Book of Meme (BOME) has witnessed a double-digit decline in the last week, forcing its price to trade at a 42-day low.

At press time, the popular meme coin exchanged hands at $0.0097. The last time its price was at this level was on May 3.

Book of Meme Sees Decline in Open Interest and Surge in Long Liquidations

BOME’s price has dropped by 29% in the past seven days. This makes it the second token among the top 10 meme assets by market capitalization, following Floki (FLOKI), which has experienced the highest losses in the past week.

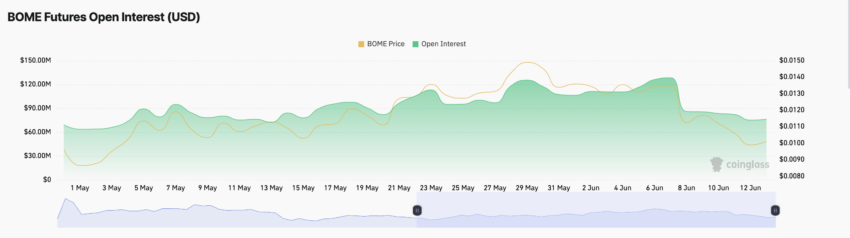

BOME’s price peaked at $0.013 on June 6 and has since trended downward. Its downtrend coincides with the decline in its futures open interest which also began to fall on the same day.

As of this writing, BOME’s futures open interest is at $76.16 million, having dropped by 40% since then.

The meme coin’s futures open interest tracks the total number of outstanding futures contracts or positions that have not been closed or settled. When it drops this way, it suggests a spike in the number of market participants exiting the market without opening new positions.

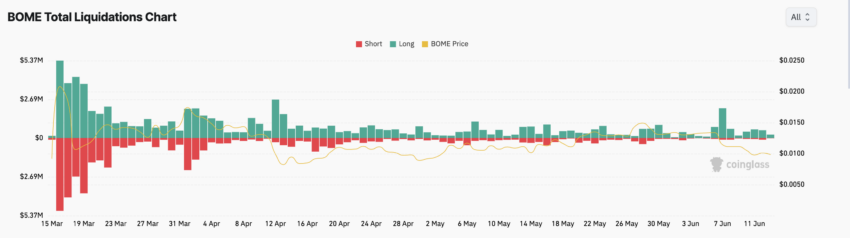

Due to BOME’s price decline in the last week, many long positions have been liquidated. For context, on June 7, long liquidations totaled $2.06 million, BOME’s highest since April 12.

Read More: Book of Meme (BOME) Price Prediction 2024/2025/2030

Liquidations happen in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when the value of an asset’s price declines. This forces traders with open positions in favor of a price rally to exit.

BOME Price Prediction: A Potential Fall Under $0.009?

BOME’s key momentum indicators confirmed the low demand for the meme coin. For example, its Relative Strength Index (RSI) was 34.31 at press time.

An asset’s RSI tracks overbought and oversold conditions in the market by tracking an asset’s price momentum and changes.

It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and may be due for a correction, while values below 30 suggest that the asset is oversold and might be poised for a rebound.

BOME’s current RSI signals that market participants prefer to sell their holdings to prevent further losses rather than buy new tokens.

If this bearish bias toward the meme coin intensifies and traders continue to sell, BOME’s value may slip under $0.009 to trade at $0.007.

However, if the bulls emerge to defend the $0.009 price level and buying activity begins to climb, BOME’s price may rally toward $0.01.

beincrypto.com

beincrypto.com