Drowning in liquidity

Let’s quickly build a basic crypto portfolio. One that would be mostly long-term holds, between three and five years.

Digital assets tend to be closely correlated with bitcoin, which — combined with a high degree of failure — makes the crypto equivalent of stock-picking quite risky.

So, in this very hypothetical scenario (purely for educational purposes), more averse allocators would likely run a combination of bitcoin, ether and solana alongside a handful of high-conviction bets.

More than likely, some of those bets would be grappling with some degree of supply inflation, either through daily token emissions or major unlocks on specific dates.

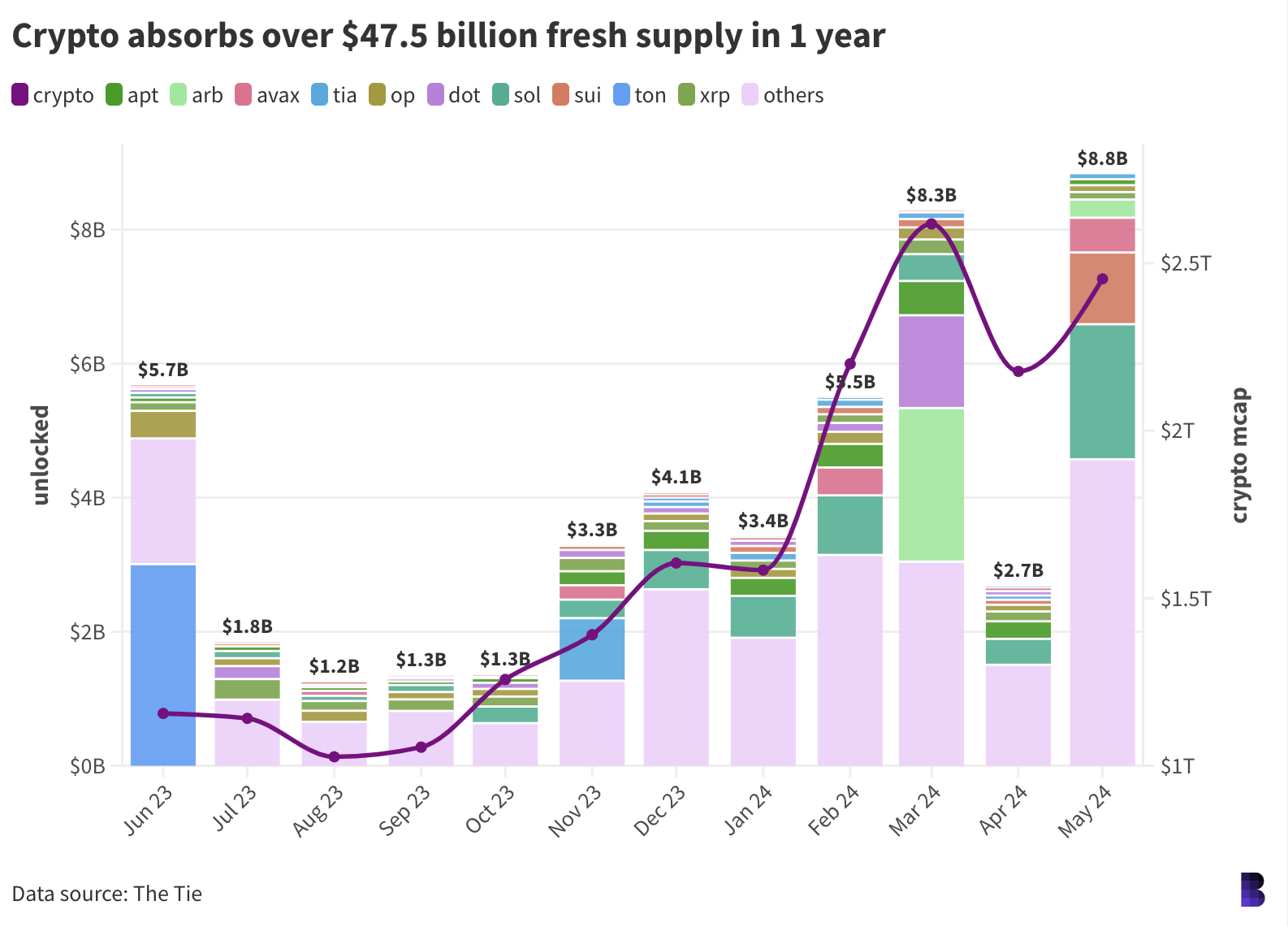

Last month saw at least $8.8 billion in fresh supply unlocked — the highest monthly release over the past year.

