Litecoin price rebounded above $85 on June 6 after gaining 5.56% in the last 48 hours, on-chain data shows $LTC miners’ long-term buying trend could be the main catalyst.

$LTC Joins Market Rally with 6% Boost

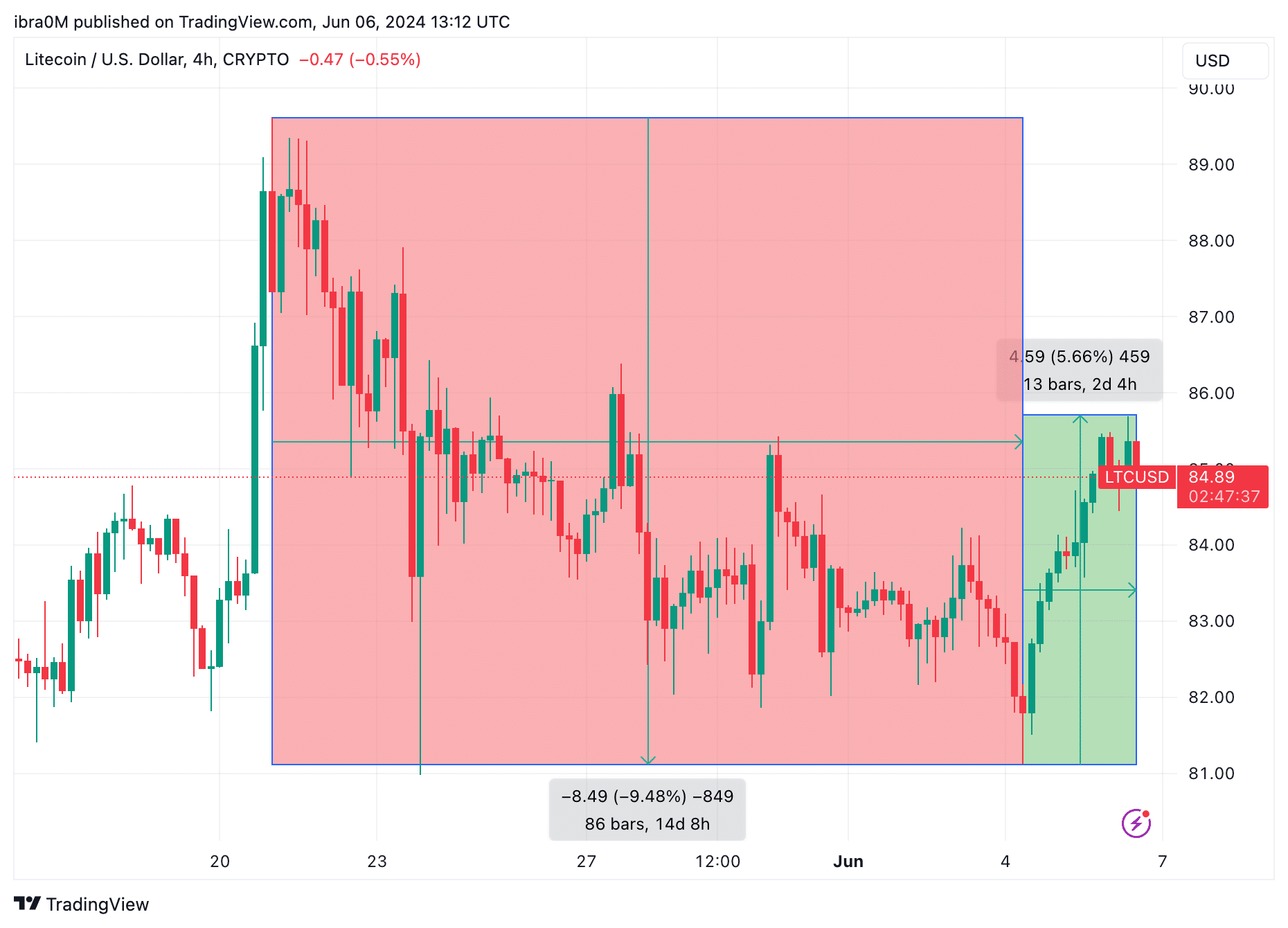

As investors shifted capital towards the Ethereum ecosystem in the wake of the ETH ETF approvals last week, Litecoin became one of the worst-hit assets, tumbling 10% in the last ten days of May 2024.

