Solana (SOL) price continues to decline as the broader market cues turn bearish, as does investor interest.

Along with them, a key cohort that has had an influence on Solana is stepping back.

Solana and Institutions: The Complicated Duo

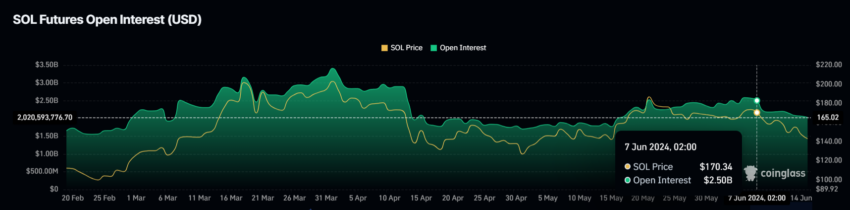

Solana’s price is bearing the brunt of its investors’ pullback, which is evident in the open interest (OI) and inflows. Firstly, investors are becoming increasingly skeptical.

The shift in sentiment reflects the broader uncertainties and volatilities within the market, prompting Solana holders to adopt a more cautious approach to their investments. In the span of a week, the OI has declined by more than $500 million from $2.5 billion to $2 billion.

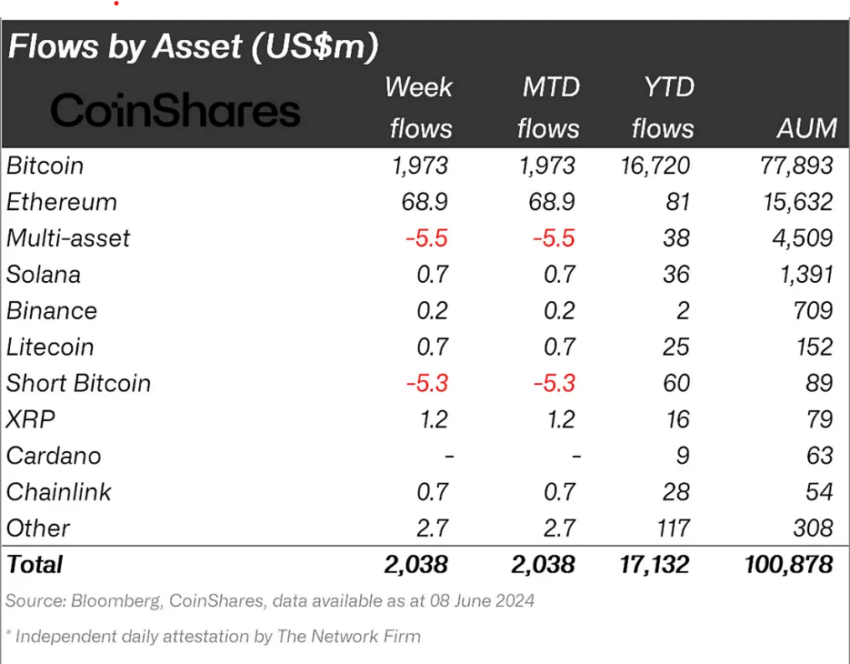

Furthermore, until the end of May, institutional investors had shown a strong preference for Solana (SOL), signaling confidence in its potential. However, this trend has significantly changed recently.

Currently, institutions are diversifying their investments by allocating funds to Ripple (XRP), Litecoin (LTC), and Chainlink (LINK). This redistribution of investments highlights a strategic move to mitigate risks and capitalize on the potential of other cryptocurrencies.

For the week ending June 8, all three assets witnessed about $0.7 million worth of inflows each. While this did not put a dent in Solana’s spot as the asset with the highest inflows year to date, it is being challenged. Ripple (XRP), on the other hand, has seen nearly $1.2 million worth of inflows.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

SOL Price Prediction: A Difficult Recovery

Solana’s price trading at $144 will likely continue its decline to tag $137 as a support floor. This price has been tested in the past and marks a monthly low for SOL. Should the skepticism be sustained among investors, the altcoin could fall to $126.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

On the other hand, if Solana’s price bounces back from $137 or earlier and reclaims $150 as a support floor, it could recover quickly. Breaching $156 is the ideal target for SOL, and securing it as support would enable a bounce back to $170. This would not only help regain the recent losses but also invalidate the bearish thesis.

beincrypto.com

beincrypto.com