(That figure includes the top 130 or so cryptocurrencies by market cap, not counting bitcoin, ether, memecoins and a number of other assets which don’t have the same tokenomics structure as tokens issued by startups and other entities.)

Ten major cryptocurrencies have released over $1 billion in fresh supply in the past year. Including token incentives to network validators, solana has released $5.8 billion and toncoin $3.1 billion, while arbitrum and aptos have eked out more than $2 billion each.

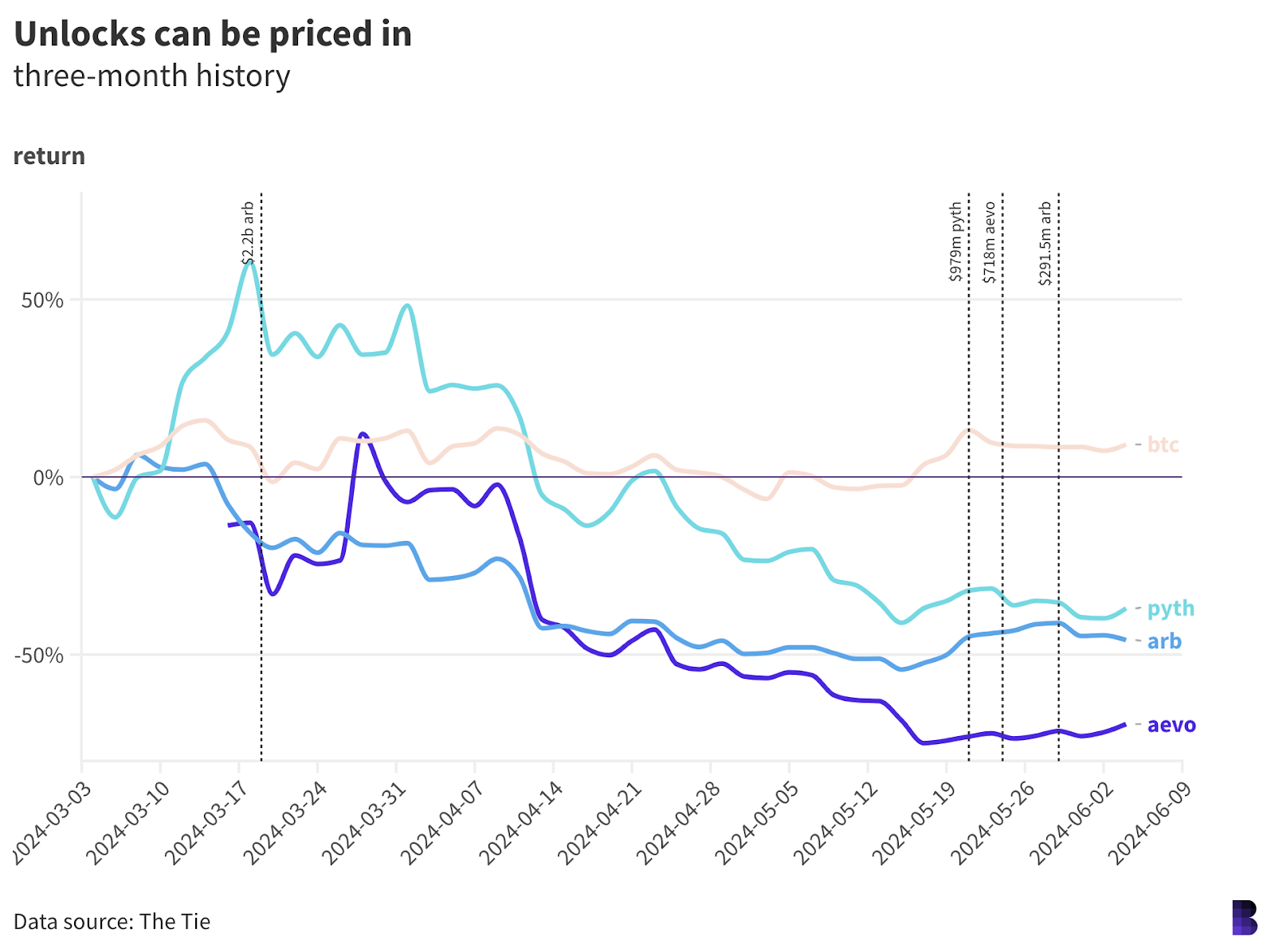

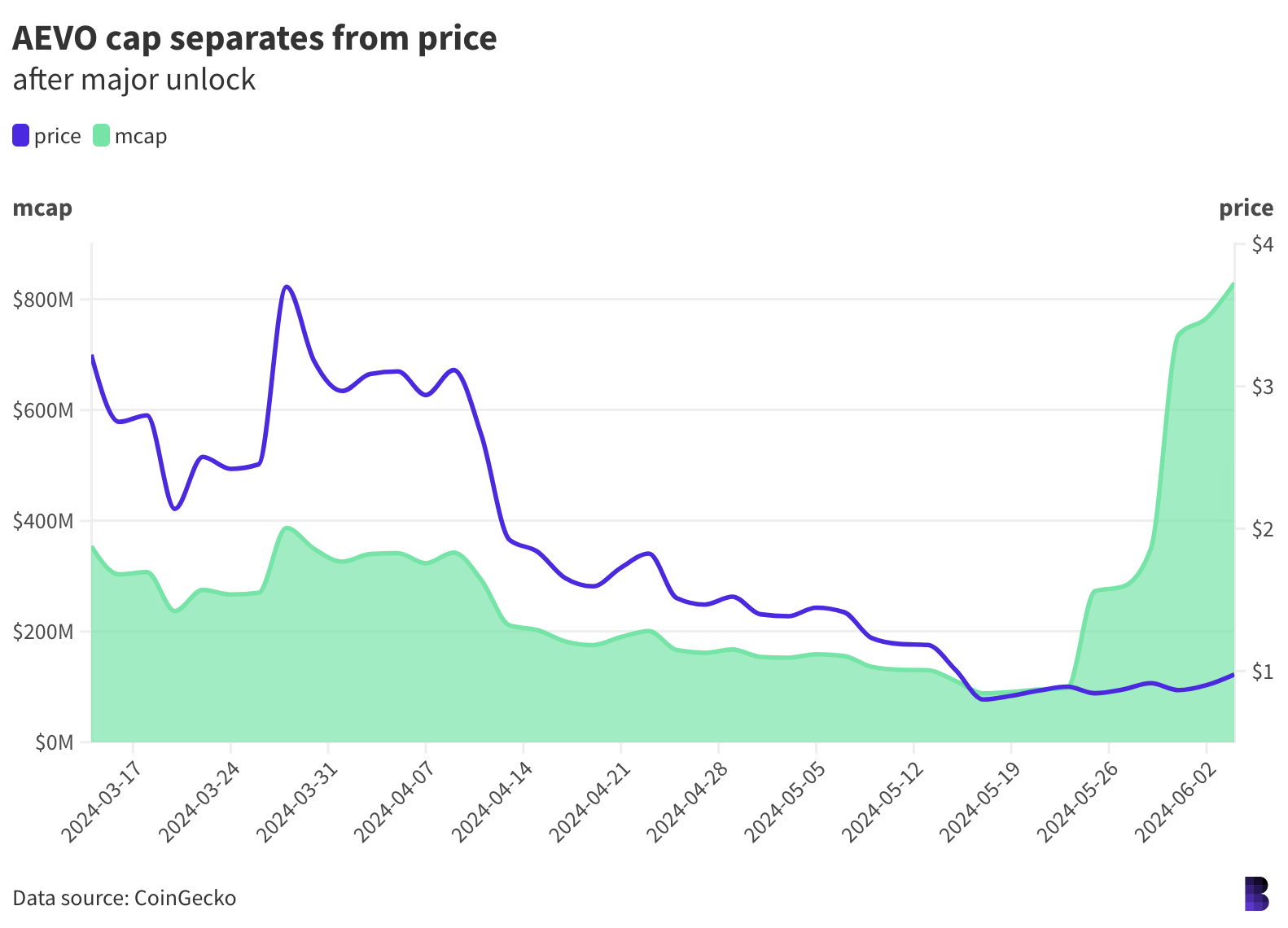

Solana markets have easily absorbed all that SOL supply, which is generally steady due to it mostly going to validators. Arbitrum, pyth and aevo haven’t held up so well.

In those cases, bad vibes around the impending token unlocks — in arbitrum’s case worth $2.2 billion — appear to have dragged prices down well before the actual supply was released.

It was only after the pyth, arb and aevo unlocks happened that their markets stabilized, albeit after sinking by around half against the US dollar.

All of this makes constructing a crypto portfolio a bit of a minefield. The utility, novelty and promise of practically any crypto project can be completely undermined by how markets react to token unlock schedules on any given day.

There are ways to track when big batches of supply will be released. TokenUnlocks does a decent job, although some data is behind a paywall.

We know that the market cap distance between blue-chip cryptocurrencies and the rest of the market has widened since the peak of the last cycle in 2021.

The weakening case for holding anything outside of the top two or three — which are safe from unlock schedules — could very well have something to do with it.

— David Canellis

Data Center

- MATIC, PYTH, ATOM, LINK, IMX and FIL get honorable mentions for each releasing more than $800 million in supply over the past year.