However as the ETF euphoria cooled up, other potential bullish catalysts have emerged this week. Chiefly, demand for Litecoin has surged this week, amid growing optimism surrounding the next US Jobs report and imminent Fed rate decision in June.

As seen above, Litecoin’s price has now rebounded 5.66% in the last 48 hours to reach the $85 mark at the time of writing on June 6, reversing a significant portion of the losses recorded in the last week of May.

While the Litecoin price bounce quite mirrors the bullish sentiment surround the overall crypto markets trend this week, on-chain data suggests recent shift in $LTC miners’ disposition may actually be the major catalyst.

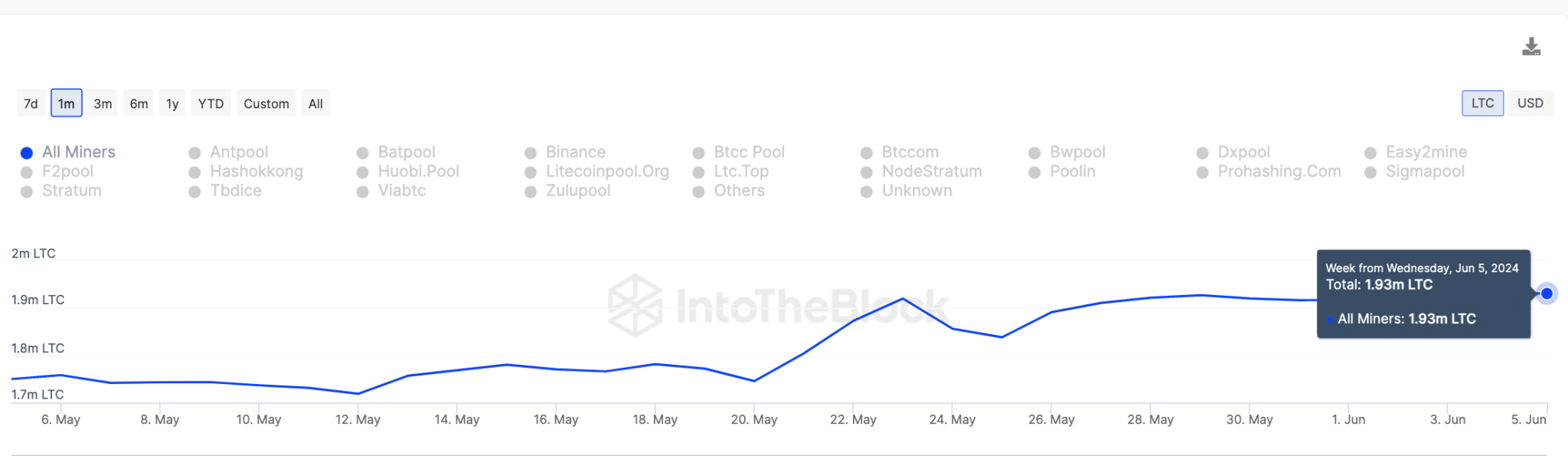

The miner reserves chart provided by IntoTheBlock offers a clear and detailed illustration of the total amount of $LTC coins being held in custody by established miners and mining pools. This serves as a vivid indication of the current state of $LTC reserves in the mining ecosystem.

Looking at the chart above, Litecoin miners now hold a total of 1.93 million $LTC in the cummulative balances at the time of writing on June 6. But zooming out, the chart also shows that they only held 1.75 million $LTC as of May 5, 2023.

