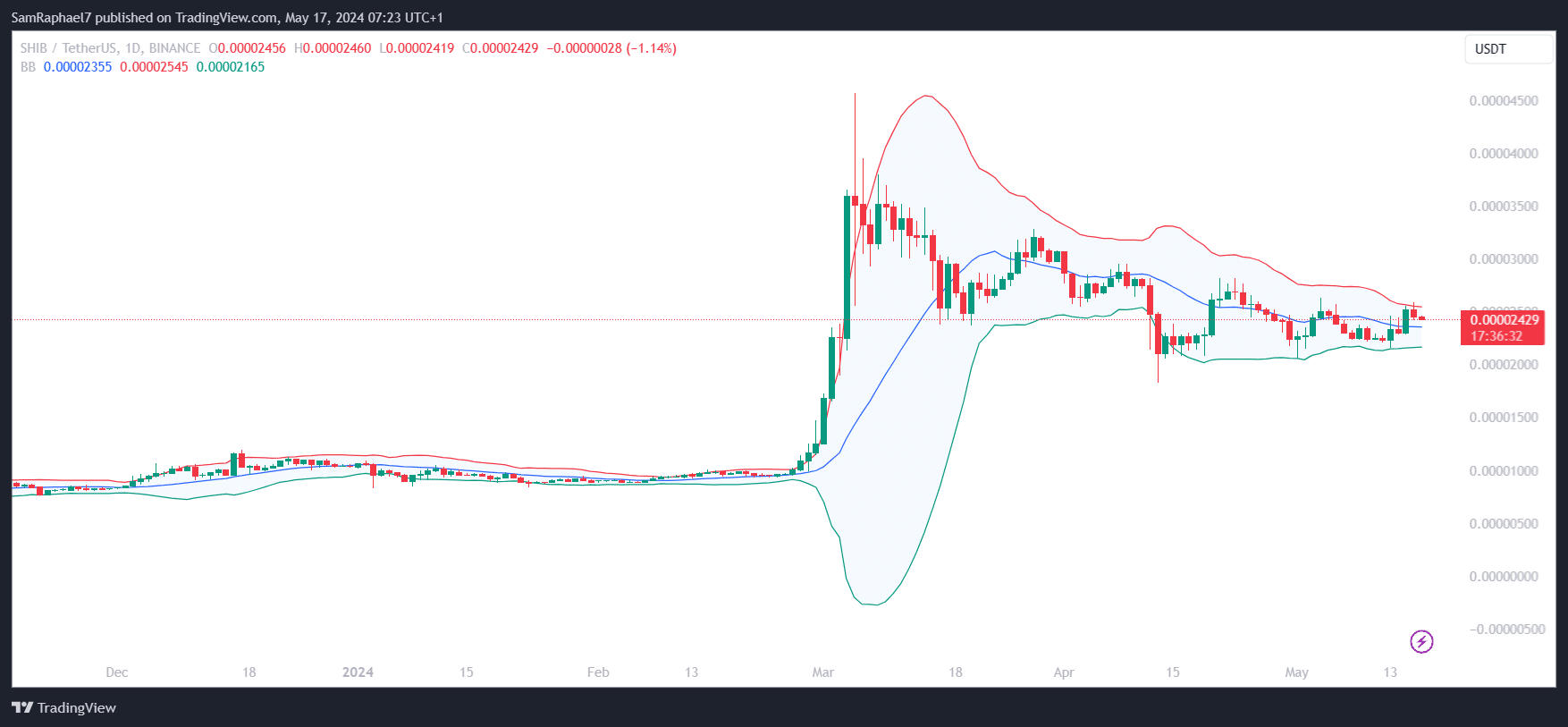

The Bollinger Bands on the daily Shiba Inu chart suggest the downtrend might be weakening, with analysts setting breakout targets at $0.00006.

Shiba Inu now trades at a critical juncture following the persistent downtrend that plagued it from May 4. Recall that earlier this month, SHIB sought to recover from the price decline recorded throughout April, which led to a 27.16% monthly loss, the highest since the Terra implosion of May 2022.

The recovery efforts from earlier this month faced a hiccup on May 4, resulting in another round of losses. However, this renewed downward push came to a halt on May 13 after Shiba Inu retested the lower Bollinger Band upon the crash to $0.00002156.

Bollinger Bands Suggest Weakening Downtrend

Now, the Bollinger Bands suggest SHIB might be gearing up to register a breakout that would eventually help eliminate this sustained downtrend. For context, traders leverage the Bollinger Bands to identify overbought or oversold regions, which could be useful in detecting an imminent trend reversal.

When a cryptocurrency’s price slumps to retest or break below the lower band during a downtrend, this typically suggests that the asset might be breaking into oversold territories. SHIB retested this lower trendline during the price collapse on May 13, signaling that the downtrend is weakening.

