Top cryptocurrencies demonstrated a robust recovery last week. The global market cap surged by 7% to reach $2.41 trillion. This increase reflected a $160 billion gain in valuation, driven by significant rises in most of the leading cryptocurrencies.

Here are our picks for the top cryptocurrencies to watch this week:

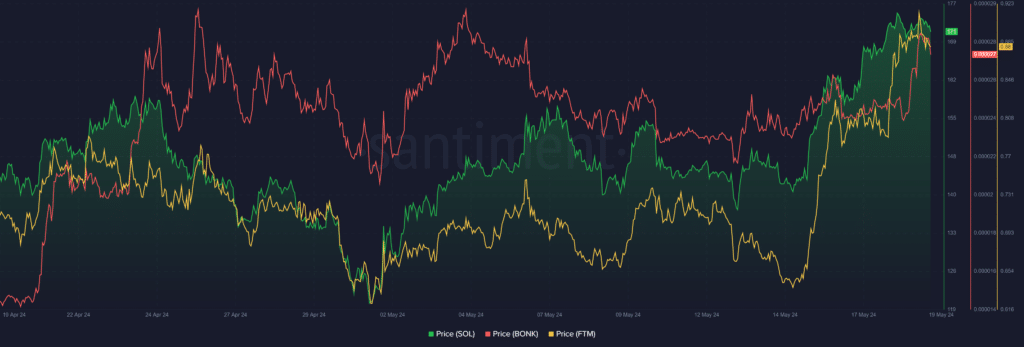

$SOL, $BONK, FTM - 1">

$SOL, $BONK, FTM - 1"> $SOL retests 1-month high

Solana ($SOL) emerged as one of the top cryptocurrencies last week, despite experiencing range-bound movements initially.

It began the week below the critical $150 threshold and struggled to show strength amid bearish conditions in the broader market.

Following Bitcoin’s (BTC) significant 7.52% gain on May 15 in response to the U.S. CPI data release, the broader market experienced an impressive uptrend. Solana capitalized on this momentum, achieving an 11.61% upswing. It ultimately broke above the resistance at the upper Bollinger Band on the daily chart.

When trading platform Robinhood launched a Solana staking program in Europe, the coin closed May 15 at a $158 price, looking to ride on the existing uptrend for more substantial gains.

The asset recorded three consecutive intraday gains from May 16 to 18, breaching the much-coveted $170 territory to retest a one-month high of $176. Solana closed last week with a 21% uptick, making it one of the best-performing assets within this period.

$BONK breaches 50-day EMA

Bonk ($BONK) also began last week with a bearish consolidation following the downtrend observed in the previous week. But the meme coin capitalized on the market resurgence on May 15 to record an 8.42% daily gain, closing the day at $0.00002153.

This upswing led to a confident breach of the 50-day EMA, which $BONK has been battling to surpass since May 10. The crypto token soared to a 10-day high of $0.00002648 the next day, but the resistance at this price level resulted in a price slump, leading to a 3.9% intraday loss on May 16.

Despite this loss, $BONK remained above the 50-day EMA, suggesting a retention of the bullish momentum. The next two days were particularly favorable, bringing in a 9.88% gain. With $BONK changing hands at $0.00002601, the bulls would look to break above the resistance at the upper Bollinger Band ($0.00002748) to sustain the uptrend.

However, a pullback toward the middle band at $0.00002444 could test the asset’s strength substantially, as a drop below this level would mark a free fall to retest the 50-day EMA. $BONK closed last week with a 13.4% gain.

FTM spikes 21% in a week

Fantom (FTM) started last week on a more bearish note than the broader market. The asset slumped by nearly 10% during the first three days of the week while other tokens witnessed range-bound price action.

Nonetheless, the market-wide rally on the back of the CPI data release helped FTM recoup all these losses. As a result, it surged by an impressive 18.22% on May 15, eventually closing the day at a monthly peak of $0.7590. The last time Fantom closed a daily candle at this level was on April 20.

This massive upswing, which marked Fantom’s largest intraday gain since March 17, 2023, was buoyed by a rise in the Accumulation/Distribution metric. Notably, the indicator witnessed an increase from 1.197 billion FTM on May 14 to 1.308 billion FTM on May 16, suggesting an increase in buying activity.

Fantom ended the week with a 21% increase, mirroring Solana’s upswing. At its current price of $0.8600, the asset would need to defend the Fibonacci 0.5 zone ($0.7671) fervently to hedge against any declines to last week’s lows below $0.6600. Conversely, a push above Fib. 0.618 ($0.8741) could set the stage for a rally above $1.