Solana’s price tumbled to a 30-day bottom of $139 on Friday, June 14; on-chain analysis explores some of the key metrics that could trigger an SOL rebound phase in the days ahead.

Solana Succumbs to More Downside After Hawkish US Fed Rate

Since the Ethereum ETF approval drew investors’ attention away from other competing Layer-1 projects in late-May, the likes of Solana (SOL), Avalanche (AVAX) and Cardano (ADA) have all struggled for traction.

However, despite Solana node validators’ best efforts to cool the selling pressure, the SOL price surrendered to even more downside this week after the US Fed rate pause decision dashed bullish investors’ hopes of a rate cut in H1 2024.

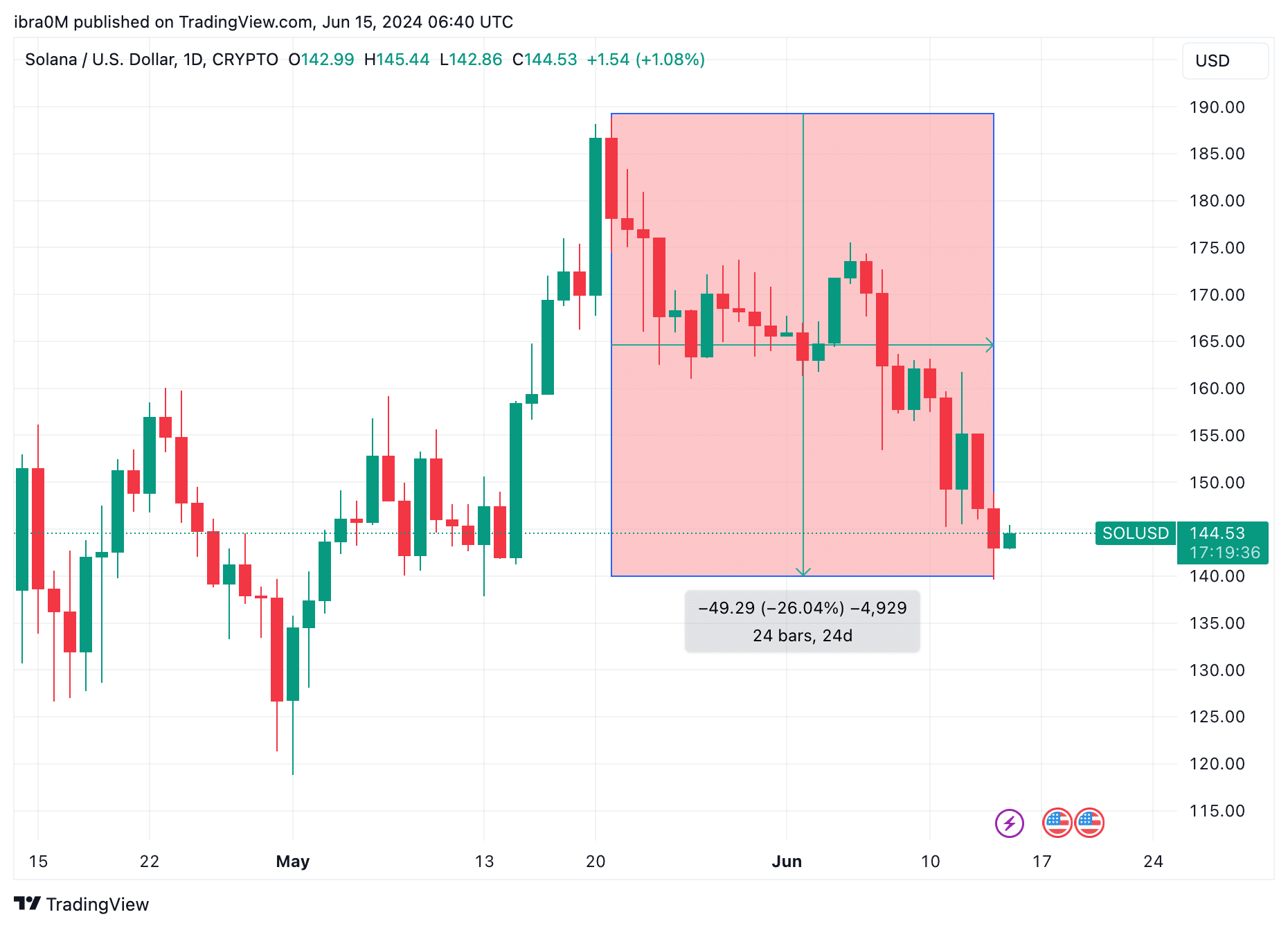

As seen above Solana price tumbled towards $139 on June 14, its lowest since May 13 2024. This underlines how Solana has struggled since Ethereum ETFs were approved by the United State Securities and Exchange Commission (SEC).

In early, June Solana node validators began to stake more SOL coins, in a bid to earn passive income amid the market downtrend and also slow down the selling pressure. However, the hawkish US Fed rate decision this week has negatively impacted SOL’s rebound prospect.

Solana Price Forecast: Traders Mount $120M LONG Positions as Bottom Nears

Solana’s price has fallen below the critical psychological support level at $140, but recent trends observed among speculative traders suggest that the SOL market bottom could be near.

