This month was a rollercoaster for crypto markets, with mostly bullish trends and price jumps. It was caused mainly by the buzz around possible $ETH ETF introduction, a continuation of the $BTC ETF’s bullish sentiment. The highlight of May was that gainers were much higher than losers. Let’s take a look at the most popular cryptos and define the top losers and winners for May.

May was a very good month for all cryptos, as major popular symbols were moving in a constant and strong uptrend, with some popular coins gaining as much as 46% of their value. Together with solid projects like Uniswap and Chainlink gaining momentum, meme coins became widely popular, with $PEPE and $FLOKI leading the charge with 147% and 75% gains. This is why we decided to provide an analysis of the top 5 meme coins that gained the most in May 2024. Let’s begin with gainers and then switch to top 5 losers and top meme coin gainers.

Top 5 Gainers

The CEO of FundedBull, an expert trader, Desimir Paskalev: “May 2024 truly showcased the potential of the crypto markets in general. The anticipation surrounding the Ethereum ETF, after the successful introduction of Bitcoin ETF, is a powerful fuel for bullish sentiment. I would especially emphasize projects like Uniswap and Solana, which showcased strong growth, which is a reflection of overall investor confidence around the crypto market’s upward trajectory. The future seems very bright right now.”

From the top 5 gainers of May, 3 out of 5 were among the TOP-10 cryptocurrencies by market capitalization. Uniswap and Chainlink are 19th and 13th respectively. These cryptocurrencies reflect the overall bullishness of crypto markets this month. All these bullish price upswings were supported by positive fear and greed index dynamics this month, as the indicator was mostly in greed territory, reflecting the overall willingness of crypto enthusiasts to invest more in digital assets. Let’s analyze each of the top 5 gainer cryptos in more detail.

Uniswap ($UNI) +50%

Uniswap is a decentralized exchange where crypto holders can connect their wallets and exchange their crypto assets for other coins. The platform has shown dominance over the past 30 days, with the highest price being $11.68 on 26th May. The Uniswap Foundation announced a new governance proposal to enhance the protocol’s governance system. This proposal included a new fee-sharing mechanism incentivizing $UNI token holders to stake and delegate their tokens, strengthening the platform’s long-term sustainability and governance. This was followed by a surge in trading volume for $UNI tokens, and it managed to maintain a strong bullish trend (uptrend) this month. Uniswap v4 will be launched later this year with extensive code audits, ensuring the security and reliability of the DEX platform. The following trading volume spike propelled the Uniswap token’s price in a strong uptrend, which is still the case at the end of May 2024.

The price at the beginning of the month was just $7.4, continued trading in the range for the first week, reaching the lowest price of the month ($6.7), and starting from this point the trend changed to a storing uptrend. The price especially shot up on the 20th of May and reached $11.68.

Chainlink ($LINK) +32%

Chainlink’s gains were mainly a result of the whale activities. 23 new whale wallets purchased large amounts of $LINK, indicating a growing confidence among large investors. Whales typically employ advanced strategies and analysis tools, and many small investors usually follow suit. The US Fed also paused rate hikes, which increased optimism in the market. Together with Chainlink’s growth to the $19.12 level, the project secured several high-profile partnerships, including SWIFT, establishing itself as a leader in providing critical oracle infrastructure for asset tokenization and real-world assets traded on the blockchain. All these factors coupled with whale activity propelled $LINK to 32% gains.

The $LINK price started at $13.39 at the beginning of the month, then continued to rise to fall shortly after, reaching the lowest point of $12.91 on 15th May. This was a turning point for the $LINK price as it started a strong uptrend, reaching 19.12 on 29th May.

Solana ($SOL) +28%

Several technical and fundamental changes supported Solana’s growth. The primary driver was the anticipation of the Firedancer launch, a side-chain client developed by Jump Crypto. This is a major upgrade aiming to enhance Solana’s network performance, improving its capability to handle larger transaction volumes.

