ETFs with a side of chaos

Looks like Gary Gensler’s SEC isn’t so anti-ETH ETF after all.

Let’s start with the most recent news. Early this morning, Fidelity filed an amendment to its S-1 — the registration statement that the SEC will have to approve to launch the fund — and removed the staking language.

This isn’t a huge surprise, because when the tide suddenly turned late Monday and reports began to circulate that the SEC was suddenly engaging with the issuers, one of the first expected changes was staking.

It’s not currently clear what else the regulator will ask the issuers to adjust, though The Block reported that issuers were asked for “light” changes. The new documents will be filed with the SEC this morning.

The SEC told us that they don’t comment on individual filings when asked about the ETH ETF proposals.

If you somehow missed the commotion late Monday and have no idea what I’m talking about, let’s recap.

Yesterday afternoon, Bloomberg analyst Eric Balchunas took to X to say that they were raising their ETH ETF approval odds to 75% from 25%.

Media reports — including one from Blockworks — trickled in, confirming that issuers were beginning to hear from the SEC. The lack of engagement from the regulator in the first place was one of the driving forces for the pessimism around a May decision.

This morning’s filings from potential issuers are the real confirmation, though. The SEC is here, and they’re feeling chatty. Issuers are on a tight deadline; the SEC has to approve documents by Thursday night if they’re going this route.

But this isn’t going to look like the bitcoin ETFs (though even that process was unique in its own ways). The most likely scenario here, I’m told, is that the SEC approves the issuer’s 19b-4 filings. Those filings inform the SEC of a proposed rule change, and they’re one of a few necessary documents for the SEC to approve.

All that is to say, this doesn’t mean that the ETH ETFs are launching this week.

The SEC will still need to approve the issuer’s S-1s, or registration statements, before the funds are cleared to launch. This is where things get tricky. The ETF Store President Nate Geraci said it’s possible for the regulator to approve the 19b-4’s then slowly move forward with the S-1 approvals. Then we’ll see the funds launch.

While the process for the SEC is clear, the water’s still muddy because it’s unclear if the SEC had a sudden change of heart or if they planned to approve the ETFs all along.

Geraci told me he thinks this was the regulator’s plan, but the change seemed to shock both Balchunas and his colleague James Seyffart.

One thing’s for sure, though — this is a pretty unusual route to approval.

“I’ve never seen anything like this honestly. Based on the people I’ve spoken to, no one was ready or expecting this. Kinda tells me that this was a decision from above and may have been a political decision,” Seyffart told me.

Van Buren Capital’s Scott Johnsson agreed with Seyffart, adding that the SEC “has a long history of simply denying crypto applications without any comment, as we had witnessed with BTC spot products until this year’s final approval.”

“To reach out to multiple issuers (including those without upcoming deadline) to request amendments on an expedited basis is indicative of a last minute course change,” Johnsson said.

Whether political or planned, this week just got way less boring.

— Katherine Ross

Data Center

- Bitcoin is still trading above $71,000 after surging to a local high of $71,958 overnight.

- Meanwhile, ether is trading above $3,700, retaining Monday’s post-SEC rumor gains.

- Yesterday’s market move added more than 8% to crypto’s collective market capitalization, per CoinGecko.

- Ether futures open interest jumped to more than $15 billion over the past 24 hours, according to CoinGlass data.

- Nearly $270 million worth of short positions were wiped out in the past day, per CoinGlass.

