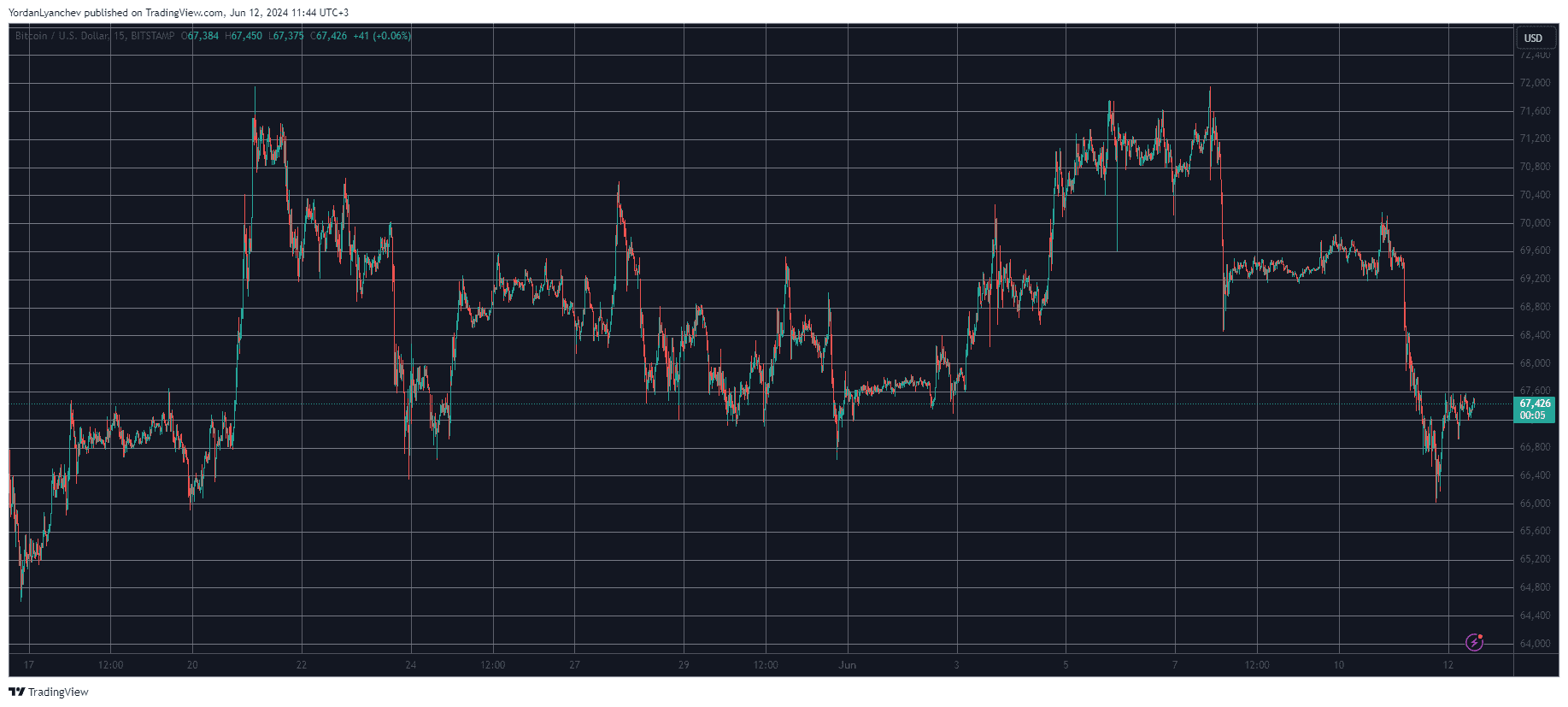

Bitcoin’s price actions have been heavily influenced by major economic developments on the US front once again, as it dropped from over $70,000 to $66,000 ahead of the US CPI data and the latest FOMC meeting.

The altcoins also faced massive volatility lately, but PEPE has emerged as the top dog with a 10% surge.

BTC Prepares for US Developments

The primary cryptocurrency had a violent end to last week as it dropped from $72,000 to under $68,600 in hours. The weekend was a lot less eventful as the asset recovered some ground and stood at just over $69,000.

The landscape took a more positive turn on Monday when bitcoin jumped by just over $70,000 once again. However, the end of the impressive spot BTC ETF streak of inflows resulted in more pain for the underlying asset, which tumbled toward $68,000 on Tuesday.

Another price decline followed suit in the past 12 hours that drove BTC to its lowest position since May 20 of $66,000. This came amid fears about the US CPI data and the next FOMC meeting, both of which should be today.