After 30-days on the downward trajectory, Solana traders are now making strategic moves to anticipate the market bottom.

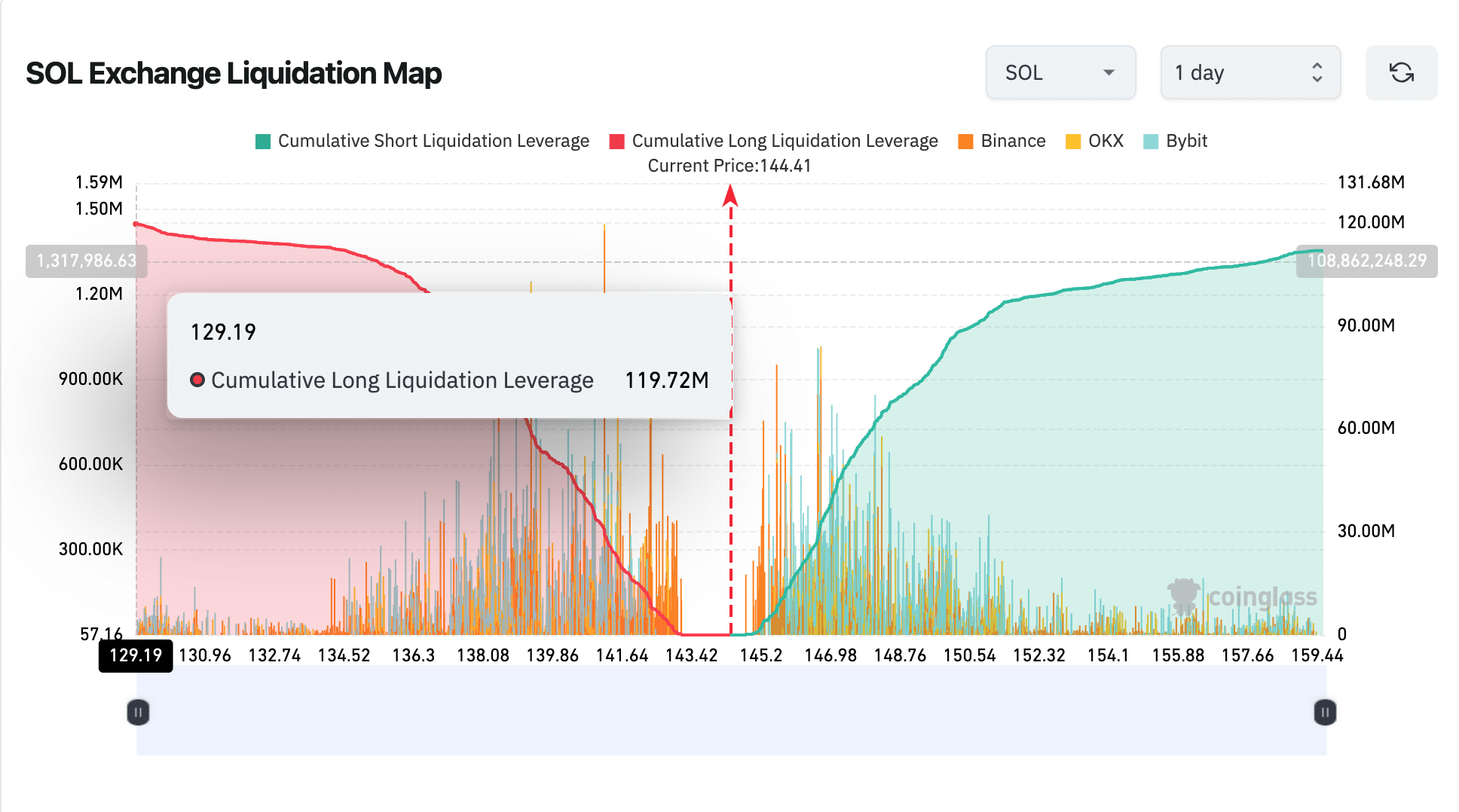

Coinglass’ Liquidation map chart compares the value of SOL LONG contracts against the active SHORT contracts listed across various derivatives trading platforms.

As shown below SOL Long traders have place active contracts worth $120 million around the current prices, in a bid to score outsized profits when spot prices begin to rise again.

Meanwhile, in comparison, the total active Short contracts currently stand at about $109 million. Effectively, this shows that LONG contracts have exceeded the SHORTs by over $10 million, signaling that bulls are making moves to seize control in the next market phase.

In terms of short-term support and resistance level, bulls are likely to face an imposing sell-wall at the $150 area. In indication of this, the chart shows that over $96 million worth of the active SHORT contracts have been placed at $150.54 level.

To avoid such large losses over, the majority of those traders could stage massive sell-offs and deploy stop-loss triggers as the SOL price approaches the $150 level in the days ahead, potentially slowing down the rebound phase.

But if bull can avoid that setback, the resulting short-squeeze could drive the rebound phase toward the $170 mark.

Conversely, in the event of a prolonged correction phase, Solana Bulls can count on the $130 level as the next major support cluster.

thecryptobasic.com

thecryptobasic.com