Bitcoin Cash price fell to a 25-day low of $447 on June 12, 2024, recent trends observed among BCH derivatives traders suggests the market bottom could near.

Bitcoin Cash Price Plunges to 25-day Low

The global crypto market slid into a consolidation phase on Tuesday June 11, as bulls failed to sustain the positive start to the week. Bitcoin Cash mirrored the broader crypto market performance, tumbling to new weekly-lows.

BCH’s flailing price performance dates back to June 7, when the US Non-Farm payrolls report triggered a considerable market crash. Since then BCH price has struggled to find sufficient demand for a sustain rebound phase.

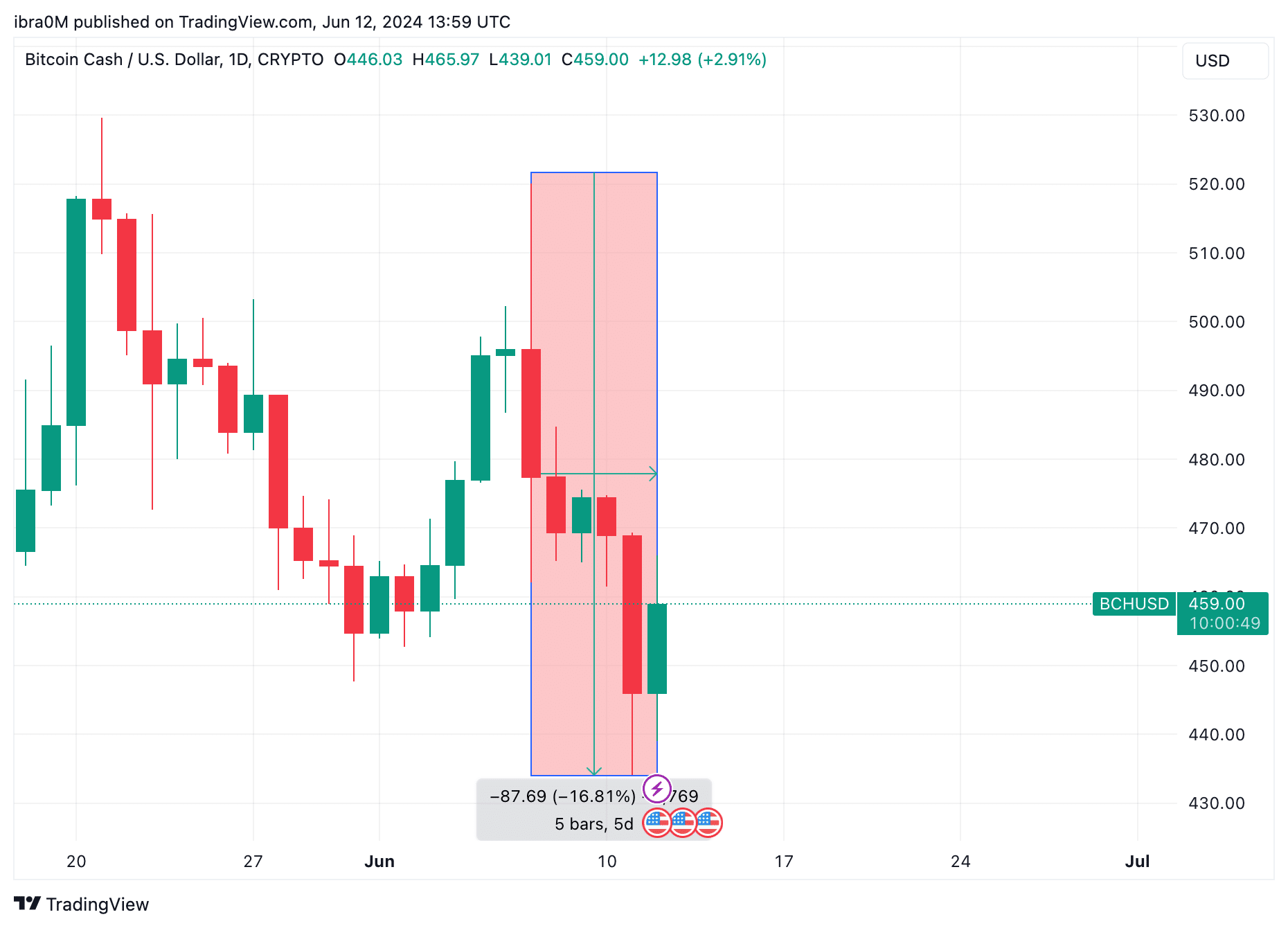

As seen in the chart above, Bitcoin Cash price has declined 16.81% from $520 on June 7, and falling as low as $439 within the daily timeframe on June 12.