Bitcoin has been able to bounce off and currently trades above $67,000. However, more volatility is expected during the day after both those US developments take place.

For now, BTC’s market cap stands below $1.330 trillion, while its dominance over the alts is at 51.5%.

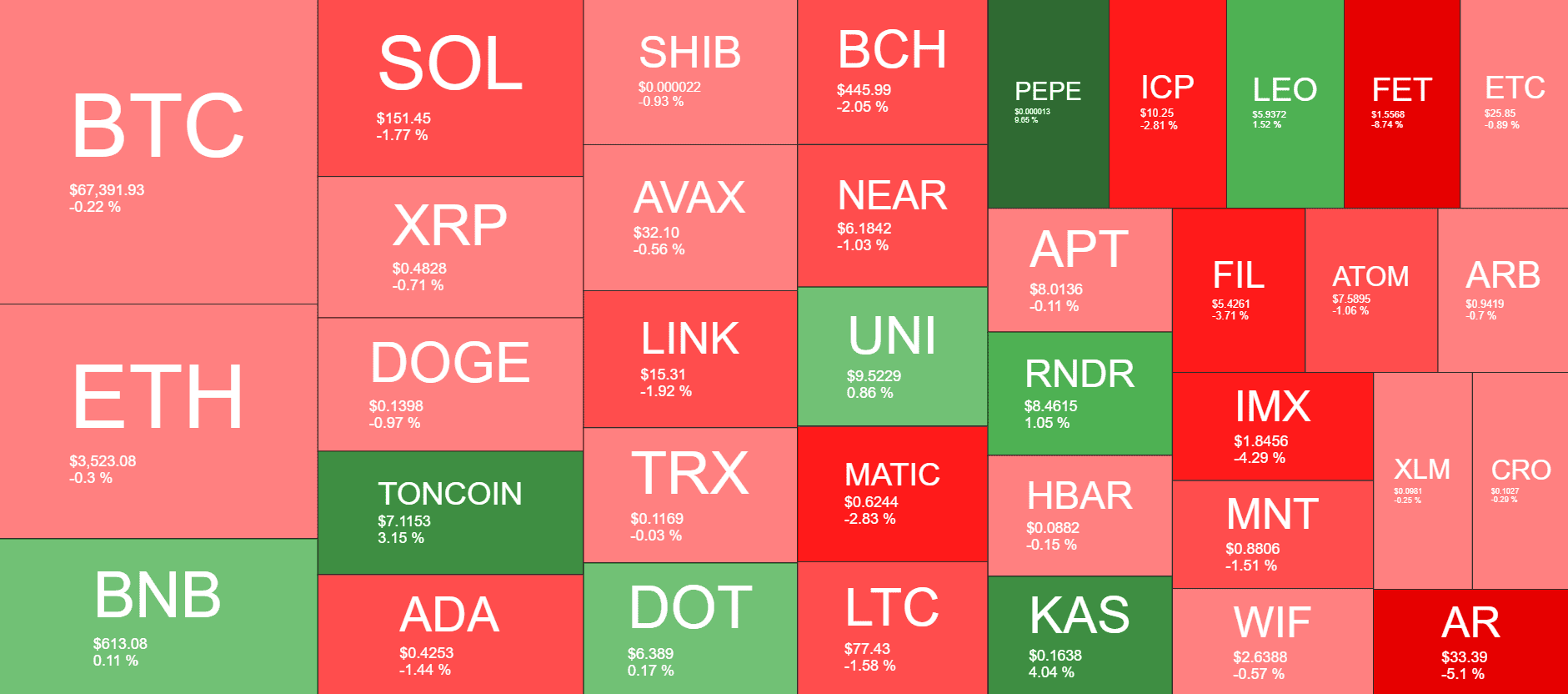

PEPE Defies Overall Trend

Most larger-cap alts have been quite sluggish over the past 24 hours after they lost a lot of value yesterday. ETH, SOL, XRP, DOGE, ADA, SHIB, AVAX, LINK, and TRX are still slightly in the red.

In contrast, TON has jumped by 3%, while KAS has added just over 4% in the past day.

PEPE has emerged as the top performer from this cohort of assets. The meme coin is up by 10% and sits above $0.000013 now.

In contrast, FET has dumped by more than 8%, followed by AR (-5%), IMX (-4%), and FIL (-4%).

The total crypto market cap has shed some more value and now sits below $2.6 trillion.

cryptopotato.com

cryptopotato.com