Bitcoin’s underwhelming price movements continue as the asset was stopped at $66,400 and was pushed down toward $64,000 for the third time this week.

The altcoins have turned red as well, with numerous painful declines, especially from the meme coin niche.

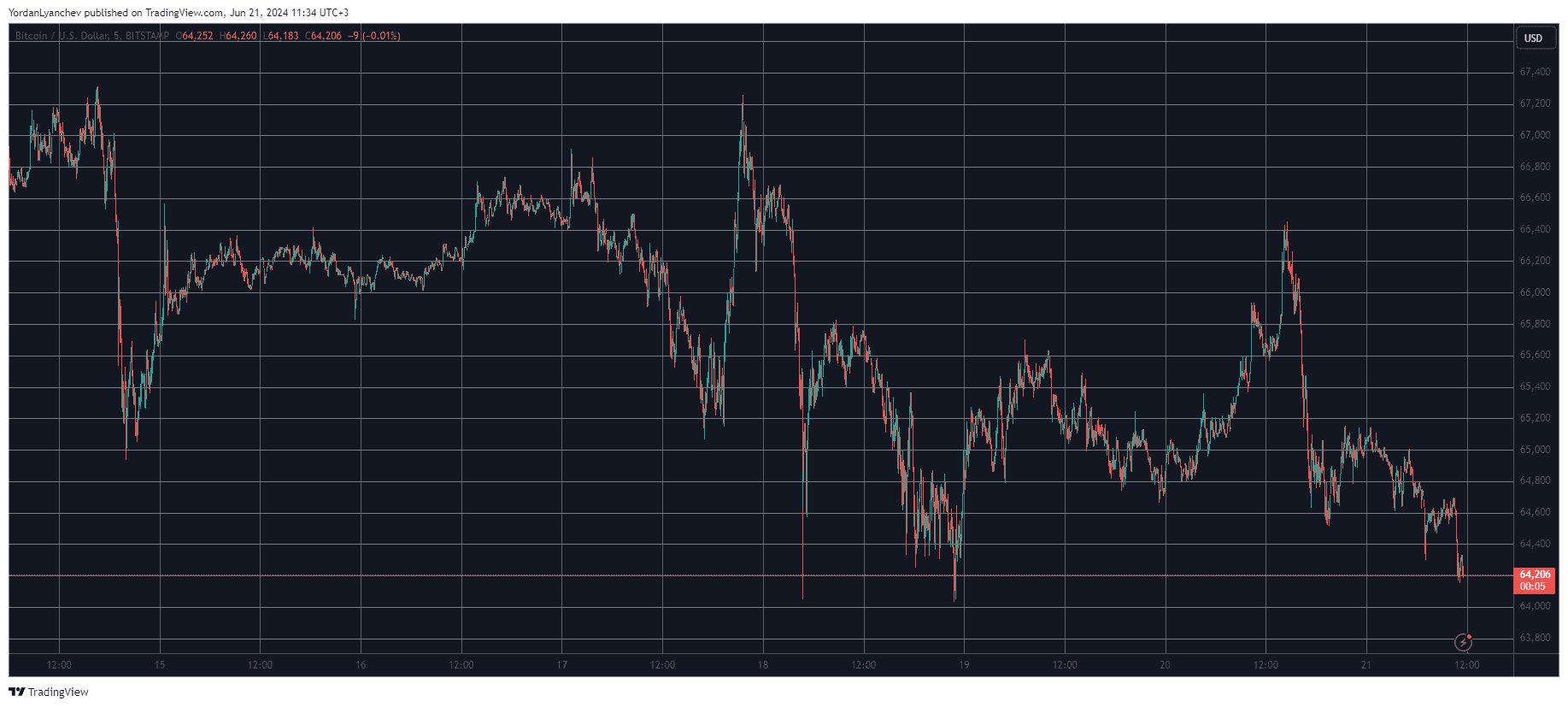

BTC Slips Toward $64K

It’s safe to say that the primary cryptocurrency has seen better days in terms of price movements. In fact, just last week, it pumped to $70,000 on a couple of occasions, but its failure to continue north resulted in painful rejections that pushed it to under $65,000 by Friday.

The weekend was less eventful as the asset reclaimed some ground and stood at just over $66,000. The start of the new business week began with a leg up toward $67,000, which was halted in its tracks, and the bears drove BTC south to a monthly low of $64,000.

After bouncing off, bitcoin went on the offensive yesterday and jumped to just shy of $66,500 (on Bitstamp). Yet, another rejection followed, and BTC now struggles to remain above $64,000 once again.

These price drops come amid continuous outflows from the spot Bitcoin ETFs. After the pause on June 19, the withdrawals yesterday were close to $140 million, with GBTC outplacing FBTC for the first time in days.

With BTC now being 2% down on the day, its market cap has slumped to $1.265 trillion. Its dominance over the alts is slightly up, though, to 51.5%.

Meme Coins Suffer

The altcoins are in an even worse shape than BTC, at least the majority of them. ETH is down by more than 3% and sits below the psychological support of $3,500. BNB has declined by a similar percentage to $583.

More losses come from SOL, SHIB, DOT, LINK, XRP, DOGE, ADA, and others from the larger-cap cohort.

However, some of the biggest losers on a daily scale are from the meme coin realm. WIF dumped to a multi-month low today, followed by JASMY, BONK, BRETT, PEPE, and FLOKI – all of them are down by more than 8% in a day.

The cumulative market cap of all crypto assets has seen about $50 billion gone in a day.

cryptopotato.com

cryptopotato.com