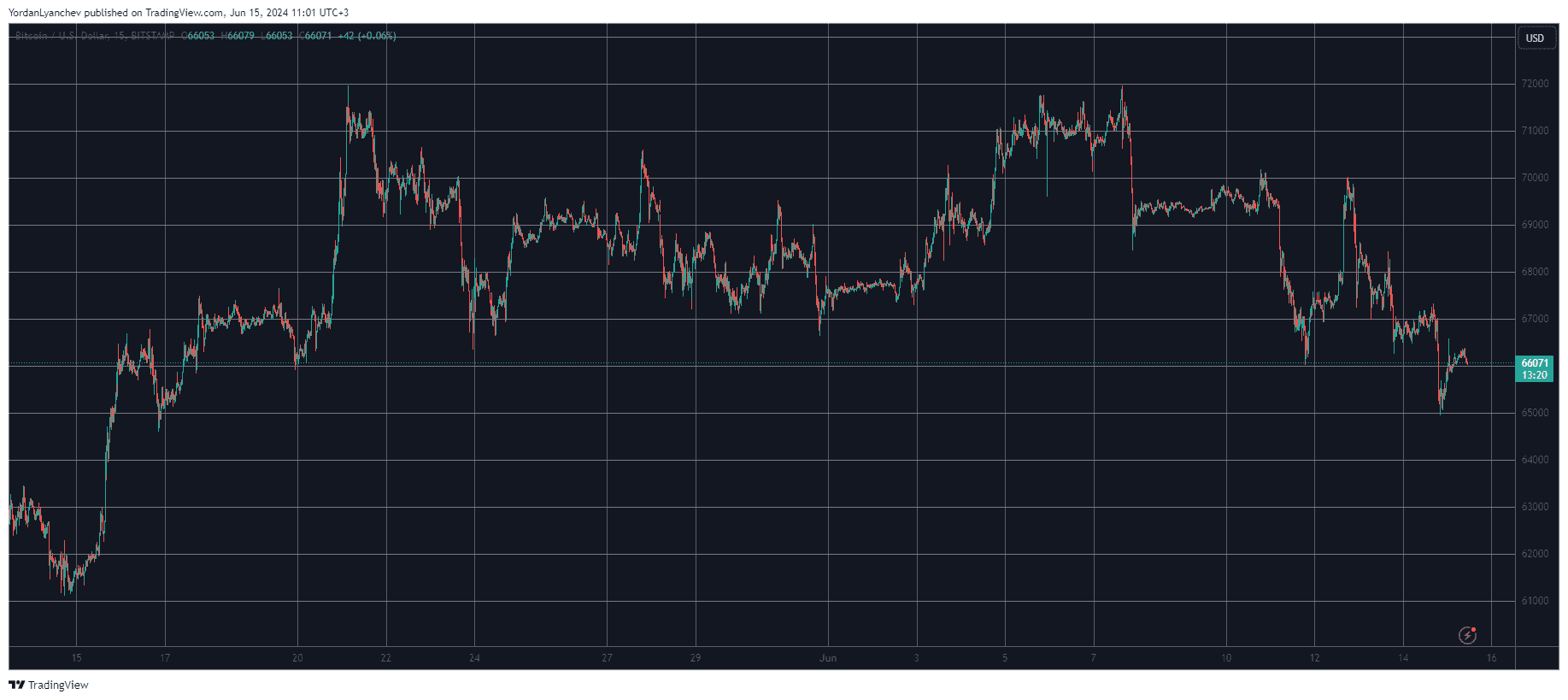

Bitcoin’s price movements for the past few days have been quite painful as the asset slumped to $65,000 yesterday for the first time in about a month.