Interestingly, the retest preceded an impressive recovery push from Shiba Inu, buoyed by Bitcoin’s (BTC) rebound. However, SHIB faced resistance when it touched the upper trendline at a high of $0.00002588 yesterday. Shiba Inu requires a further push from the bulls to retain this upward momentum and eventually breach the upper trendline.

Shiba Inu Sees Reduced Volatility

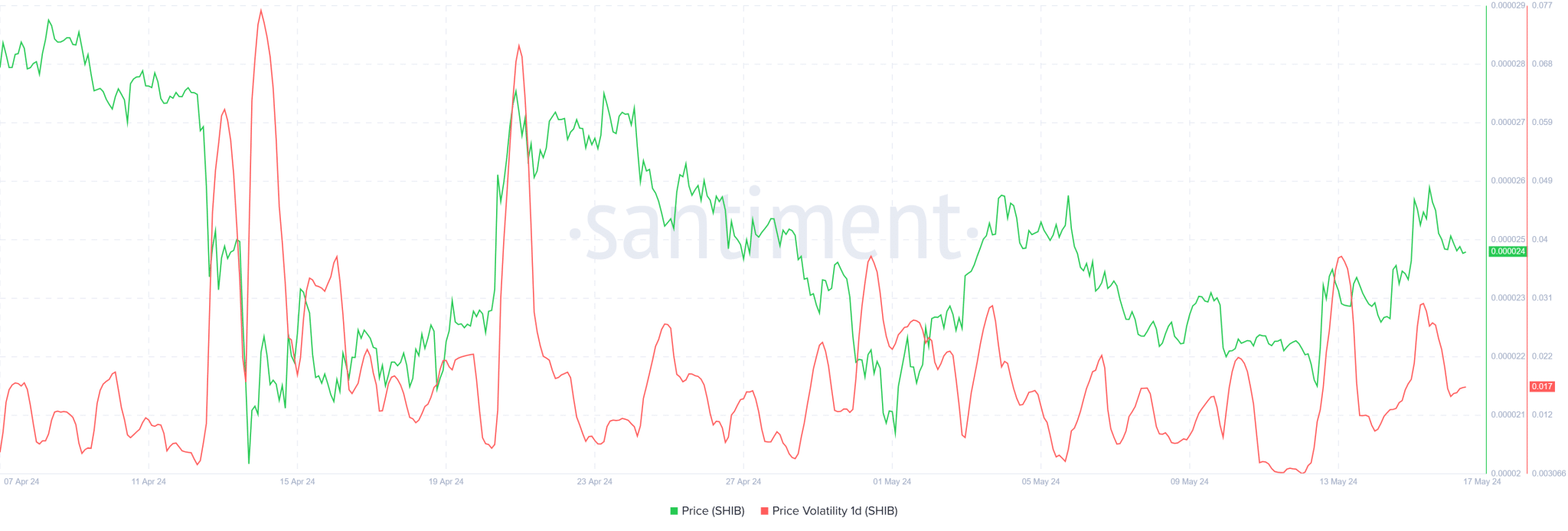

A closer look at the daily chart shows that the Bollinger Bands are currently contracting. Such a significant squeeze indicates reduced volatility, a pattern that suggests an imminent sharp price move. Data from Santiment shows that Shiba Inu did record a drop in volatility this week.

SHIB’s volatility collapsed to 0.003097 on May 12, the lowest in three months. The last time Shiba Inu saw its volatility drop to this level was on Feb. 25, when it slumped to 0.001892. This slump preceded Shiba Inu’s meteoric surge in late February, leading to a 370% spike to $0.000045 on March 5.

Despite a mild increase in volatility over the past few days, this metric remains below the daily average. Meanwhile, market analysts have identified a symmetrical triangle on the daily chart, confirming that Shiba Inu has broken above the upper trendline. This breakout further sets the state for a significant price upswing.

A $0.00006 Target

Shiba Inu currently trades for $0.00002429, looking for another opportunity to retest the $0.000025 zone. The bulls would look to ride on the growing accumulation trend from shark and whale addresses to propel this much needed breakthrough. The Crypto Basic confirmed that these addresses have bought 4.35 trillion since March.

Amid these bullish indicators, some pundits expect Shiba Inu to reach a price of $0.00005. However, market analyst SHIB Knight believes Shiba Inu has the potential to hit the $0.00006 price level when it witnesses a trend reversal. This price would mark a 147% increase from Shiba Inu’s current value.

Good potential with $SHIB 📈📈 pic.twitter.com/pcaQ2Ju7Uw

— $SHIB KNIGHT (@army_shiba) May 16, 2024

thecryptobasic.com

thecryptobasic.com