- Enjin Coin price experienced a 26% crash from its highest to lowest trading price last week.

- Network Realized Profit/Loss metric shows a capitulation event took place on June 2.

- Supply Distribution reveals that one cohort of whales seized the opportunity and bought ENJ dips.

The Enjin Coin (ENJ) price outlook remains predatory after the sharp decline registered last week, with on-chain data showing that some whales benefited from the fallout by accumulating ENJ.

Enjin Coin whales capitulation and accumulation

ENJ price fell sharply last week. The gaming-related token declined 26% from the $0.3978 high on May 28 to the $0.2923 low on June 2, extending losses for six consecutive trading days.

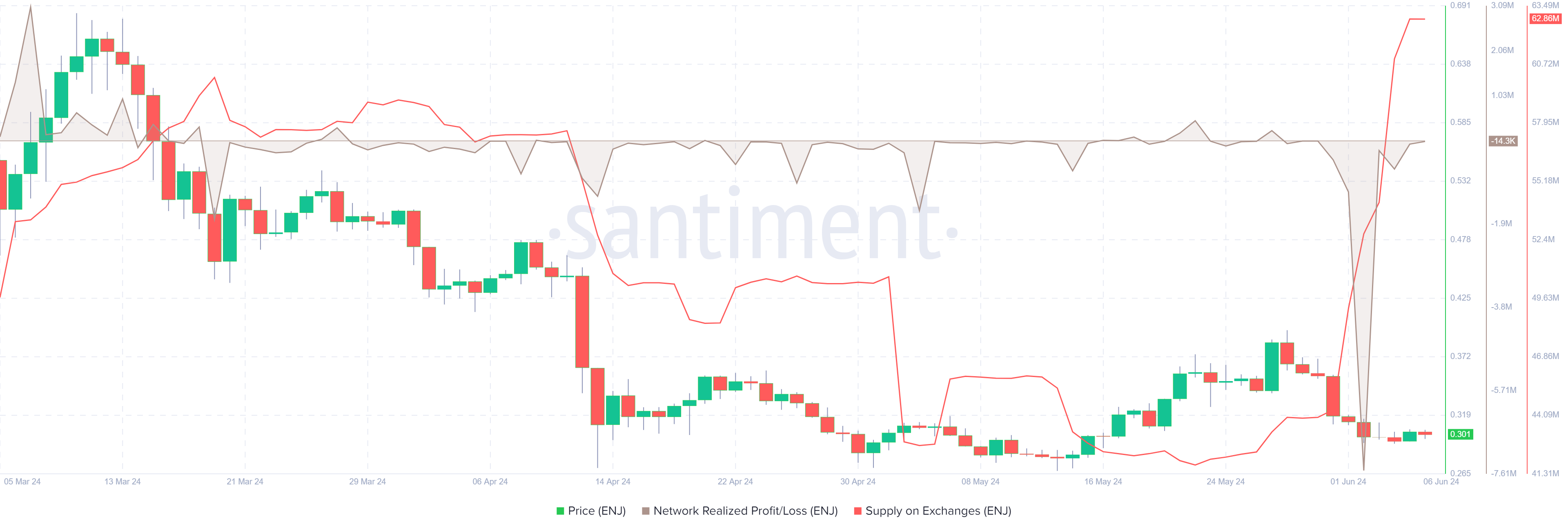

On-chain data provider Santiment’s Network Realized Profit/Loss (NPL) indicator computes a daily network-level Return On Investment (ROI) based on the coin’s on-chain transaction volume. Simply put, it is used to measure market pain. Strong spikes in a coin’s NPL indicate that its holders are on average, selling their bags at a significant profit. Strong dips, on the other hand, imply that the coin’s holders are on average realizing losses, suggesting panic sell-offs and investor capitulation.

In ENJ’s case, the NPL indicator spiked from -2,445 on May 30 to -7.5 million on June 2, coinciding with a 15.8% price crash. This massive negative downtick indicates that the holders are, on average, realizing losses, suggesting panic sell-offs and investor capitulation.

During this capitulation event, the ENJ supply on exchanges rose from 19.75% from May 30 to June 2. This is a bearish development, which further denotes investor confidence in ENJ.

ENJ Network Realized Profit/Loss chart

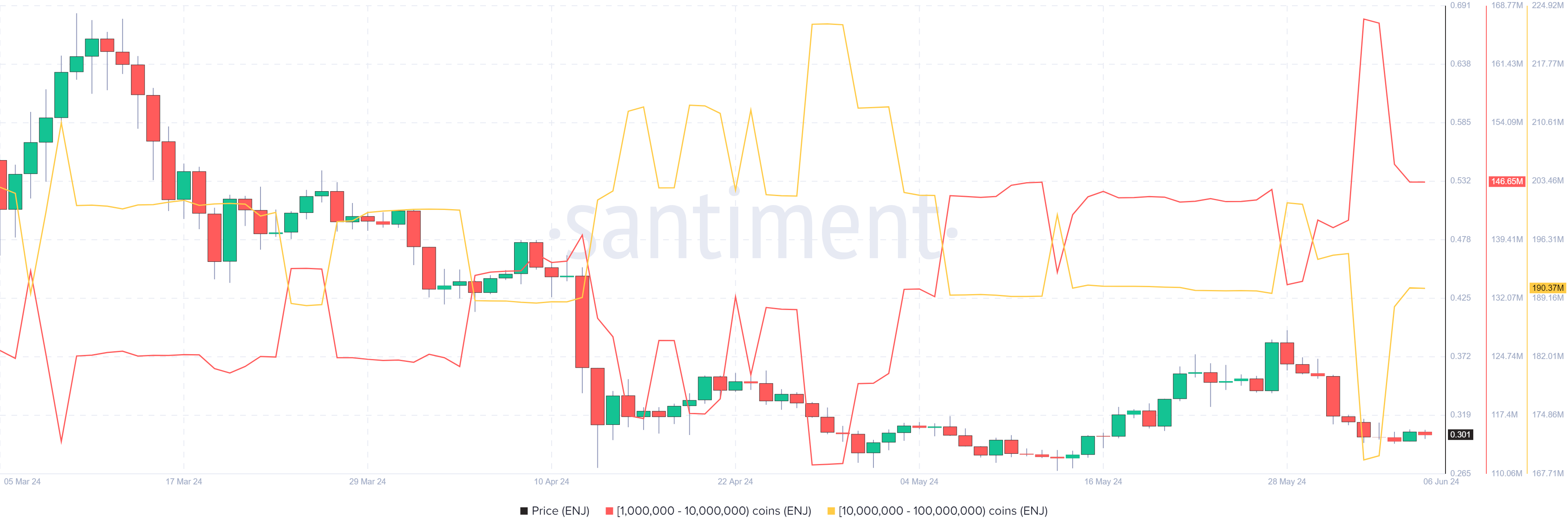

Looking at Santiment’s Supply Distribution metric shows that whales with 1 million to 10 million ENJ tokens dropped from 167.09 million to 146.65 million from June 2. Meanwhile, wallets holding 10 million to 100 million ENJ surged from 146.65 million to 190.24 million in the same period.

This interesting development shows that the first cohort of whales could have fallen prey to the capitulation event while the second set of wallets seized the opportunity and accumulated ENJ at a discount.

ENJ Supply distribution chart

In spite of strong on-chain data for Enjin Coin, if market sentiment sours and Bitcoin's price takes a bearish turn, then the overall crypto market could crash, invalidating the bullish thesis for Enjin. Investors should exercise caution, as the Enjin price could potentially crash alongside Bitcoin.

fxstreet.com

fxstreet.com