Bitcoin and cryptocurrency markets started the day with a decline due to interest rate cuts before the FED's interest rate decision, increasing political uncertainties in Europe and outflows in spot BTC ETFs.

While Bitcoin fell by more than 3 percent in the last 24 hours to the level of 67 thousand dollars, the largest altcoin Ethereum dropped to 3 thousand 500 dollars.

Stating that concerns about the FED's ability to keep interest rates high for a long time increased the selling pressure, analysts said that while a maximum of two interest rate cuts were expected from the FED by the end of 2024, it is now being discussed that even September may be too early for an interest rate cut.

Uncertainties in the USA and negative macroeconomic data reduced investors' interest in risky assets such as Bitcoin, and negatively affected prices.

Bloodbath in Bitcoin and Altcoins: 185 Million Dollars Evaporated!

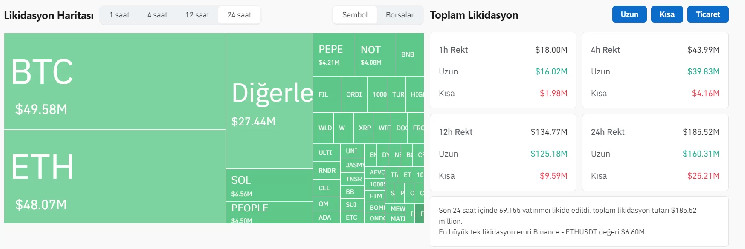

While this decline caught investors in long positions in reverse, according to Coinglass data, leveraged positions of $ 185.3 million were liquidated in the last 24 hours.

Of this, $160.1 million consisted of long positions and $25.2 million consisted of short positions.

While more than 69 thousand investors were liquidated in the last 24 hours, the largest liquidation occurred in the ETHUSDT trading pair worth $ 6.60 million on the Binance exchange.

$49.5 million in Bitcoin; While $48 million was liquidated in Ethereum, BTC and ETH were followed by Solana (SOL) and PEOPLE.

This sharp decline has caused the cryptocurrency market to lose blood, but it also offers investors the opportunity to buy at the bottom.

The Fall in Bitcoin May Continue!

While investors were wondering whether the decline would deepen, successful analyst Michael van de Poppe predicted that the decline in BTC could fall to 64 thousand – 65 thousand dollars.

Stating that these declines have occurred before, Poppe said:

“Bitcoin continues to fall after rejecting the $71,000 area. Due to the upcoming FOMC meeting and CPI data, we expect to see tests at the $64-65,000 level before the markets start to rise again.

Bitcoin and cryptocurrencies almost always correct before these events and then turn upwards.

“The same price movement occurred in previous months.”

#Bitcoin continues to fall after rejecting the $71K area. Expecting that we’ll see tests at $64-65K before the markets are reversing back upwards due to the upcoming FOMC meeting & CPI data. pic.twitter.com/YM6wNlLcdo

— Michaël van de Poppe (@CryptoMichNL) June 11, 2024

*This is not investment advice.