Solana price experienced an 8.52% upswing over the weekend, briefly surpassing the $150 milestone. This upward momentum was spurred by the integration of PayPal’s $PYUSD stablecoin into Solana’s DeFi ecosystem. Here’s an in-depth analysis of what could unfold in the coming week.

$45M $PYUSD Deployed on Solana, Fuelling Weekend Price Rally

The recent incorporation of PayPal’s native stablecoin, $PYUSD, into both the Solana blockchain has generated positive buzz around $SOL price action. This integration, announced on May 29, seeks to leverage Solana’s scalability, high-speed and low-fees, thereby enhancing $PYUSD’s reach within the cryptocurrency space.

Launched in August 2023, $PYUSD has quickly garnered a market valuation of over $420 million according to CoinMarketCap data. The decision to integrate with Solana and Injective is part of a broader strategy to boost $PYUSD adoption by capitalizing on more efficient and scalable blockchains.

After the initial announcement on May 29, the $SOL market response was largely subdued due to broader bearish trends influenced by Ethereum ETF approval news and unfavourable US economic indicators.

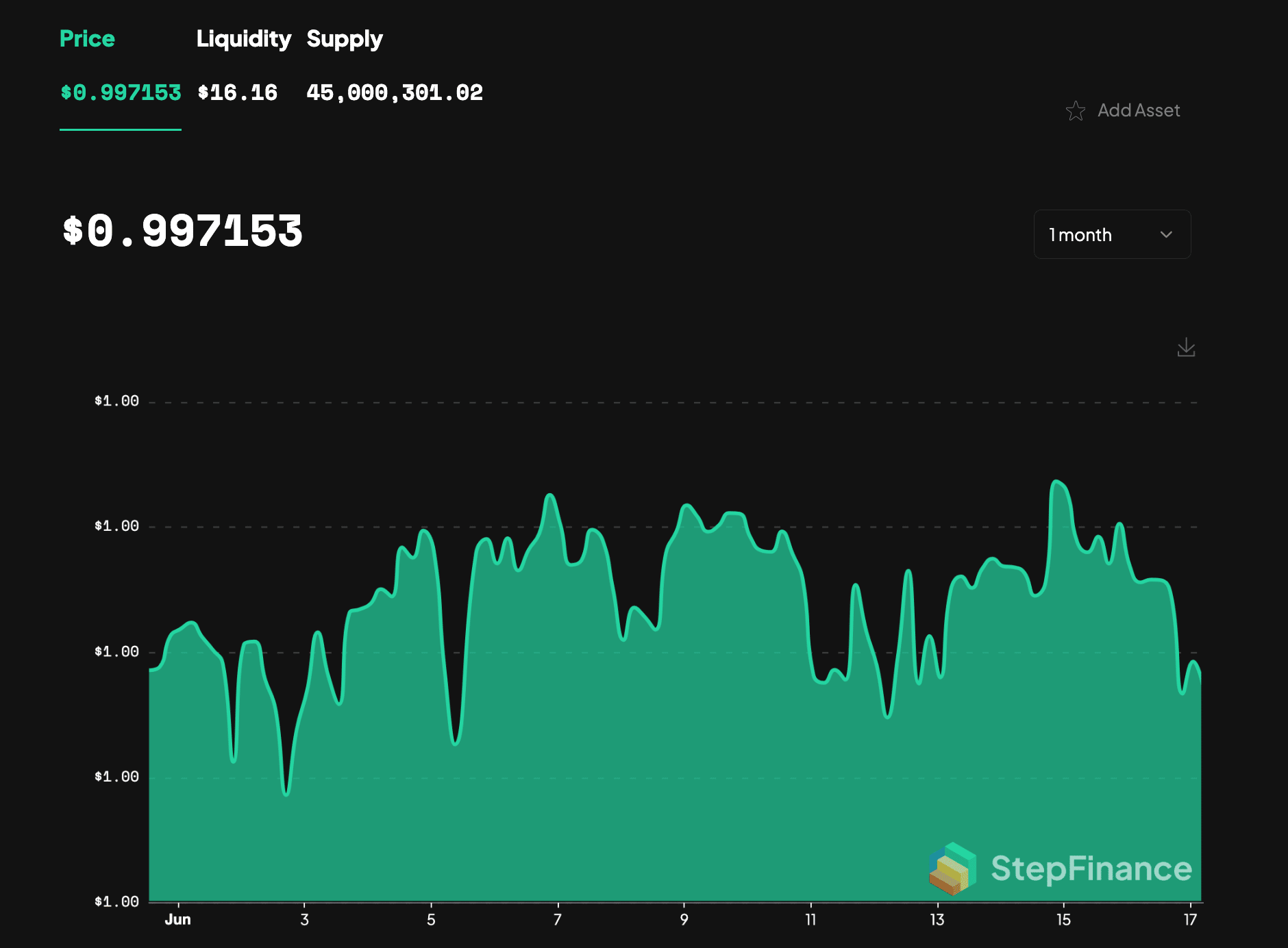

However, according to Step.Finance, a Solana native portfolio management tool, over $45 million worth of $PYUSD has is already circulating within the Solana DeFi ecosystem at the time of writing on June 17.