These factors were not unnoticed by investors and caused the price of $SOL to shoot up to its highest point in May at $187. On May 27th, the Solana community voted to allocate 100% of priority fees to network validators. This move not only ensured that validators were adequately rewarded but encouraged more validators to join and maintain the network’s security and efficiency. Significant whale activity followed these events. With the influx of large investor capital, $SOL maintained its steady growth and price stability over the month.

The price started at $126 and managed to reach the highest point of the month on 21st May ($187). Then it consolidated to the previous support zone and ended the month with trading near the $172 price level.

Ethereum ($ETH) +27%

The main topic around Ethereum this May was ETF anticipation. The speculation around the Ethereum ETF approval generated considerable excitement among investors, followed by $ETH’s price upward impulse. This was not a coincidence as the $BTC’s ETF was approved earlier, the price of $BTC spiked and both retail investors and whales saw this as an opportunity to capitalize on the bullishness of the world’s 2nd crypto. ETFs allow investors to gain exposure to $ETH without directly holding the cryptocurrency.

The upcoming Dencun upgrade was supporting $ETH’s growth. The EIP-4844 (proto-danksharding) is a major factor. This upgrade is going to address the long-standing problem of $ETH high fees for Layer 2 solutions. Historically, Ethereum price tends to surge ahead of significant network upgrades, and this month it was also supported by outside factors of $ETH approval.

$ETH started at $2914 and was trading sideways till 24 May when it experienced a strong upward impulse. The price reached $3910 on 23rd May, retraced back to resistance, and then reached the highest price of 3941 on May 27th.

Toncoin ($TON) +23%

Toncoin was integrated into Telegram’s ecosystem, which was a major driver of its price growth. Telegram implemented a revenue-sharing initiative, allowing channel owners to earn 50% of ad revenue in Toncoin. This was a significant milestone for $TON and pushed its price upwards. Telegram also announced an initial public offering (IPO) which further boosted investor confidence and solidified $TON’s growth.

Toncoin has implemented several technical upgrades introducing $TON payment channels and $TON storage to improve user experience. These upgrades have attracted more users and developers to the $TON ecosystem, supporting its price appreciation. Ton Foundation also launched the “Open League” community rewards program valued at over 115 million USD.

$TON started at $4.72 and after a tiny retrace started to enter a strong uptrend, rising all the way up to 7.42 on the 13th of May. The price was trading around the $6.5 level at the end of the 31st of May.

Top 5 Losers

It was relatively difficult to find losers this month, as the majority of cryptos moved in an uptrend fueled by $BTC and $ETH ETFs’ introduction. Despite these bullish sentiments, there were some losers this month, mainly caused by unlocking events and regulatory scrutiny.

SUI −8%

The main reason behind Sui’s fall was a significant unlocking event. These events release numerous tokens into the market, which is always a strong bearish sign. There were also reports of a problem with South Korean regulations regarding Sui’s activities, strengthening the overall bearish sentiment.

Sui was trading at $1.11 at the beginning of May, and $0.88 on the 15th of May. The price started to rise immediately and reached the highest price of $1.16 on 21st May. However, it couldn’t continue this short-term bullish trend and collapsed to reach 1.02 and was trading near these elves on 31st May. Overall, Sui was not very attractive this month even for sellers, as the coin was moving up and down creating a choppy price action, which is never a good trading condition.

Internet Computer ($ICP) −7%

The concerns over $ICP’s technology and scalability drove the price into bearish territory. Poor marketing and weak partnerships were only strengthening the bearish sentiment, hindering $ICP’s growth potential. Add the allegations of insider trading involving the founders of Dfinity, the organization behind $ICP, and the recipe for a disaster is complete.

Internet Computer was characterized by choppy price action, with a price moving up and down erratically. Price started at $12.9, reached $13.9, and immediately collapsed to the lowest point of the month at $11.3 on 13th May. After touching this lowest point, it immediately shot up and continued the uptrend, reaching $13.49 and collapsing. With this price behavior, $ICP seemed a risky investment asset in May.

$OKB −5%

The flash crash of January 2024 had its shockwaves continued in May as well. This crash was caused by the liquidation of a large cascade of leveraged positions. OKX immediately announced plans to enhance its risk management mechanisms, but the damage was done and investors felt unsafe investing in $OKB.

