For the past month and a half, Fetch.ai’s ($FET) price has been affected by mixed market and investor signals.

Investors now seem to be losing confidence in the asset and are likely to move away from altcoins.

Fetch.ai Is Not Fetching Investors Any Gains

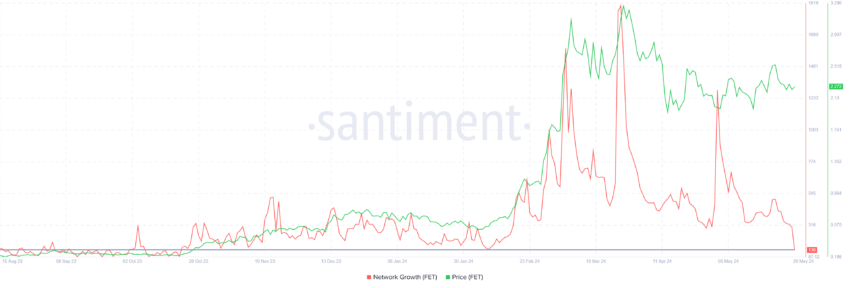

Fetch.ai’s price could see bearish momentum build as its investors are making bearish moves at the moment. The first sign of this is visible in the asset’s network growth, which refers to the formation of new addresses on the network.

This is essential in ascertaining whether the project is gaining or losing traction in the market. In the case of $FET, network growth has dropped to a seven-month low, suggesting that investors do not see much incentive to transact on the network.

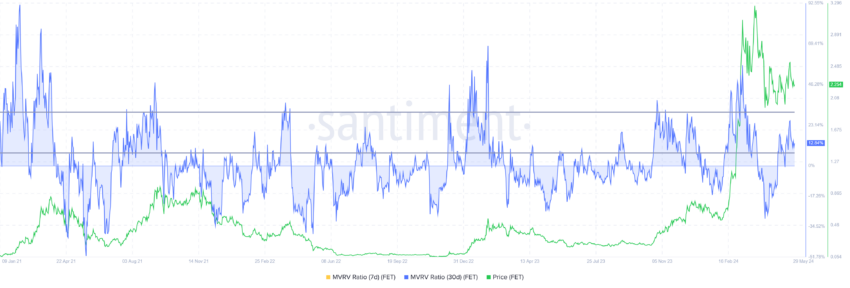

Furthermore, the Market Value to Realized Value (MVRV) ratio also supports a bearish outcome. The MVRV ratio assesses investor profit or loss. Fetch.ai’s 30-day MVRV sits at 12%, signaling profit, potentially prompting selling.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Historically, $FET corrections occur within the 7% to 30% MVRV range, which is labeled a risk zone. Thus, Fetch.ai’s price could draw a drawdown if investors opt to book profits.

$FET Price Prediction: Key Support Close to Invalidation

Fetch.ai’s price, $2.24, is hovering just above support at $2.22. This price point has also been tested as resistance in the past, and sustaining a move above it is key to ensuring a breach of $2.49.

This price level has been breached a few times in the past two months, but the Fetch.ai price has been unsuccessful in closing above it. Given the aforementioned factors, $FET could dip to lows of $1.95.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

But if the altcoin does manage to bounce back and flip the resistance of $2.49, it could head towards $2.85. This would also invalidate the bearish thesis Fetch.ai’s price is witnessing.

beincrypto.com

beincrypto.com