Polygon (MATIC) price fell to a new weekly-low of $0.69 on Friday May 31, on-chain data analysis reveals the pivotal role that whale investors have played in the ongoing downtrend.

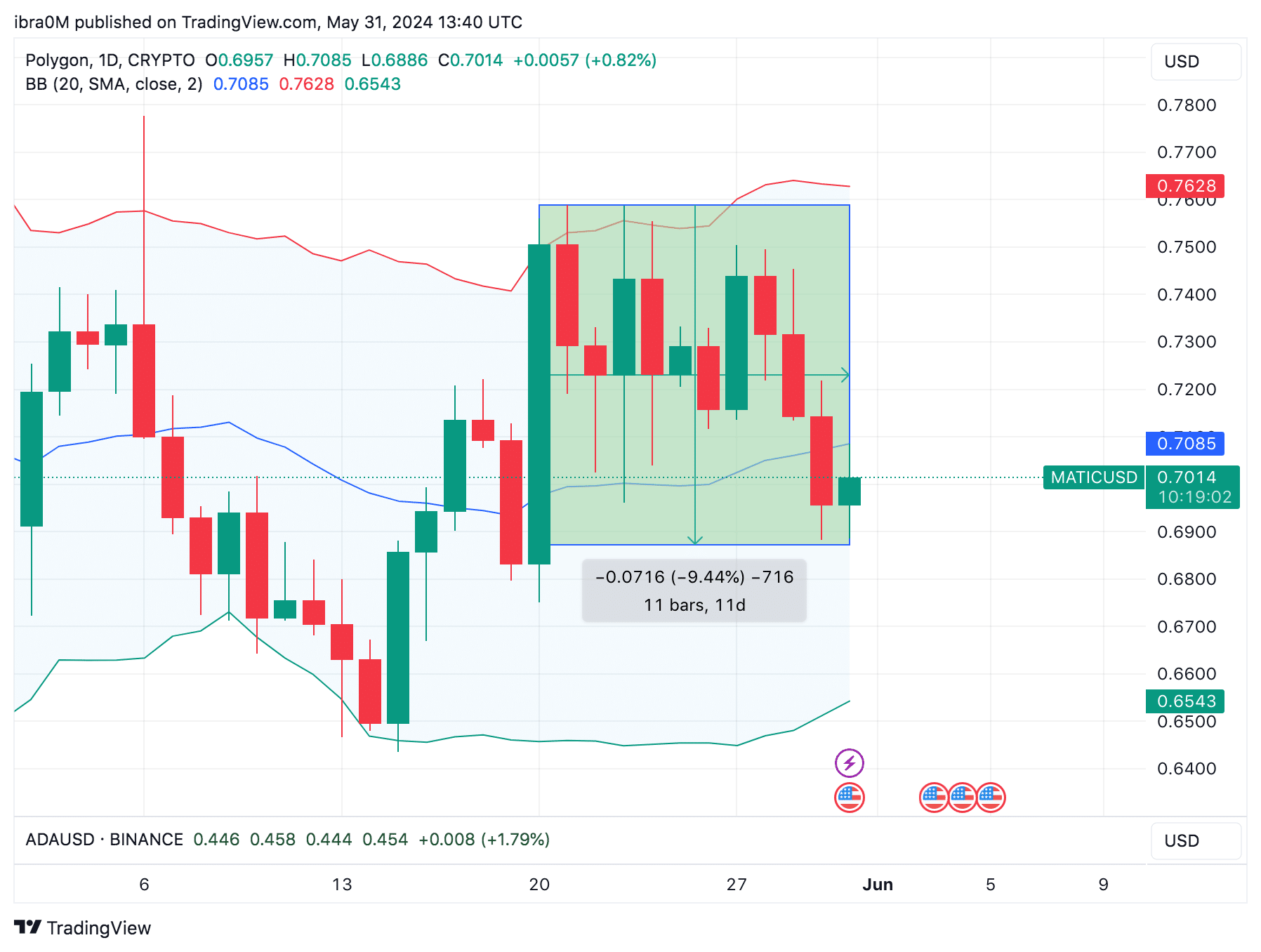

MATIC price is down 9% Since Ethereum ETF Approval

Founded in 2018, Polygon (MATIC) was tipped to become the quintessential “Ethereum killer,” offering superior scalability and lower fees compared to the ETH network.