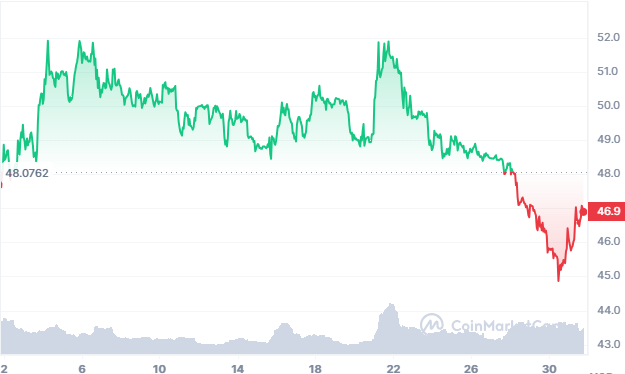

$OKB was down by 5.75% this month, showing sideways and bearish tendencies. The price started at $48 and rose, reaching the month’s highest price of $51.9 three times, creating a triple top pattern. Then it could not reach this level a 4th time and continued mostly downward. It later tested the same level and collapsed, reaching the lowest point of $44.9. On 31st May, OKG was trading near the $47 level. It might continue climbing up in the 1st week of June but seems a risky buying opportunity as of now.

TRON ($TRX) −6%

The project and its founder have faced multiple controversies and legal issues, which had a significant negative effect on $TRX’s price. Investor confidence was weakened as the project is characterized by a centralized structure despite large total value locked (TVL), and its strong position in the DeFi space.

TRON’s price behavior started promising at $0.11 immediately rising, then it traded around $0.12 levels for some time and started to enter into a consistent bearish trend on 16th May. It still is in a well-established bearish trend, trading around $0.112 territory. Currently, $TRX’s price has not been able to break the resistance level and there is a high chance of bearish continuation.

VeChain ($VET) −5%

There was not much news around VeChain and since it is mainly a technology and platform provider, the lack of collaborations and partnerships allowed only the technical side of the price to overtake fundamentals.

$VET was the only popular coin among the top 20 cryptos by market capitalization to experience losses this month. It started the month at $0.034 and quickly rose to the highest price of $0.038 on the 6th of May, collapsing on the following days to reach the lowest price of $0.032 on the 13th of May. On 31st May, the price was testing the lows. It is difficult to predict $VET unless something new happens that can propel the price in either direction.

Top Meme Coin Gainers May 2024

Together with major cryptos, meme coins were wildly popular this month, with leading tokens gaining significant traction from investors and meme lovers. $PEPE gained an astounding 147% this month, leading other popular meme coins. The second gainer of meme tokens was $FLOKI, rising by an impressive 75% in May. Dogwifhat showed a solid 57% growth, and Bonker rose by 44%. The father of all meme coins, Dogecoin, was shy this month, only gaining 14%. With the Solana meme coin rising, these gains were not a surprise by any means. There were rumors about the Dogecoin ETF, which propelled Dogecoin’s price. If the rumors turned out to be true, we could anticipate a further upward impulse in DOGE’s price.

Final Thoughts

Overall, May was a very bullish month for main crypto projects. If we look at top losers and compare them to top gainers, the difference is huge. Gainers experienced significant bullish price swings, while losers were shy to only lose several percentage points. While it would be alarming in any other financial sector, in crypto markets any movement below 10% is not significant.

The majority of top gainers were cryptos in the top 20 with market capitalization showing an overall bullish month for the digital currencies markets. The most gainer was Uniswap with 50%, followed by Chainlink, Solana, Ethereum, and Toncoin. Sui lost 8%, and $ICP, $OKB, TRON, and VeChain also experienced some minor losses. Meme coins were absolute winners this May, led by 147% growth of $PEPE, showing the public’s positive interest in fun crypto projects. Supported by the $BTC ETF introduction and also $ETH, the future for cryptos never seemed as bright.

cryptonews.net

cryptonews.net