to curb the tenacious downswing. The Relative Strength Index (RSI) shows proof of this attempt.

- Relative Strength Index (RSI): This technical oscillator shows whether a cryptocurrency’s momentum is bullish or bearish. It can also spot overbought (readings above 70) and oversold (readings below 30) points.

On June 18, $AVAX dropped to the oversold region. But at 32.07, the RSI reveals that little drops of buying pressure are starting to appear. If bulls sustain this momentum, $AVAX’s price may jump to $30.95. In a highly bullish scenario, the token’s value can reach $33.20.

However, the Ichimoku Cloud indicator shows that $AVAX may experience a stumbling block in the attempt. If this happens, the bullish price prediction will be invalidated.

Ichimoku Cloud: It consists of five moving averages, which help to identify the trend direction. As a result, it spots resistance and support regions.

If the price denoted by the candles moves about the cloud, it is an uptrend. But if the cloud is above the price, it is a downtrend. Looking at the $AVAX/USD daily chart above, we observe that the cloud was below the price in March.

Read More: How to Buy Avalanche ($AVAX) and Everything You Need to Know

Consequently, this drove $AVAX to $60.66 at that time. However, as of this writing, it is the other way around. By the look of things, $AVAX’s price can increase. However, if buying pressure is not intense, it may not surpass $31.98. This may force a rejection to $26.60

beincrypto.com

beincrypto.com