This week, we take a closer look at Ethereum, Ripple, Cardano, Dogecoin, and Polkadot.

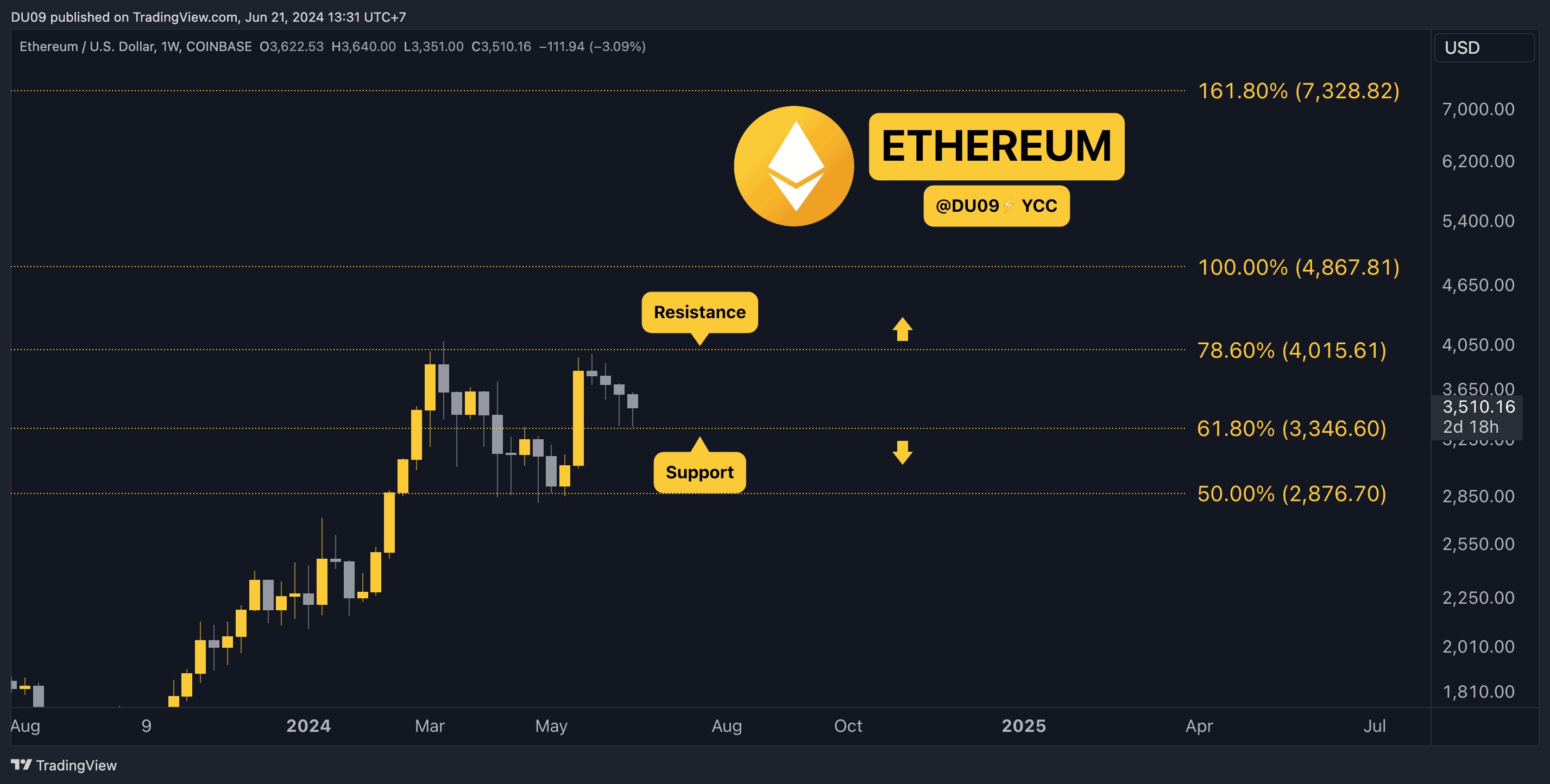

Ethereum (ETH)

Ethereum is at a similar price level to last week and is still trading above the key support at $3,500. As long as this level holds, then buyers still have a shot at a reversal later.

The key resistance is at $4,000, and the market appears to be quite indecision about where to go next. The momentum indicators on the weekly timeframe, such as the MACD, have a bearish bias, which gives sellers the upper hand right now.