- It sounds like a lot, but the supply inflation of the analyzed tokens represents less than 2% of crypto’s current market cap.

- A handful of cryptocurrencies have otherwise reduced their supplies, including TRX, DYDX and MKR.

- Solana memecoin BRETT has broken through a $1 billion market cap, up 60% in the past week.

- BTC and ETH are still choppy below $69,000 and $3,800. SOL is also flat.

On the road to adoption

Are we there yet?

Mind you, our destination isn’t a grandparent’s house at the end of a long road trip, but rather where we stand with institutions at this point.

Almost two months ago (wow, time flies when you’re having fun), I wrote that the institutions still seemed to be on the sidelines. But I want to take another look following the surprising ETH ETF approval and recent events such as Consensus.

“I think the bitcoin ETFs were a seminal moment,” Roger Bayston, Franklin Templeton’s head of digital assets, told me. He added that the demand doesn’t only reflect the success of the products, but that the products themselves signaled “a shift” in the regulatory landscape.

And it’s not just the products. Bayston said it feels like momentum as a whole has shifted. Something clearly necessary in the US, thanks to the murkiness of the current environment.

And — putting institutions aside for a second — that change is going to be necessary for retail participation as well, SecondLane CEO Nick Cote said on Empire this week.

“I don’t think retail is going to be coming back in the US until we see some changes around policy that enables retail participation to be easier,” he noted.

So right now, all eyes should be on institutions as they pave the path forward. And, as David wrote yesterday, some of the TradFi heavyweights are definitely succeeding in their respective lanes.

Look at Franklin and BlackRock’s tokenized funds, for example.

“As more investors — large and small — become more aware of the use cases for the underlying blockchain technology and away from the headlines” around the regulatory status of securities and tokens, then “when institutions see actual use cases in the institutions that they run, I think that [leads to] more adoption,” Bayston noted that his own firm followed that path with the aforementioned BENJI.

The whole thing will become “self-fulfilling” once firms open their eyes and see that crypto is more than just the SEC’s lawsuits. When that happens, and regulatory clarity is rolled out, we could see a domino effect leading to bigger institutional activity, as well as higher retail activity.

Cote, on Empire, seemed to agree with Bayston’s points.

“I would suspect retail comes more into play once institutions are able to offer products to their client base,” he told Jason Yanowitz and Santiago Santos.

Jason Guthrie of WisdomTree told me he thinks one of the big aspects will be letting people integrate and use the technology. After that, it becomes easier to adopt and adapt.

So it seems we’re moving toward acceptance and adoption, but it won’t happen overnight. And that’s okay.

— Katherine Ross

The Works

- Over in Europe, Deutsche Bank partnered with Bitpanda to process customer deposits and withdrawals, Reuters reported.

- Core Scientific announced it’ll provide 200 megawatts of infrastructure to host CoreWeave’s high performance computing services.

- The CEO of Aptos Labs, Mo Shaikh, was named to the CFTC’s digital assets subcommittee, DL News reported.

- Former Binance CEO Changpeng Zhao began his four-month prison sentence in California on Monday.

- E*Trade’s considering kicking Roaring Kitty off of its platform, the Wall Street Journal reported.

The Morning Riff

The NYSE went down yesterday after a glitch caused a string of erroneous trades. Does DeFi fix this?

Would be cooler if it did. But not really. Not yet.

Decentralizing the NYSE could be done in a way that reduces the likelihood of those kinds of snafus. And Larry Fink has been really into the idea of tokenizing all assets and running markets on blockchain rails.

For what it’s worth, the Australian Stock Exchange actually tried that but scrapped the project due to its unsuitability, after spending $170 million.

Even crypto-native implementations still go down in unexpected ways. The two-day hiatus of Degen, the layer-2 for trading Farcaster memecoins, comes to mind.

The way things are going, the tech will catch up. But if NYSE ever did convert to a blockchain, more than likely, we’d quickly read about their devs rolling it back.

— David Canellis

Yes and no. Obviously, the simple answer is that existing DeFi technology could fix the problem we saw yesterday. Right now, though, it’s an unrealistic expectation.

The stock market, and the individual exchanges (especially a storied institution like the NYSE), are so heavily regulated. Heck, Wall Street just implemented the ability to settle trades in one business day versus two, and now we want to tell them about firms like Chainlink, which offer decentralized oracle networks?

We have to be pragmatic. These types of institutions won’t be on the first, second or even third lines of adoption, they might even be some of the very last to make the technological changes. Education, of course, is key here, but don’t jump to thinking that the NYSE is going to turn to DeFi overnight.

— Katherine Ross

blockworks.co

blockworks.co