Arbitrum’s (ARB) price is trading above the critical resistance level of $1.17, but this breakout might not be sustained.

The reason is most likely that potential profit is occurring at the hands of ARB holders, given the surge in profits.

Arbitrum Investors Appear Keen to Sell

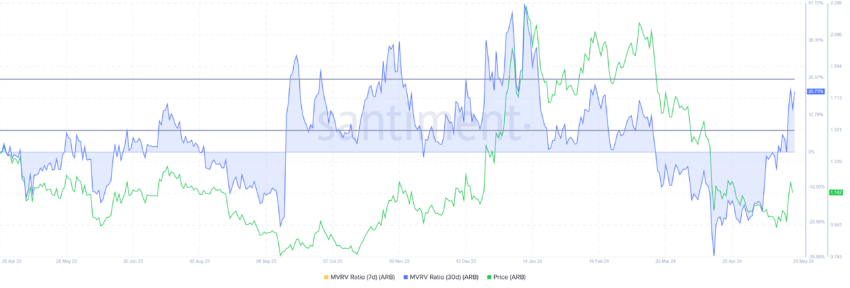

Arbitrum’s price could be noted to have a drawdown owing to the increasingly bearish cues from ARB holders. Their sentiment suggests that selling is the likely outcome, as substantiated by the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit or loss. Arbitrum’s 30-day MVRV sits at 20%, signaling profits, potentially prompting selling. Historically, ARB corrections occur within the 7% to 24% MVRV range, labeling it a danger zone.

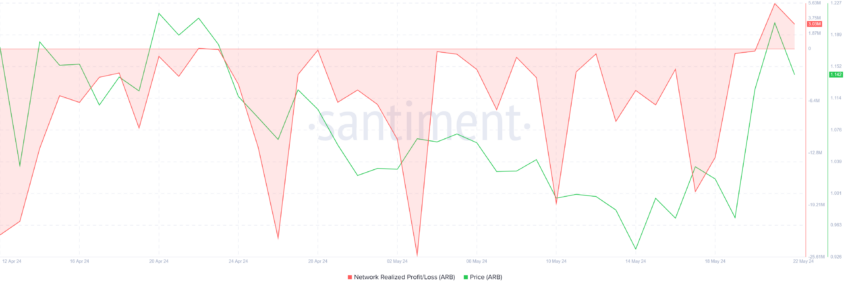

Further cementing this outlook is the fact that investors are realizing profits. As ARB rallied over the past week, rising by 20%, it also brought the first bout of gains noted in almost a month.

Realized losses turned into realized profits across the network and will likely continue rising. This is only possible via selling, and ARB investors could opt to secure their gains before another dip occurs.

Read More: What Is Arbitrum?

Thus, Arbitrum’s price is prone to a decline.

ARB Price Prediction: Bearish Indicators Dominate

Arbitrum’s price breached through the month-long resistance of $1.17, and the altcoin is currently changing hands at $1.18. But despite this breakout, the cryptocurrency will likely face a decline due to the presence of intense bearish cues.

The Ichimoku Cloud is one such indicator that suggests the market is still bearish. It is a comprehensive technical analysis indicator that provides insights into support, resistance, trend direction, and momentum.

As long as the cloud is red, it suggests a positive outcome is unlikely, and this could also be the case with ARB.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

Consequently, Arbitrum’s price could fall to $1.1 or lower, potentially towards $0.92.

However, a bounce off the support at $1.17 could initiate a recovery towards $1.30. If the rise can be sustained, this might also invalidate the bearish thesis.

beincrypto.com

beincrypto.com