Crypto markets jumped on June 12 after U.S. CPI numbers for May came in flat, fueling expectations for promising inflation data.

U.S. Consumer Price Index (CPI) data was unchanged last month, down from 0.3% in April. The year-over-year (YoY) CPI also dropped from 3.4% in April to 3.3% in May, besting predictions that data would remain the same.

Core CPI YoY levels declined from 3.6% to 3.4% last month, the lowest rate since April 2021. The general consensus estimated a 3.5% point for this index.

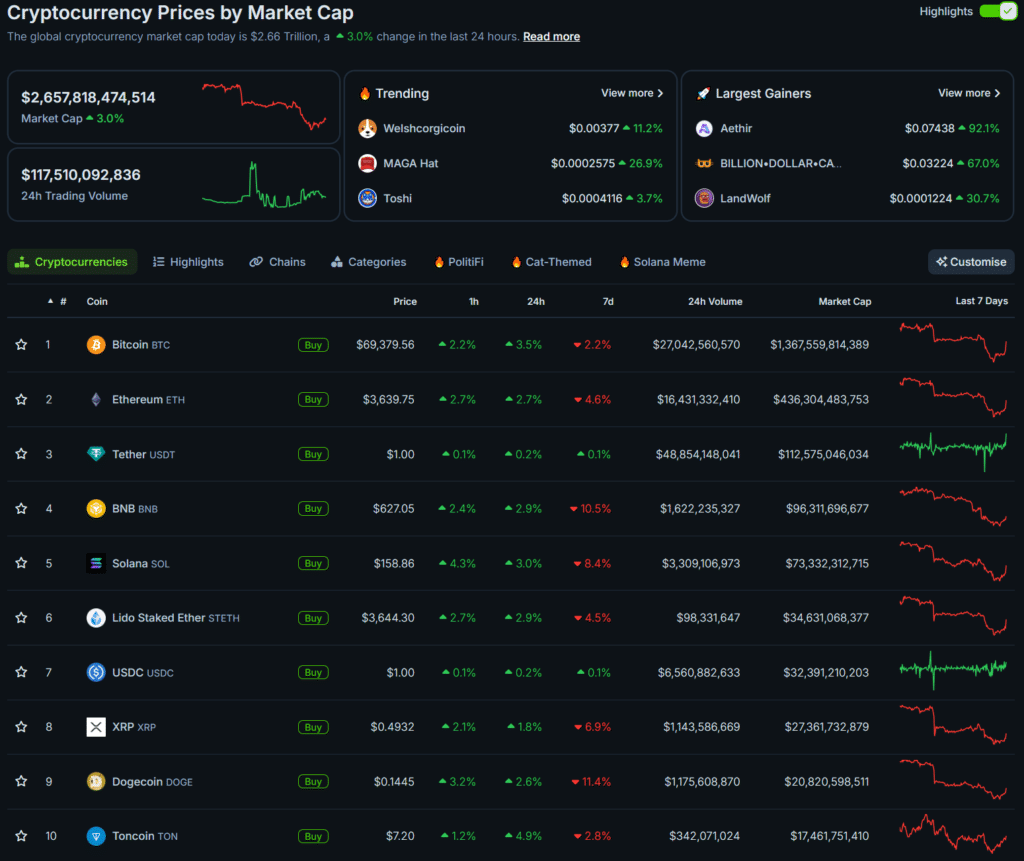

Following the improved data, the total crypto market cap grew by 3% to reach $2.65 trillion, per CoinGecko. Bitcoin (BTC) broke a two-day red streak with a 4% surge, leaping above $69,300, while Ethereum (ETH) increased by nearly 3% to $3,639 at the time of writing.

Other digital assets ranked in the top 10 tokens, like BNB, Solana (SOL), XRP, Dogecoin (DOGE), and Toncoin (TON), also posted modest gains on the day.

Softer inflation data could buoy crypto prices

A QCP Capital report suggested that crypto traders and investors anticipated cooler inflation data from the forthcoming Federal Open Market Committee (FOMC) meeting.

The firm noted “aggressive buying” of June 13 calls and increased funding rates, indicating market positioning for an upside move.

“A neutral FOMC outcome could propel the crypto market to retest its highs once more,” said QCP Capital analysts.

Cryptocurrencies and risk assets could see liquidity inflows if the Fed mirrors decisions from other apex banks. Recently, the European Central Bank and the Bank of Canada slashed rates. The U.S. dollar index (DXY) rose to a 30-day high following the news, meaning more capital became available for investments.