Looking ahead, Ethereum appears to be waiting for a decisive move. Unless something changes soon, support at $3,500 could be put under pressure again soon.

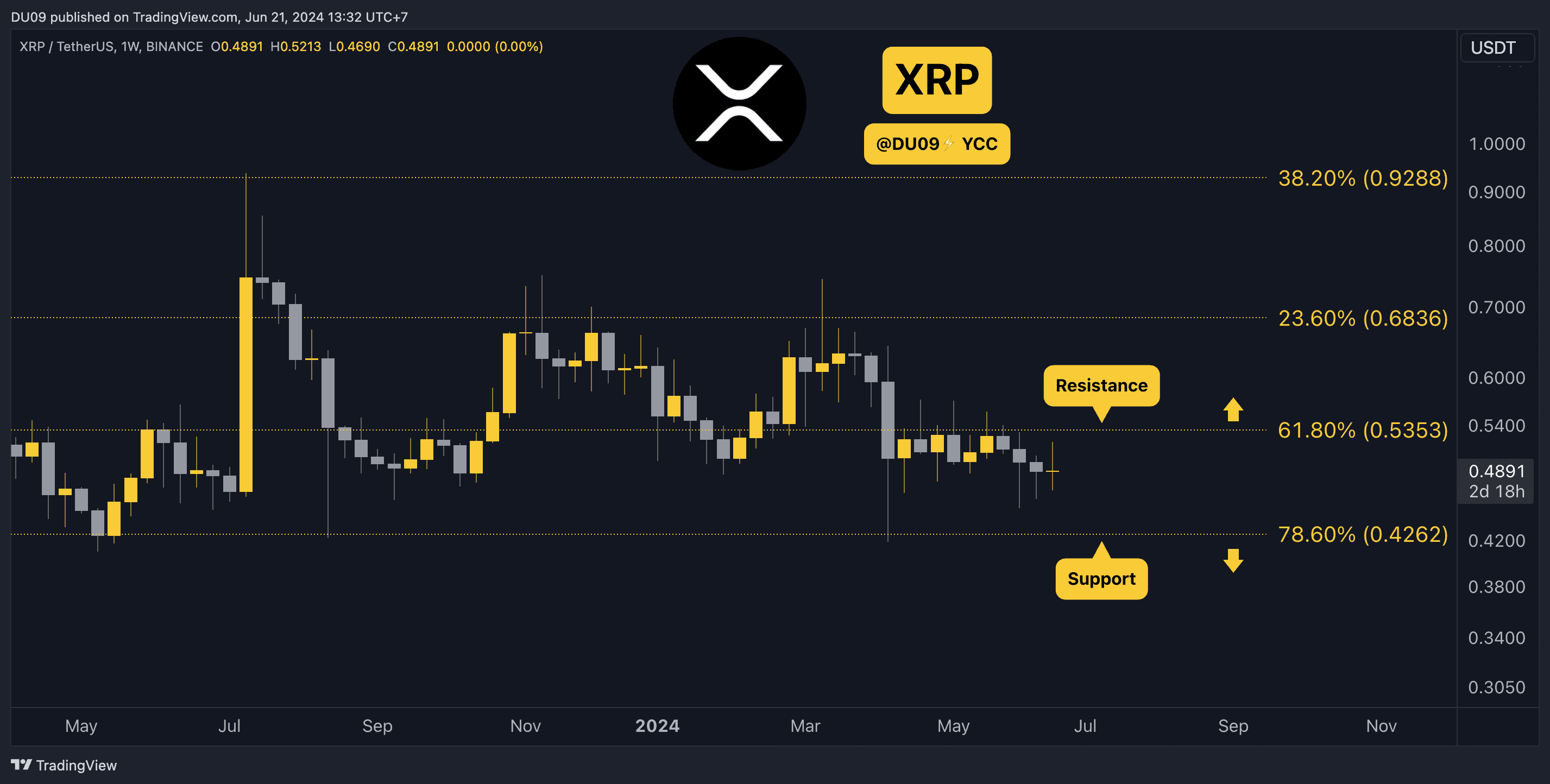

Ripple ($XRP)

After $XRP fell under 54 cents, the price action turned bearish, and this level became a key resistance. This week, the selling pressure faded, and buyers managed to push the price up by 2%. This may bring some optimism back if continuation follows.

While buying volume remains low, this latest push from buyers could signal that interest is coming back to $XRP whenever its price is under 50 cents.

Looking ahead, $XRP remains in a large range, and until the key resistance is broken, the hope of a sustained recovery or rally will have to wait.

