- 1 Arbitrum showed remarkable growth in TVL, boosting the investors’ confidence in the platform.

- 2 The number of ARB holders has increased, per the Santiment data, indicating bullishness.

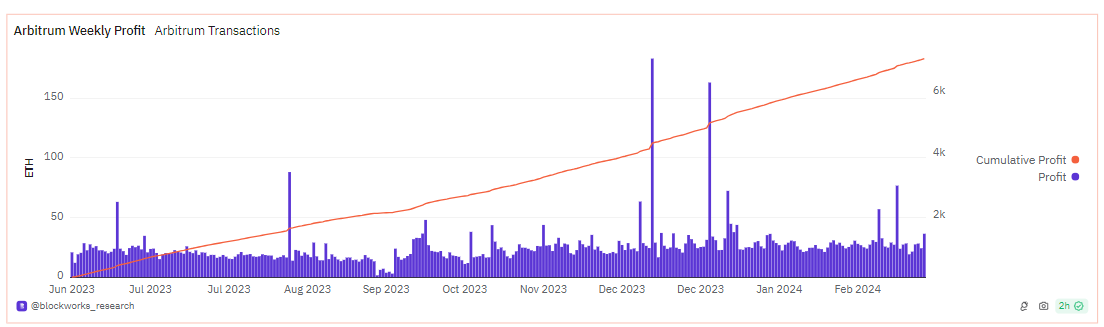

Arbitrum is showcasing growth in terms of TVL and holder addresses, showcasing the investor’s confidence in the protocol. Moreover, the ARB weekly profit also surged, according to Dune’s data.

Arbitrum Weekly Cumulative Profit Surge

According to Dune’s data, Arbitrum crypto’s weekly cumulative profit has surged, showcasing network growth. Meanwhile, the revenue (how much the ARB network made a profit) froms a difference in transaction fees paid through the user. Afterward, this revenue is paid to L2 nodes for storage costs and computation.

Source: Dune`

Moreover, as per the data of the token terminal, the active users weekly and daily also showed a mild surge in recent times. At the time of writing, weekly active users are at 3.0M, and daily active users are at 701.7K.

Arbitrum TVL And Holders Growth

According to DeFiLlama, Arbitrum TVL demonstrated good growth in the last few months. On November 10, 2023, its TVL stood at $1.9 Billion. From there, it grew to $3.103 Billion.

Additionally, the number of holder’s addresses advanced in the last few days. On 22 May, the total number of holder’s addresses stood at 1172000. It increased to 1195954 on 5 June.

The increasing Total Value Locked (TVL) and the rising number of Holder addresses significantly enhance investor sentiment towards the Arbitrum platform. A greater TVL indicates that a larger amount of capital is being secured within the protocol, signaling a growing trust among investors.

Furthermore, the statistics highlight Pendle’s dynamic engagement and sustained attractiveness among participants and creators in the cryptocurrency ecosystem.

Is Arbitrum (ARB) Ready to Take a Boost?

On January 12, 2024, Arbitrum hit its all-time high of $2.40. Afterward, it halted down and corrected by almost 55%. However, the price took support on the $0.9422 level and tried to bounce back.

As of now, the price is trading below the important EMA levels of 50-Day and 200-Day, showcasing bearishness.

At the time of writing, the ARB is trading at $1.1140 with an intraday surge of 0.56%. It currently has a market cap of 3.25 Billion with 24 hours trading volume of 315.10 Million.

Throughout the year, the ARB crypto’s performance was lacklusturous. Year to date, it gave a negative return of 28.02%. In the last three months, it was down by almost 45%. It plunged by approximately 6.33% last week, showcasing prolonged bearishness.

Decoding The ARB Technical Indicators

According to the indicator summary of TradingView, out of 26 indicators, 12 are on the sell side, 10 are on the neutral side, and 4 are on the buy side, pointing to bearishness.

The RSI and MACD are trading in a neutral zone without a clear signal. The RSI curve is trading near the middle line at 49. The MACD is also hovering close to the zero line, showcasing neutrality.

Summary

Arbitrum has recently demonstrated robust growth in the number of holders and TVL, elevating investors’ confidence in the protocol. Despite the on-chain growth, ARB lacks in the growth on the technical chart.

Disclaimer

The analysis given above is for informational and educational purposes only. You should not take it as financial, investment, or other advice. Investing in or trading crypto assets is risky. Please consider your circumstances and risk profile before making any investment decisions.

thecoinrepublic.com

thecoinrepublic.com