Evidently, this additional liquidity has vital a key role in spurring $SOL market activity as bullish investors regained confidence over the weekend.

Market Dynamics and Price Movements

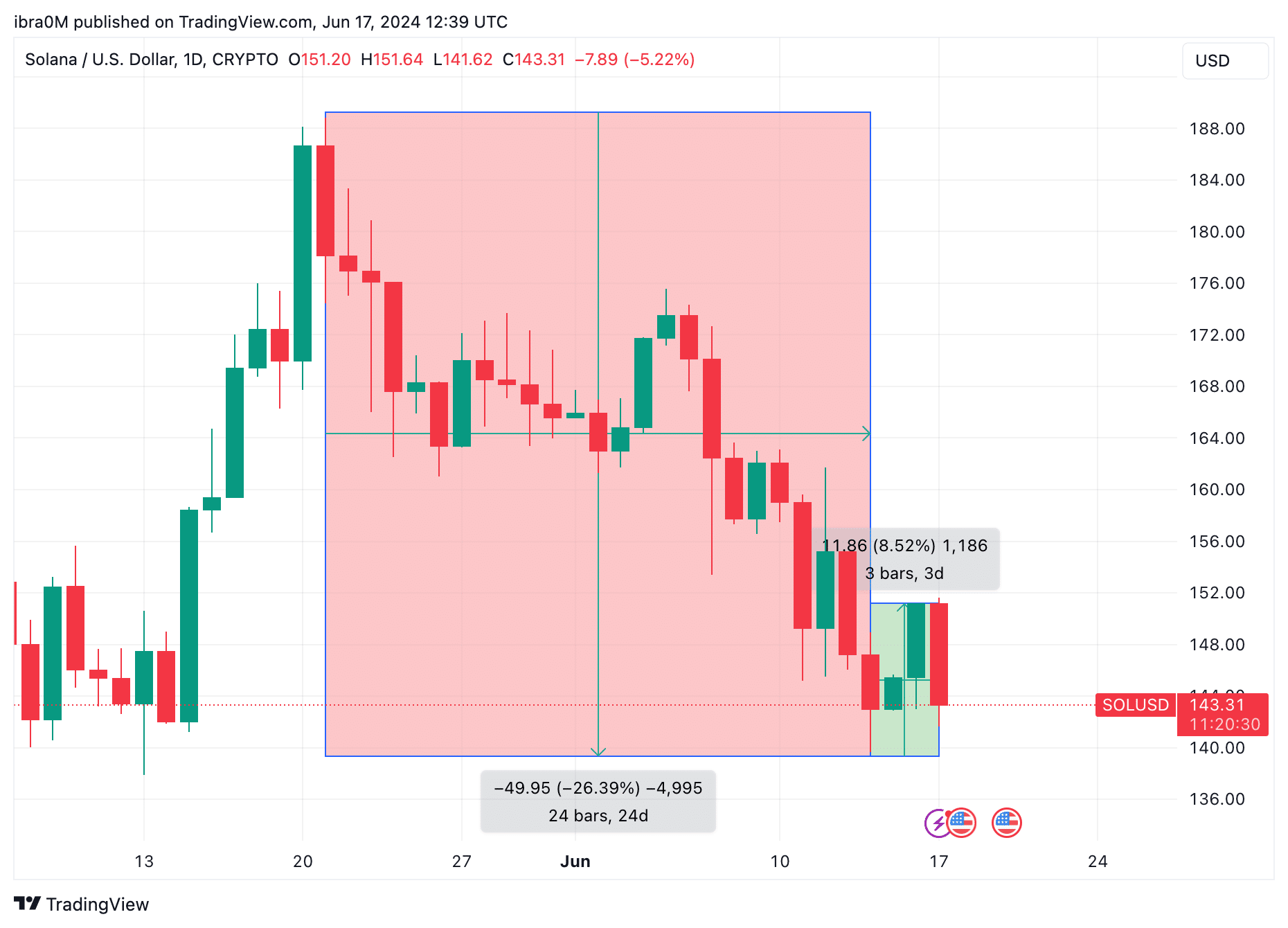

On June 14, Solana’s price started to recover from a 30-day bottom of $139, briefly grazing $151 territory over the weekend. This rally marked the end of a nearly 25-day decline triggered by hostile macro economic landscape in US.

