Bitcoin’s price actions were quite painful yesterday as the asset dumped twice to a monthly low of $64,000 before it managed to recover some ground.

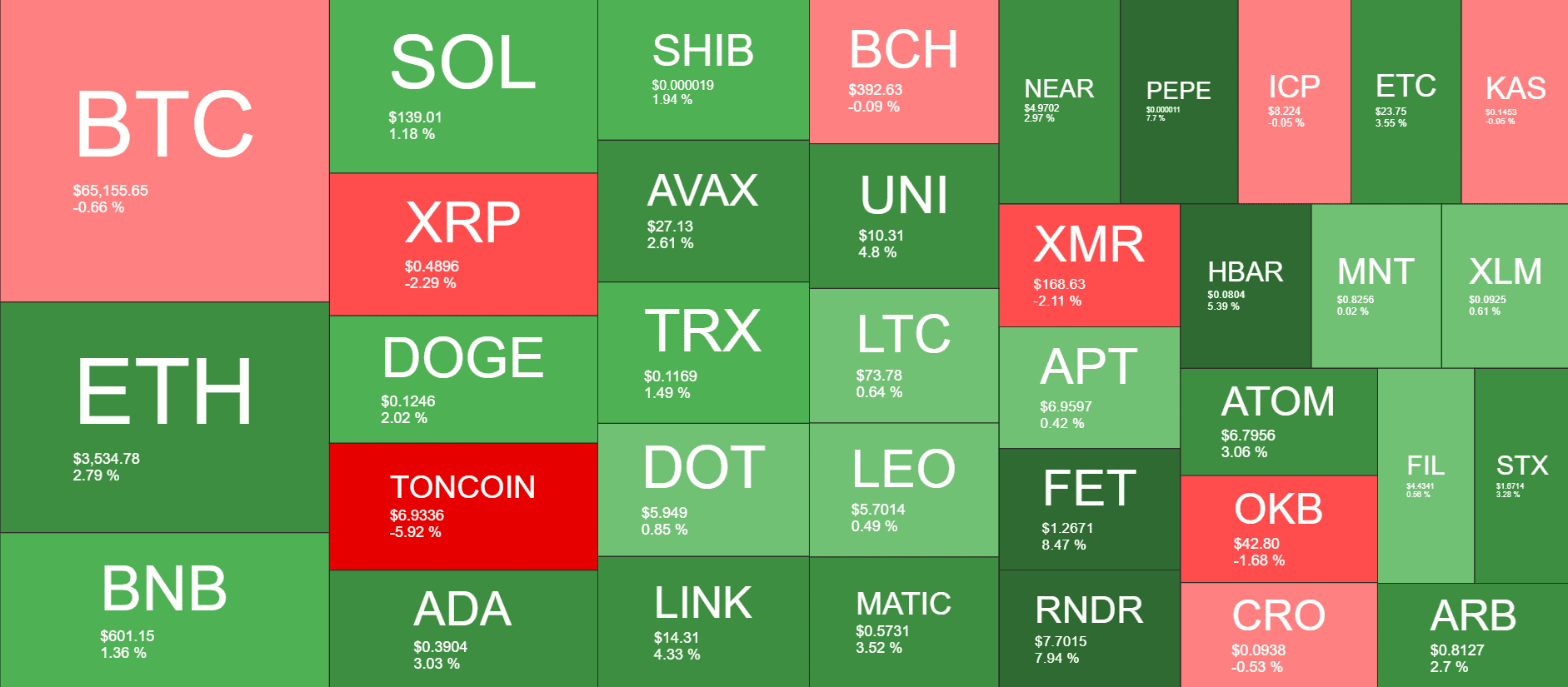

Several altcoins have bounced off following yesterday’s market-wide crash, especially those with some sort of connection to the Ethereum ecosystem.

ETH, ENS, LDO on the Rebound

Perhaps the biggest news in the crypto industry today came from ConsenSys as the company announced on X that the US Securities and Exchange Commission has notified it “that it is closing its investigation into Ethereum 2.0.” The development, which ConsenSys labeled as a “major win for Ethereum developers,” resulted in immediate gains for most ETH-related tokens.

Lido DAO’s native coin has skyrocketed by more than 15% on a daily scale to just over $2.3. ENS has soared by 13.5% and now trades above $26.

ETH is also slightly in the green but in a more modest fashion. The second-largest crypto has jumped by about 3% daily, and sits close to $3,550.