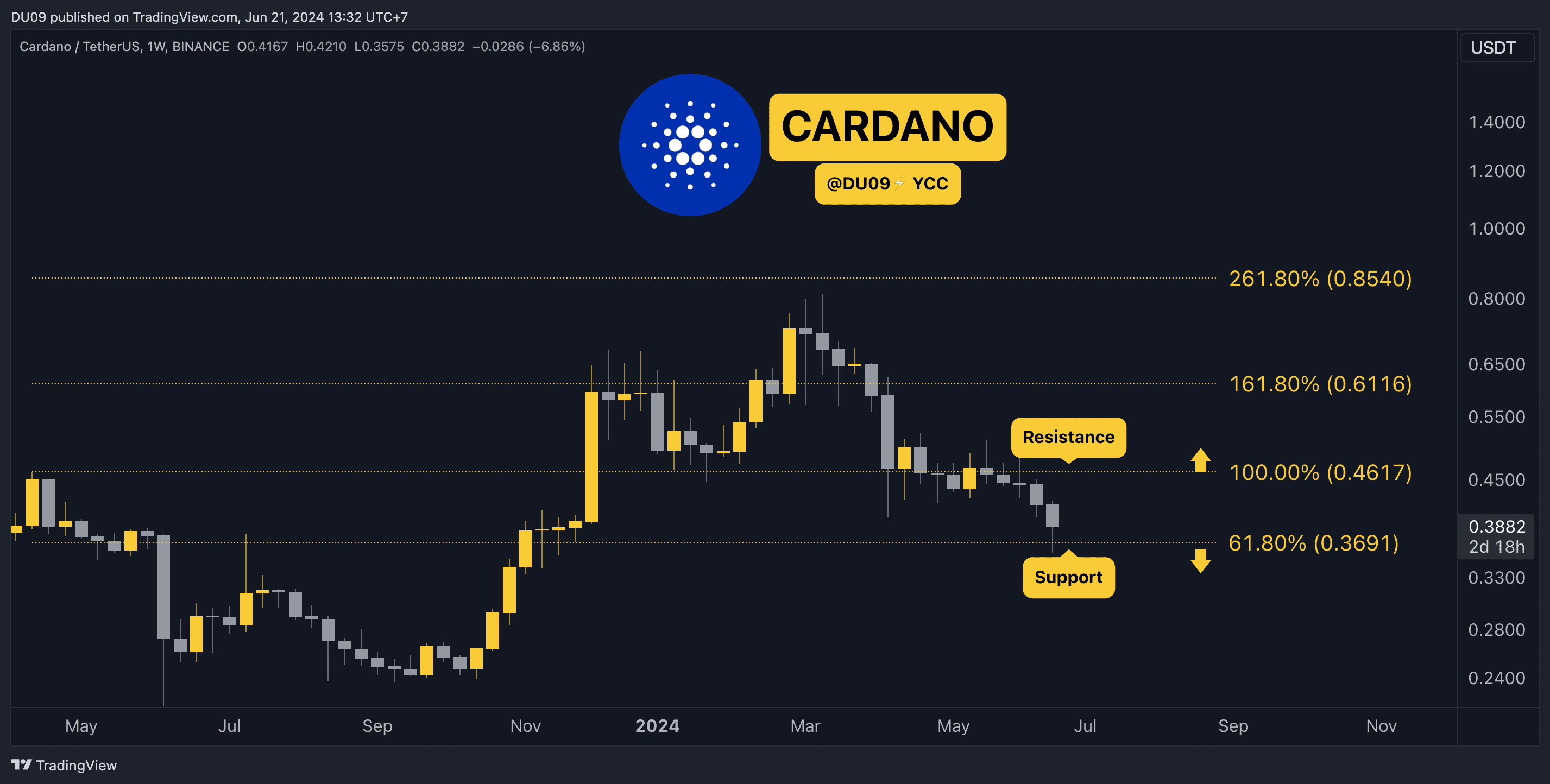

Cardano ($ADA)

$ADA had a bad week and closed with an 8.5% loss. The past five weekly candles are in red, and this latest push by sellers took the price to the key support at 37 cents.

Buyers managed to stop the assault at the key support, and for now, the price appears to hold here. Nevertheless, this latest drop has consolidated the seller’s grip on $ADA, and they may not let go any time soon.

Looking ahead, $ADA is found in a difficult situation because its price made a lower low which shows the downtrend might continue for some time until it finds a bottom.