After 5 consecutive days in decline, Bitcoin Cash price has now fallen to its lowest in 28 days dating back to May 15, 2024. With BCH price trending at historic lows, historical market data suggests that it could attract the attention of strategic investors on the sidelines looking to buy-in at the bottom.

BCH Funding Rates Enter Negative Zone as Rebound Phase Nears

In further affirmation that BCH downtrend could be near the bottom, majority of Bitcoin Cash derivatives traders have taken on a risk averse outlook this week. As prices fell rapidly over the last 5-days, bull traders have suffered significant liquidations and are now unwilling to mount leverage LONG positions.

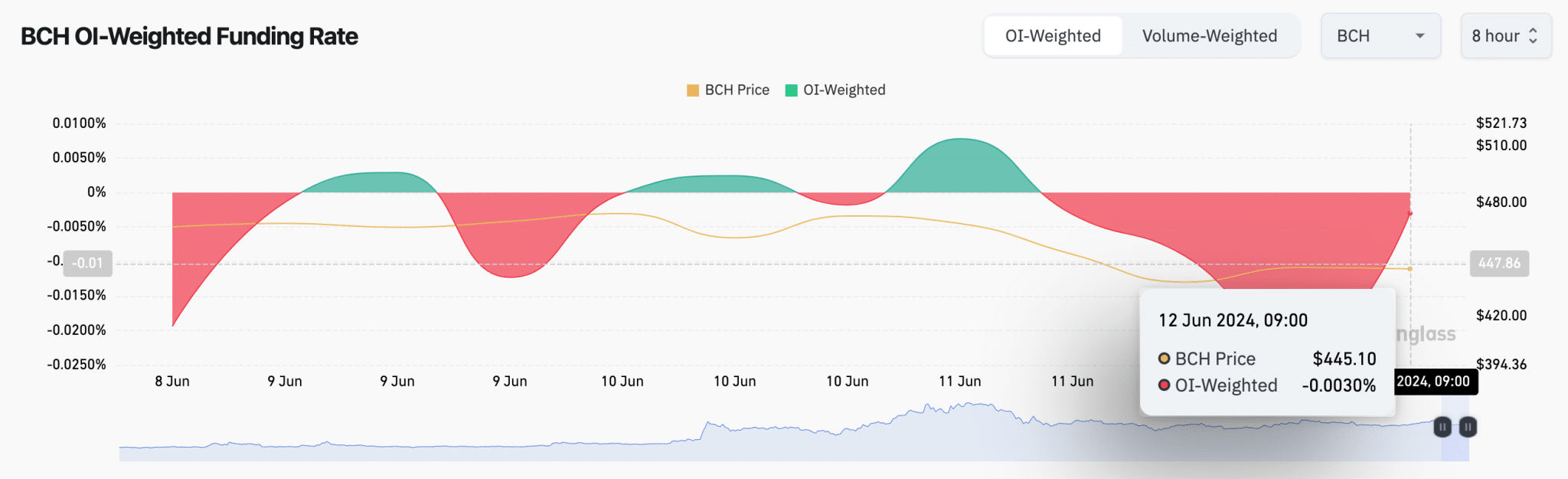

Coinglass’ Funding Rate trend tracks the percentage fees paid between SHORT traders and LONG contract holders in the BCH perpetual futures markets.

The chart above shows that BCH Funding rate entered negative values on June 12, sliding as low as -0.003% at the time of publication. Negative values of funding rates means that bears are dominant and paying fees to keep their SHORT contracts open, while bull traders rein in their positions.

When interpreted within the current market dynamics, it suggests that SHORT traders are now dominating the short-term momentum, and paying higher fees to keep their traders open, in hopes that BCH price will decline further in the days ahead.

When funding rates swings negative after a prolonged period of price downtrend as observed in the BCH markets this week, it is often signals that the bottom could be near.

If strategic investors take this cue to enter new positions, Bitcoin Cash price could be on the verge of entering a rebound phase.