Although the price retracted to around $145 after facing another bearish wave on June 17, the majority of traders remain optimistic. Data from Coinglass reveals that speculative traders are heavily favouring bullish positions, with $108.37 million in long positions compared to $82 million in short positions, indicating a strong short-term bullish sentiment.

Solana Price Outlook: Key Resistance and Support Levels

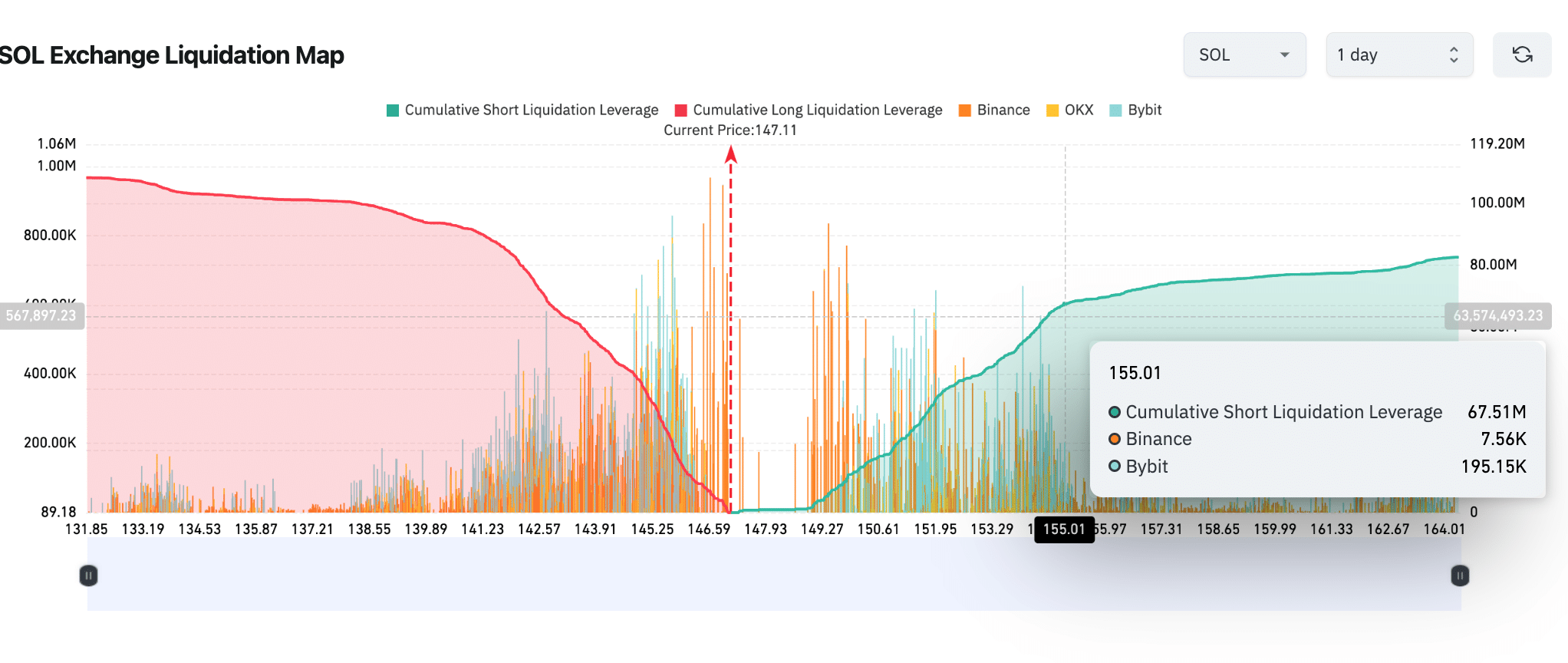

As Solana’s price rose by 8% over the weekend, bullish traders significantly outpaced the bears in the derivatives market. However, the $155 resistance level looms large due to prevailing bearish sentiment in the broader crypto market, particularly after Bitcoin prices tumbled towards $65,000 on Monday.

The Coinglass Liquidation Map shows substantial short positions around the $155 level. If Solana’s price rises above this threshold, short traders could face considerable losses, which might prompt stop-loss orders or large sell-offs, potentially halting the $SOL price recovery phase.

In terms of support, Solana bulls are expected to defend the $140 level to avoid liquidation losses exceeding $93 million. This defense could lead to Solana consolidating within a narrow price range of $142 to $153 as the traders look forward to the next major market catalyst.

In summary, while Solana’s recent price surge is encouraging, the $155 resistance and $140 support levels will be crucial in determining the next phase of its price action. As the impact of PayPal’s $PYUSD integration continues to unfold, investors will be closely monitoring these broader crypto market sentiment for potential momentum swings.

thecryptobasic.com

thecryptobasic.com