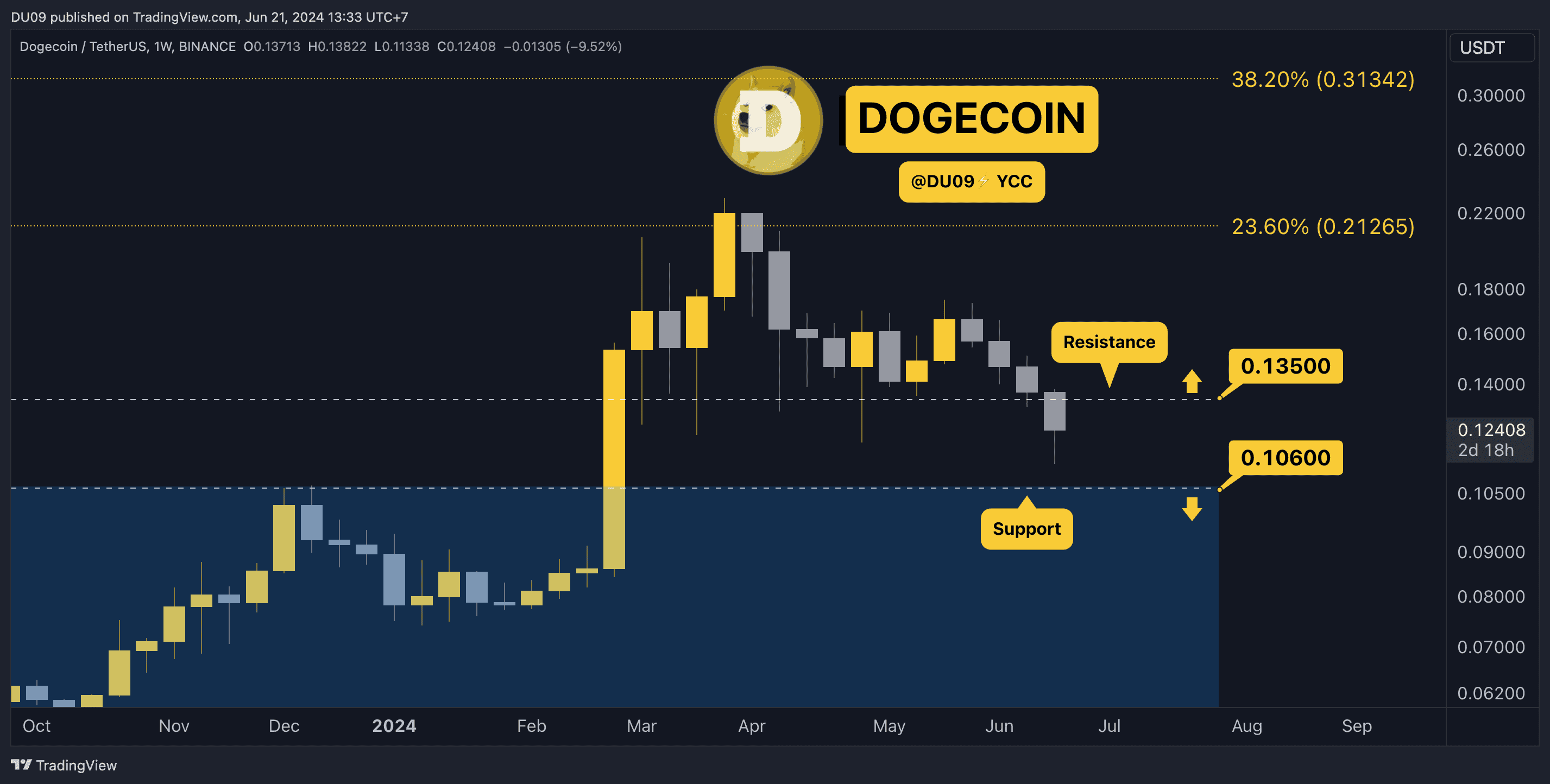

Dogecoin ($DOGE)

The meme coin season appears to have ended after a great start early in the year. Only this week, $DOGE’s price dropped by 13%. With a new local low, this correction may require more time until it finds buyers.

The current support is just above 10 cents and may be tested considering this downtrend. If so, buyers could become interested again at that level, but this is also contingent on the overall market making a recovery.

Looking ahead, the chart is bearish, and it is best to wait before considering an entry until a support level stops this ongoing correction.