A game of narratives

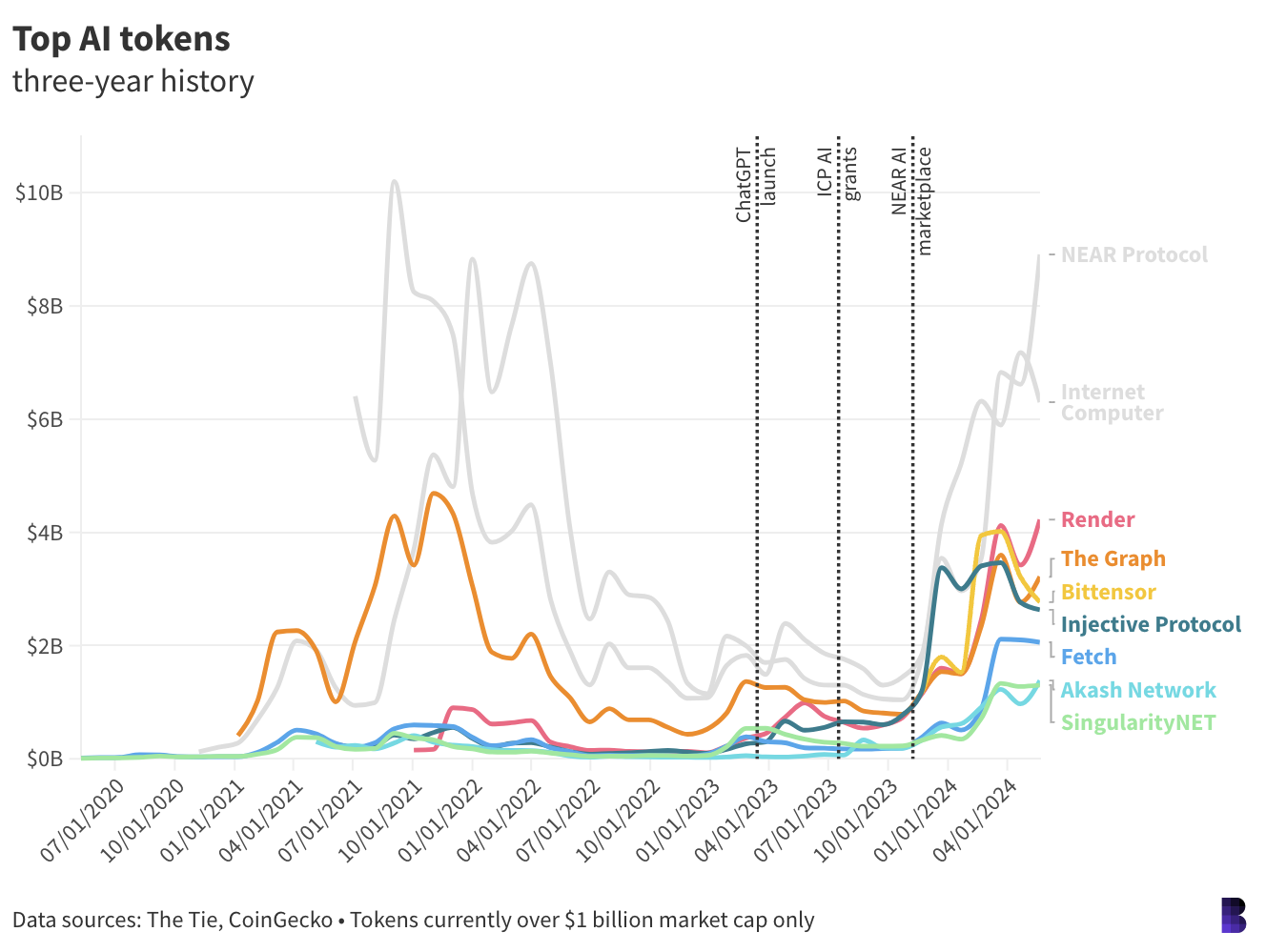

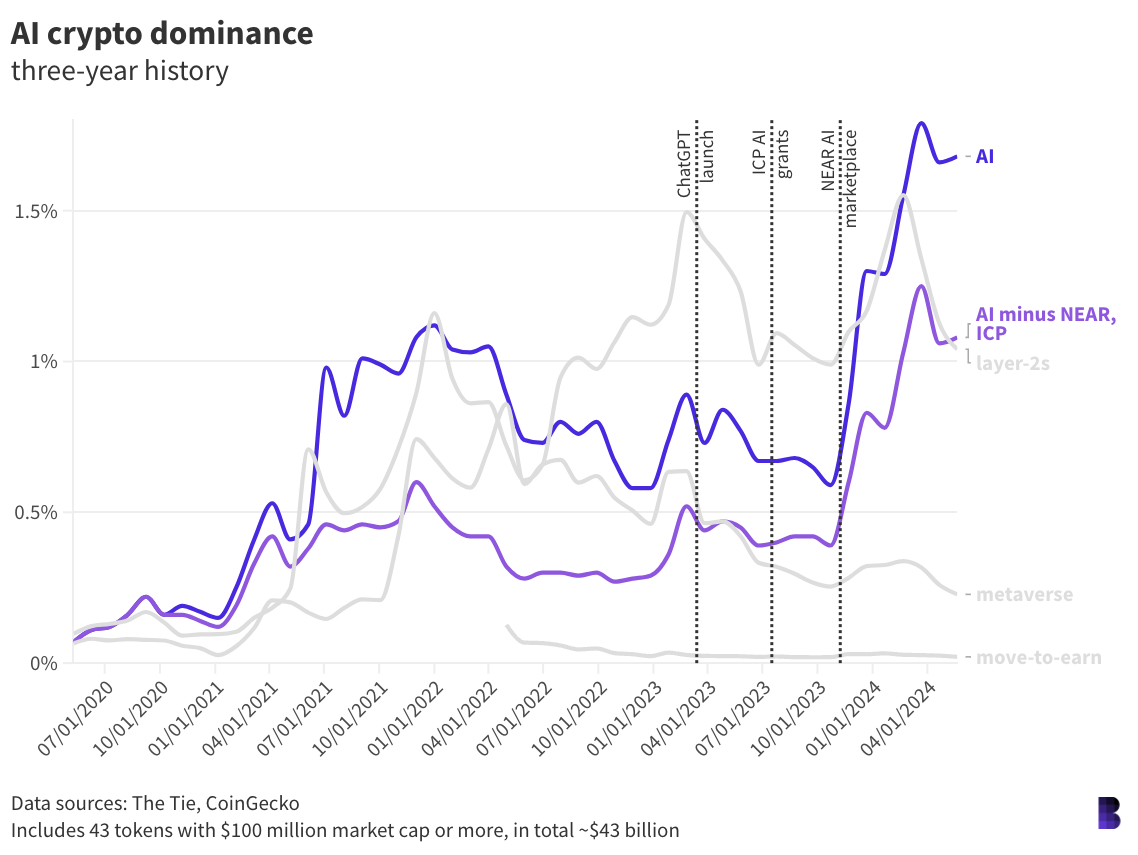

The AI pitch isn’t all too dissimilar from even the purest of crypto bull cases — which makes them great bedfellows.