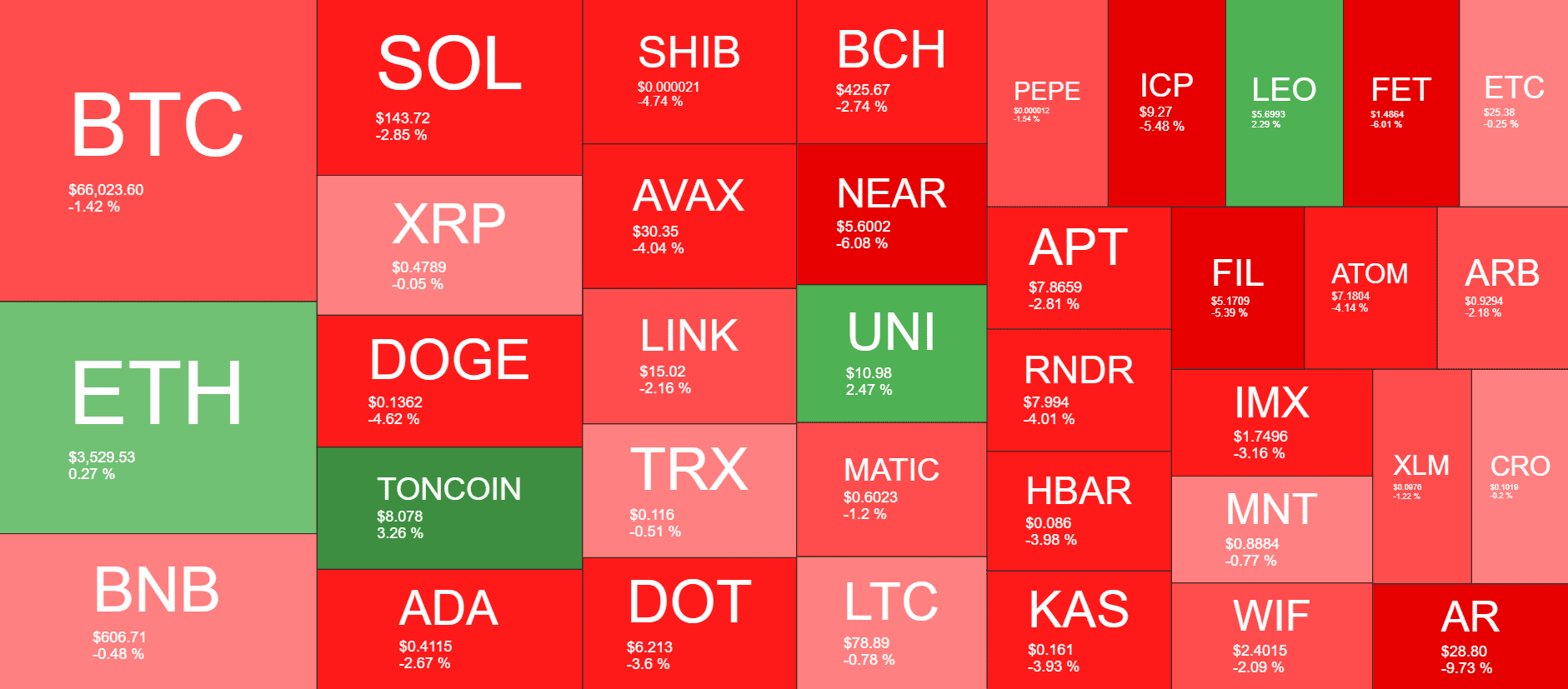

Despite recovering from their lowest positions as well, the altcoins are also deep in the red, with NEAR, FIL, and FET dumping the most.

BTC’s Rollercoaster Continues

The primary cryptocurrency had a somewhat positive start to the business week as it pumped to and slightly above $70,000 on Monday. However, the landscape changed on Tuesday amid growing anticipation and fear about the US CPI numbers and the subsequent FOMC meeting and the asset dropped to $66,000.

Once the CPI beat the expectations, BTC skyrocketed back to $70,000, but that was short-lived. A day later, bitcoin found itself slumping to $67,000 and the situation worsened on Friday evening.

The bears seemed in complete control, and they pushed the asset to a monthly low of $65,000. Although it has been able to bounce off and recover around a grand, BTC is still 1.5% down on the day. This volatility has resulted in over $200 million worth of liquidations from almost 75,000 traders in the past 24 hours.

Its market capitalization has slipped to $1.3 trillion, but its dominance over the altcoins remains strong at just over 51%.

Alts in Red

Most of the altcoins followed BTC south with notable price declines yesterday evening. Although they have been able to recover some ground, they still stand in the red now.

Solana has declined by 3% to $143 as of now, DOGE and SHIB have plummeted by almost 5%, while AVAX, DOT, and ADA have seen declines of around 2-4%.

TON is among the few exceptions, as a 3% jump has driven it to just over $8. UNI is also 3.5% up on the day and sits at $11.

More losses come from NEAR, FIL, FET, and AR. The total crypto market cap has declined by about $50 billion overnight.

cryptopotato.com

cryptopotato.com