Polkadot ($DOT)

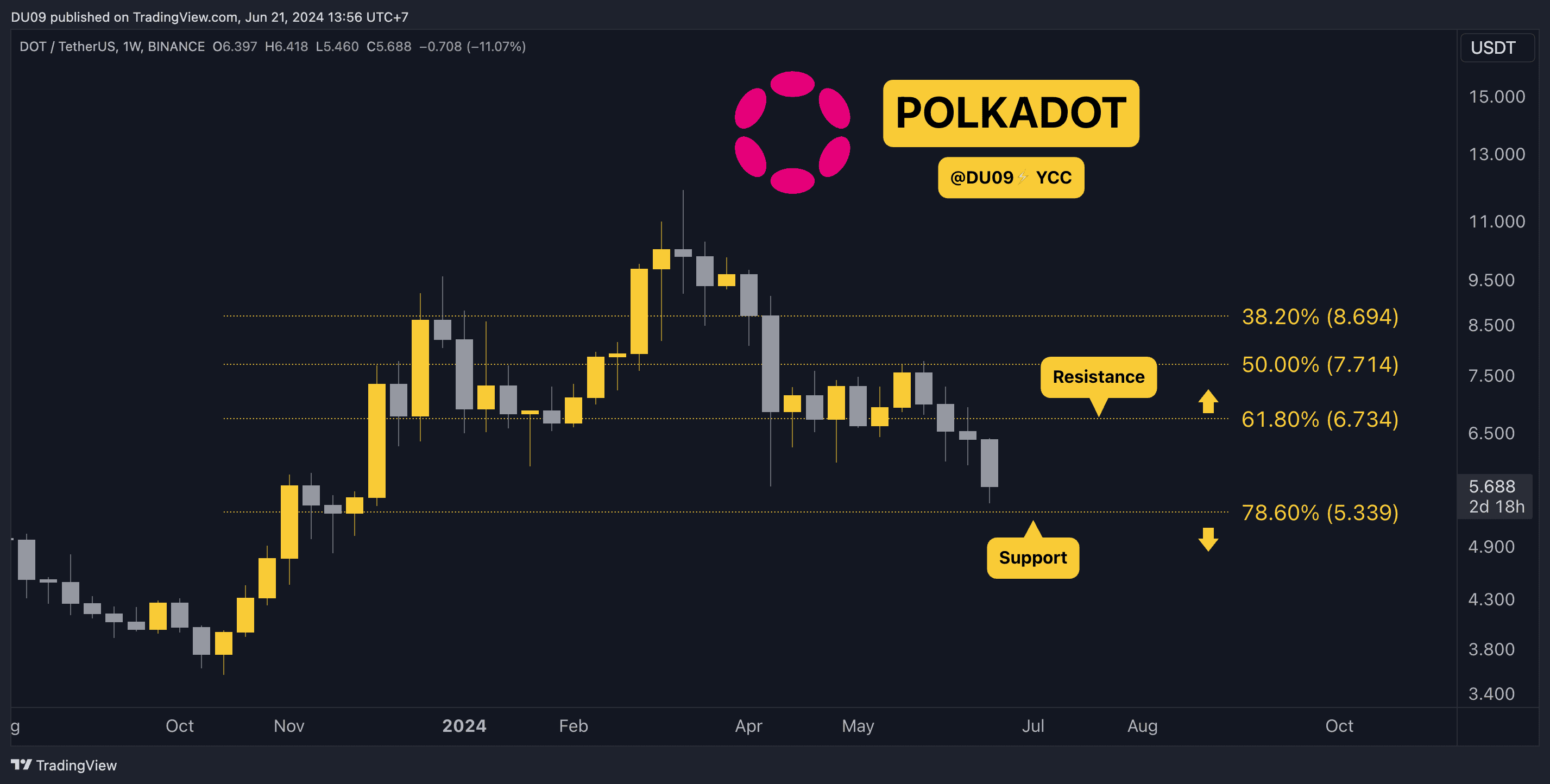

$DOT’s price action was disappointing this week after falling by 11%. This latest crash comes after the cryptocurrency failed to hold above $6.7 which is now acting as resistance. Due to this recent decline, the key support has also moved to $5.3.

The trend is bearish, and it may stay bearish until the key support is tested. If buyers manage to return there, then $DOT could form a local bottom and attempt a recovery.

Looking ahead, Polkadot holders may experience more pain before a relief rally starts. All eyes are now on the key support to see if it can stop this latest push from sellers.

cryptopotato.com

cryptopotato.com