BCH Price Forecast: $500 Retest is Viable

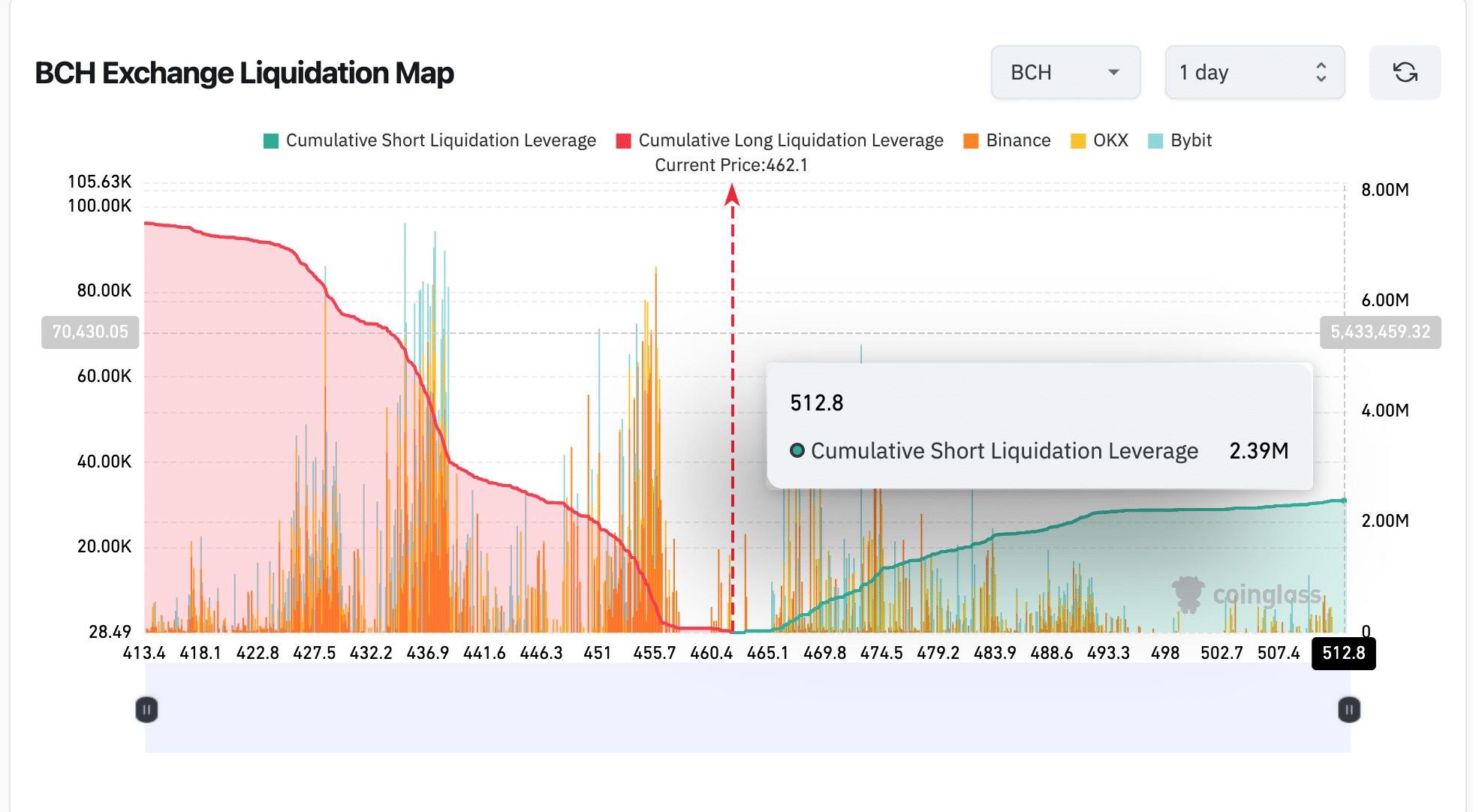

Bitcoin Cash price has declined 17% in the last 5-days, but with SHORT traders now mounting larger leveraged positions, a rapid price upswing could trigger a short-squeeze.

In this scenario, a bullish trend reversal would mean that short-traders have to purchase larger volumes of BCH to cover their leveraged positions, thus sending price rising even faster.

Looking at the active LONG vs SHORT contracts trends, BCH’s next major resistance cluster now lies at the $512 level.

As seen above, Leverage LONG contracts have now exceeded SHORT addresses by a margin of almost $5 million. At the time of writing, SHORT traders stand to lose $2.39 million if BCH price breaks above the $512.8 mark. Having held at a loss for weeks, many of these investors could opt to take early profits, inadvertently slowing that the Bitcoin Cash price recovery phase.

But on the flip side, if the bears force another wave of retracement, BCH bulls will have to mount a steady support at the $430 level to avoid doubling their monthly timeframe losses.

thecryptobasic.com

thecryptobasic.com