Other larger-cap alts with notable increases today include PEPE (8%), HBAR (5%), FET (8.5%), RNDR (8%), ADA (3%), LINK (4%), UNI (5%), and MATIC (3.5%).

In contrast, TON has slumped by 6% in the past 24 hours and now sits under $6.9.

BTC Bounces Above $65K

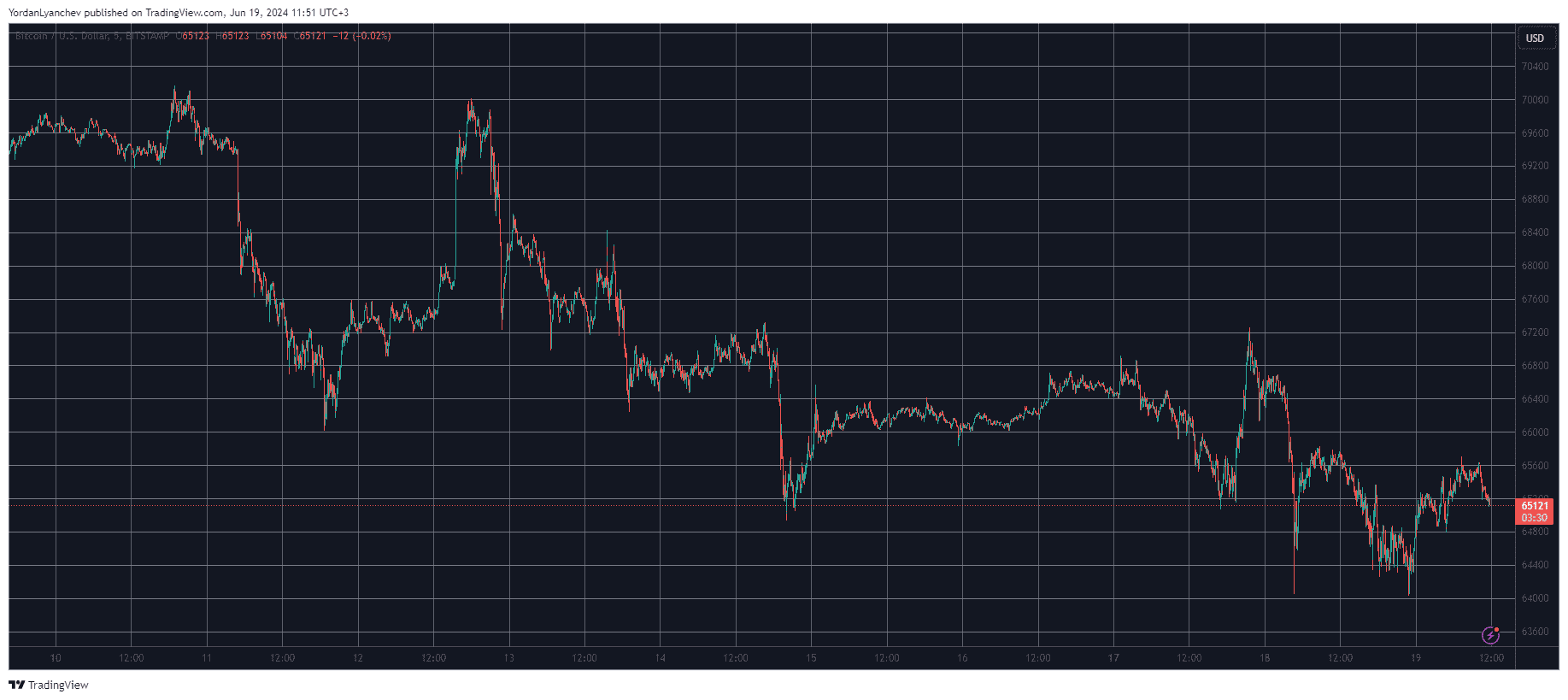

Perhaps fueled by the growing outflows from the US-based spot Bitcoin ETFs, the underlying asset’s price has lost a lot of traction since last week when it skyrocketed to $70,000 on a few occasions.

Its inability to rise above that psychological resistance resulted in immediate pain for the bulls. The weekend was less volatile as BTC remained at just over $66,000 before it was stopped at $67,000 on Monday.

The rejections led to more pain, and bitcoin fell to a monthly low of $64,000 twice yesterday. Nevertheless, it has regained over a grand since then and now sits inches above $65,000.

Its market cap has declined to $1.285 trillion, while its dominance over the alts has shrunk to 51.5%

cryptopotato.com

cryptopotato.com