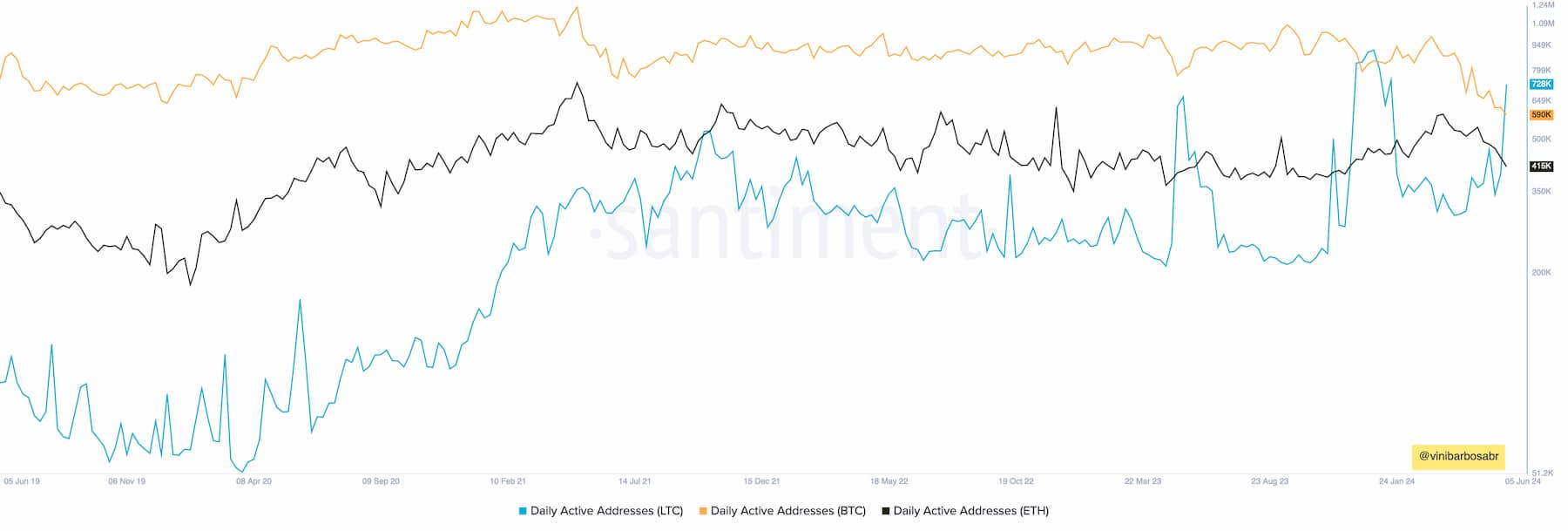

Litecoin ($LTC) surpassed Bitcoin ($BTC) and Ethereum ($ETH) in an important metric that indicates network activity, userbase, and demand. For the first time in early June, Litecoin registered more daily active addresses than the two most valuable cryptocurrencies.

Notably, Litecoin saw a 110% surge in its daily active addresses in the last seven days, reaching 728,000. Finbold retrieved this data from Santiment on June 11, with Bitcoin’s 593,000 and Ethereum’s 419,000 daily active addresses.

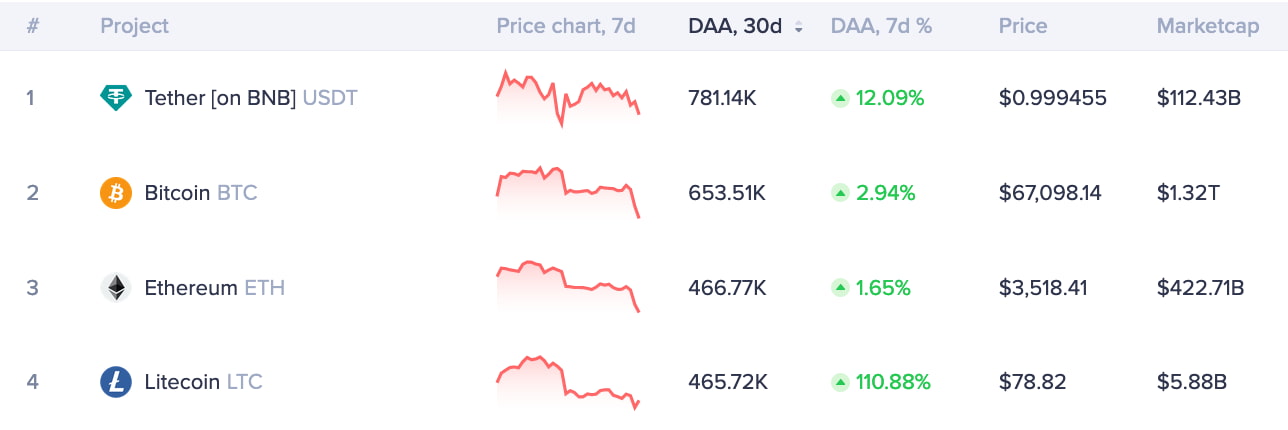

However, Tether U.S. dollar stablecoin ($USDT) still vastly dominates the market in terms of daily active address (DAA) count. Moreover, Bitcoin and Ethereum have a larger network activity average in the last 30 days, according to Santiment‘s screener.

On that note, $USDT on the $BNB Chain ($BNB) alone registers a 781,140 DAA. Meanwhile, Bitcoin, Ethereum, and Litecoin have 653,510, 466,770, and 465,720, respectively.

Litecoin price analysis amid increased network activity

From a fundamental analysis perspective, the growth of network activity highlights an increased demand for the solution Litecoin provides. More active addresses could suggest the user base is growing, which has the potential to impact $LTC’s spot price.

From a technical analysis perspective, however, $LTC struggles in a price range between $77 and $88, currently at $78.83. Interestingly, it trades close to the range’s support and below the 30-day exponential moving average (30-EMA) of $82.76.

Furthermore, the daily relative strength index (RSI) indicates weak momentum for Litecoin despite the remarkable network activity.

As of this writing, $LTC has a market cap of $5.88 billion. This is 225 times lower than $BTC’s $1.32 trillion and 72 times lower than $ETH’s $422.71 billion.

Nevertheless, daily active addresses are not a conclusive indicator to measure network activity and other factors should be taken into consideration while evaluating demand and each cryptocurrency’s user base. Bitcoin has registered an all-time low on-chain transaction and spot trading volume while record-breaking speculative demand via derivatives like futures and exchange-traded funds.

Investors must be cautious and follow further developments in the cryptocurrency market and industry to improve decision-making.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com