However, recent updates on the Ethereum network in the last few years, including the Proof-of-Stake transition, have lowered fees on the beacon chain. These updates and the proliferation of new Layer-2 networks like Base and Arbitron (ARB) have seen scaling solution projects like MATIC lose significant traction.

Following the Ethereum ETF approval last week, MATIC’s price suffered yet another major setback.

Since May 21, data pulled from TradingView shows that MATIC’s price has tumbled 9% from its recent peak at $0.75 to hit $0.70 at the time of writing on May 31.

This further intensifies the narrative that the surge in number of new Layer 2 platforms and Ethereum’s growing market dominance may be impacting the MATIC ecosystem negatively.

It is important to note that in September 2023, the Polygon team unveiled plans to restructure the project with a new native currency called the POL token.

The team anticipates that the token conversion will help secure the protocols’ long-term viability and protect its market share as the technology surrounding smart contracts continues to evolve.

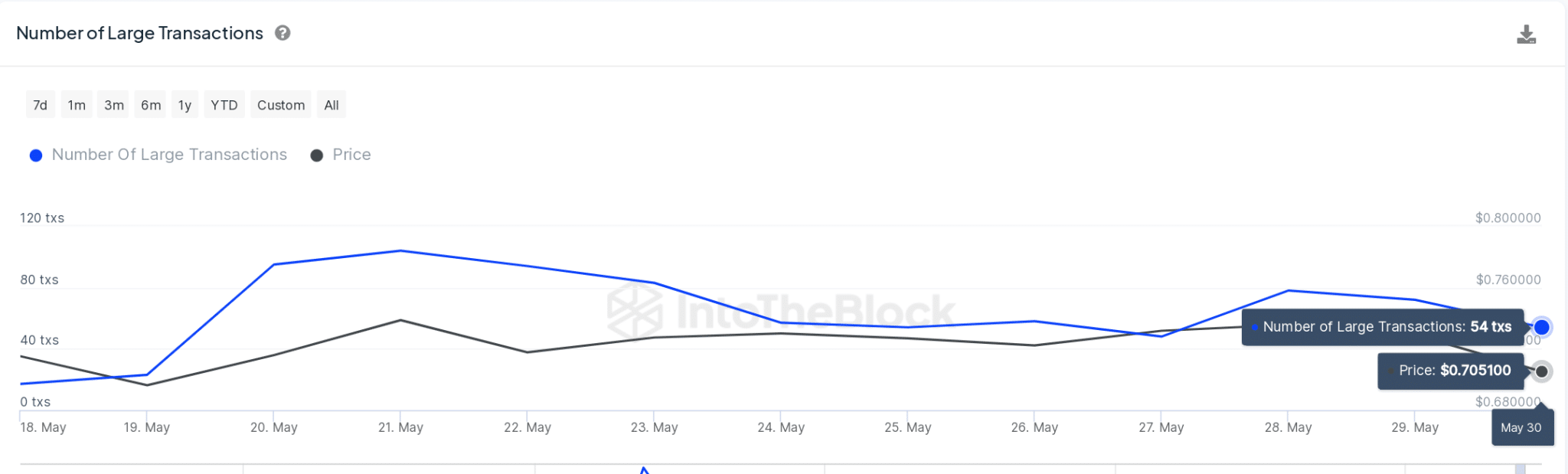

Whale Activity Declined by 40% in 10 days.

While the POL token conversion could be a highly profitable long-term solution, investors’ outlook for MATIC’s short-term price prospects still currently looks overwhelmingly bearish.