This clearly shows that Litecoin miners have been on a buying spree over the last 30-days, adding more than 180,000 $LTC to their coffers.

When valued at the current prices, the miners have effectively accumulated coins worth over $15.3 million between May 5 and June 5.

Typically, an increase in miners reserves is often regarded as a major bullish signal for the native coin price.

Firstly, it means that miners are bullish on $LTC’s long-term price prospects, and as a result they are hoarding their newly-mined coins rather than unloading them on the market. Other strategic investors could capitalize on the temporary deflationary impact of the $15 million miner-accumulation wave to enter LONG $LTC positions quickly.

More importantly, with fewer newly-mined $LTC coins diluting the market supply, the it sets the stage for an accelerated price uptrend. This partly explains why $LTC price has surged 6% in the last 2 days.

$LTC Price Forecast: Miners’ $15M Move to Trigger $100 Rebound?

Litecoin price appears to be on the verge of a major recovery breakout towards $100 in June 2024. Judging by the aria-describedby="caption-attachment-83055">

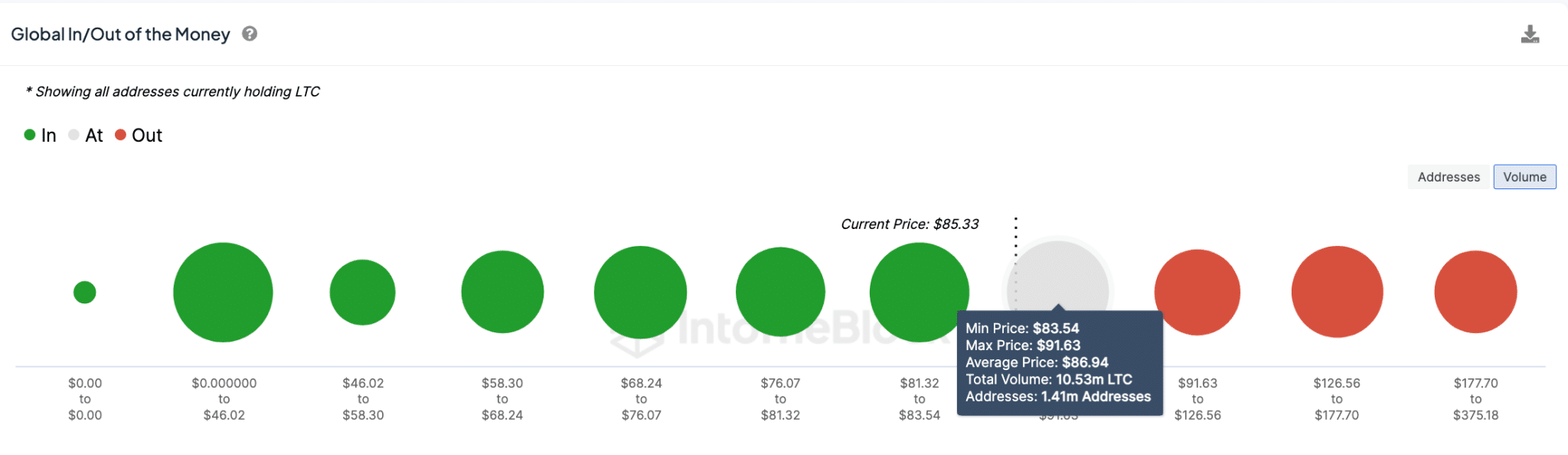

As depicted by IntoTheBlock’s GIOMAP data trends, over 1.4 million current holders had acquired 10.53 million $LTC at the maximum price of $91.6.

If they opt to take out profits early, Litecoin price recovery could hit a roadblock at that territory. However, if the bulls can set up a steady support base above that price level, a rapid breakout towards $100 could be on the cards.

Conversely, in the event of a hawkish outcome from the US Jobs report slated for Friday, June 7, Litecoin’s price could retrace towards the key support level at $76.

thecryptobasic.com

thecryptobasic.com