Injective’s (INJ) value has cratered by over 30% in the last seven days. At its current price of $20.55, the altcoin trades at its lowest level since December 11, 2023.

Interestingly, INJ’s double-digit price fall has occurred despite an uptick in its network activity over the past seven days.

Injective Saw a Spike in User Activity in the Last Week

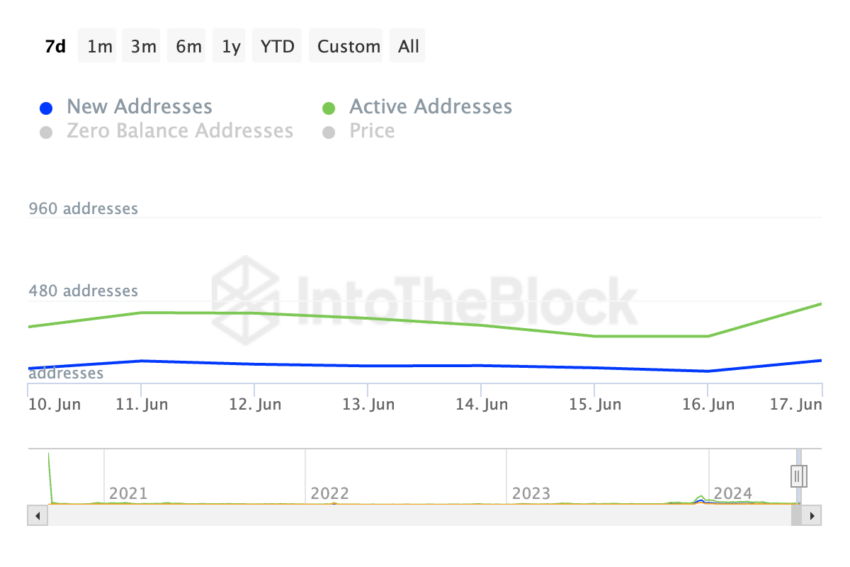

On-chain data showed an uptick in Injective’s network activity in the last week despite the altcoin’s price fall during that period. In the past seven days, the number of daily active addresses that have completed at least one INJ transaction has increased by 41%.

The altcoin has recorded an uptick in new demand during the same period. The number of new addresses created on its network to trade the token has also grown by 57% in the last week.

Injective Daily Active Addresses. Source: IntoTheBlock

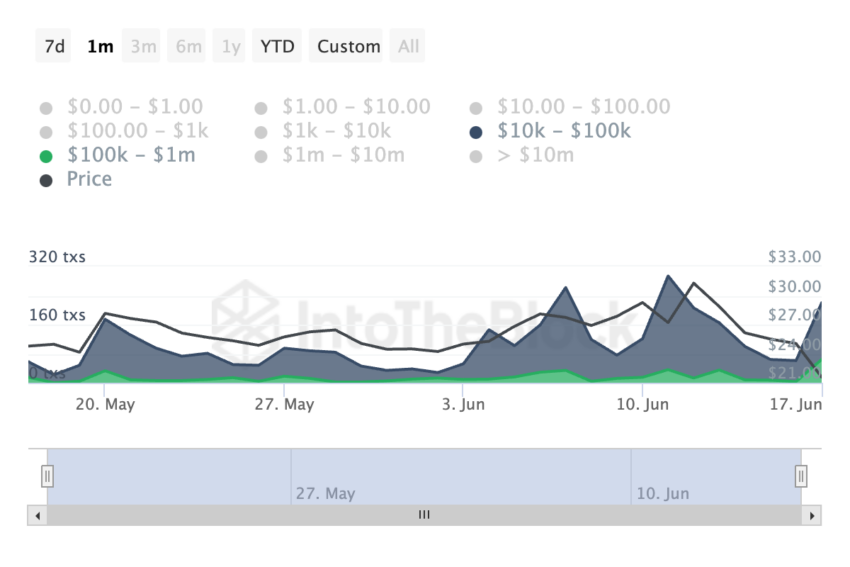

In addition, INJ has witnessed a surge in its daily large transaction volumes. In the last month alone, the number of INJ transactions worth between $100,000 and $1 million has increased by 1500%.

For INJ transactions valued between $10,000 and $100,000, the count has rallied by 255%.

Read More: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

A combined interpretation of INJ’s price decline and the uptick in its network activity could be that the price fall attracts new users who see it as a buying opportunity.

Also, the rise in transaction count, especially from INJ whales, could be due to these investors panic selling their holdings, which may lead to a further price decline.

INJ Price Prediction: Brace For Further Declines

According to readings from INJ’s price chart, the bearish bias against INJ is significant. At press time, its Directional Movement Index (DMI) shows the positive directional index (green) below the negative index.

This indicator measures an asset’s trend strength. When set up this way, the downward movement is stronger than the upward movement, indicating a bearish trend. Traders might interpret this as a signal to look for short-selling opportunities or to avoid buying positions until the trend changes.

INJ’s Aroon Down Line at 100% confirms the strength of the current downtrend. An asset’s Aroon indicator measures its trend strength and potential price reversal points.

When the Aroon Down line is close to 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently. If this downtrend continues, INJ might slip under $20 to exchange hands at $18.60.

If invalidated and the trend shifts from bearish to bullish, the coin’s price might climb toward $21.29.

beincrypto.com

beincrypto.com