On-chain data shows that whale investors have been increasingly cutting down their exposure to MATIC in recent days.

IntoTheBlock’s Large Transactions chart below monitors the daily number of transactions executed on a blockchain network that exceed $100,000. This provides real-time insights into the level of whale demand a cryptocurrency has pulled.

On May 20, when news of the impending Ethereum ETF approval first broke, the Polygon network recorded 95 whale transactions. But curiously, it has been downhill since then.

After a 10 days of persistent decline, the MATIC only pulled 54 whale transactions on May 30 according to the latest data.

This essentially shows that whale demand for MATIC has reduced by 43% since the Ethereum ETF approval.

A persistent decline in whale transactions puts the underlying token price at risk of rapid downswings. Without the liquidity that whale transactions provide, panic sellers may drive prices lower as they look to exit.

MATIC Price Forecast: $0.70 Support at Risk

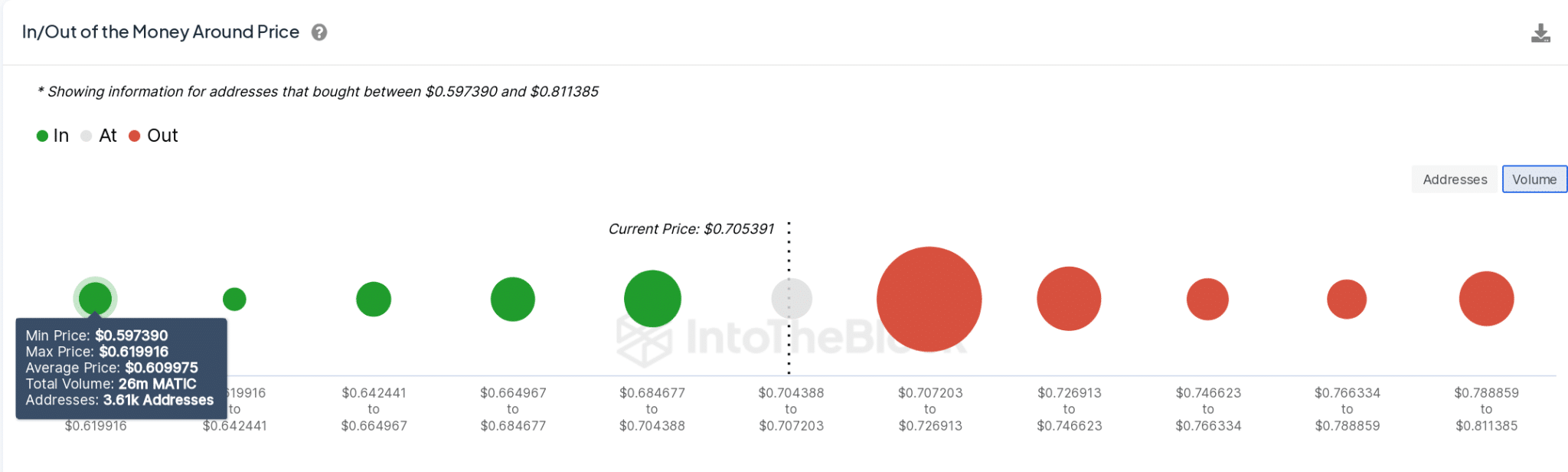

MATIC price has historically found strong support at the $0.70 level, but the 43% rapid decline in whale transactions amid mounting sell-pressure means bears could now target a reversal toward $0.61 in the near term.

IntoTheBlock’s Global In/Out of Money data, which groups all existing MATIC holders by their entry prices, also affirms this bullish stance.

As seen above, there’s a formidable support cluster of 8,910 million addresses that acquired 158.36 million MATIC at the average price of $0.69.

However, if the support level caves, MATIC’s price could slide as low as $0.61 before finding a significant buy-wall.

Conversely, if the market enters a rebound phase, bulls must flip the major resistance at $0.73 to regain momentum.

thecryptobasic.com

thecryptobasic.com