Bitcoin uses the promise of valuable crypto to secure an uncensorable digital money network. Ethereum offers yield to encourage powering a world computer that can never be stopped.

The AI crypto bull case is still crystalizing, but token incentives are similarly set to be at the heart of it.

It’s not so much “LLMs on the blockchain,” but rather, most of crypto’s biggest AI projects are, essentially, cloud computing marketplaces integrated with some element of tokenomics.

For example: spend crypto to hire GPUs to run and train models and, hopefully, decentralize the broader ecosystem along the way. Or, earn crypto by providing computing services to an ad-hoc cloud marketplace.

Other non-marketplace projects are emerging, while existing crypto projects are AI elements to their primary offerings. But politics is where AI and crypto’s narratives are truly converging.

While there had been rumblings about the censored nature of closed-source LLMs like OpenAI’s ChatGPT, Google’s “woke” Nazi imagery blunder made it clear: as powerful as AI is, it’s not immune to human biases, and it may even amplify those of their creators.

The dramatic temporary ousting of Sam Altman from OpenAI last November meanwhile exposed the AI sector’s problem with centralization, as was discussed on today’s Empire podcast.

After all, if OpenAI went away tomorrow, what would become of the hundreds (or even thousands) of startups relying on its APIs for their primary products?

Suddenly, AI crypto had an extremely clear ideological value proposition, even if it boils down to simply “add a token.”

Token incentives must drive the proliferation of open source alternatives to ChatGPT and Google Gemini (formerly Bard).

It’s a freedom of speech thing, for better or worse, similar to the Bitcoin maxis who say the only vote that matters leading into November is to pull your fiat money out of the bank and store it in bitcoin instead.

Or else, the world be stuck with watered down, corporate-controlled, heavily-censored AI chatbots, rather than based digital waifus.

And we can’t have that.

— David Canellis

The Works

- Congress will begin voting on a crypto market structure bill Wednesday, according to Blockworks’ Casey Wagner.

- House Democrat leaders oppose the measure but won’t try to compel members to vote for or against it, according to Politico.

- Blockchain gaming project Gala Games says it suffered an exploit late, Monday, resulting in an illicit sale of tokens worth $21 million.

- Coinbase and Kraken are among the crypto-focused members of a new working group focused on combating romance scams and other types of online financial fraud.

- As much as $2 billion will be collected for a victim’s fund following a settlement between New York’s Attorney General and bankrupt crypto lender Genesis.

The Morning Riff

Grayscale suddenly announced Monday that CEO Michael Sonnenshein was out (to pursue other endeavors) and Peter Mintzberg’s in (starting in August).

Katherine Ross: The new CEO is a TradFi veteran with an impressive resume. He’s had stints at BlackRock, OppenheimerFunds, Invesco, Apollo and Goldman Sachs.

Mintzberg’s an interesting hire for Grayscale, and one with such a vast body of experience that it’s hard to read the tea leaves here. He’s got experience with mergers from his time at OppenheimerFunds and Invesco, but he was also one of the top dogs at Goldman’s asset management business.

If I were a betting woman, based on the sudden withdrawal of the ETH futures ETF filing and the outflows we’ve seen from Grayscale’s bitcoin ETF, I’d probably lean toward Mintzberg being brought in to right the ship. Sonnenshein’s tenure is a storied one, but money talks. At the end of the day, they might be reconsidering how to approach the ETFs, especially if an ETH ETF is on the horizon.

David Canellis: The CEO shakeup at Grayscale formally closes the loop on a major Bitcoin storyline: the GBTC “widowmaker trade.”

GBTC, launched in 2013, was one of the first crypto-infused traditional finance products, and by the 2021 bull market’s peak had attracted nearly $44 billion in bitcoin under management.

It’s long been speculated that the bulk of GBTC’s inflows were tied to accredited investors seeking a risky arbitrage trade: GBTC had always traded at a premium to the bitcoin it held, which meant there was opportunity to profit by sending bitcoin to Grayscale in return for GBTC shares, to be sold after a six-month window had expired.

Except…GBTC’s premium to its NAV blew up in November 2021, leading to cascading credit contagion across crypto lenders including Genesis, with failed hedge fund firm Three Arrows Capital also suffering.

Mintzberg may do well to avoid enabling any similar shenanigans moving forward.

— Katherine Ross and David Canellis

blockworks.co

blockworks.co