Raoul Pal, known for his provocative macroeconomic opinions, has sparked interest with his recent remarks on the trajectory of the cryptocurrency market. In a thought-provoking post, Pal dove into the nuances of what he calls "The Everything Code," explaining how the global liquidity cycle since 2008 has shaped macroeconomic trends.

According to Pal, this cycle, characterized by near-perfect cyclicality, has been instrumental in propelling growth assets, particularly technology stocks and cryptocurrencies, to new heights.

Central to Pal's thesis is the idea that the depreciation of fiat currency, caused by increased liquidity to service debt obligations, serves as a catalyst for rising asset prices. He argues that this phenomenon, combined with the rapid adoption of cryptocurrencies, similar to the exponential growth of the internet, could pave the way for a monumental upsurge in cryptocurrency market capitalization.

Pal foresees staggering growth from $2.5 trillion to $100 trillion, backed by Metcalfe's Law and fueled by unprecedented levels of adoption.

$10T this expansion, $100T later. https://t.co/IqGD43xOxG

— Chris Burniske (@cburniske) May 13, 2024

Chris Burniske, former head of cryptocurrencies at ARK Invest, agreed with Pal's bullish outlook, stating that the cryptocurrency market could witness monumental growth, reaching $10 trillion in the near term and soaring to $100 trillion in the future.

Pal enthusiastically endorsed Burniske's view, emphasizing that there is a consensus in certain quarters of the financial community about the transformative potential of cryptocurrencies.

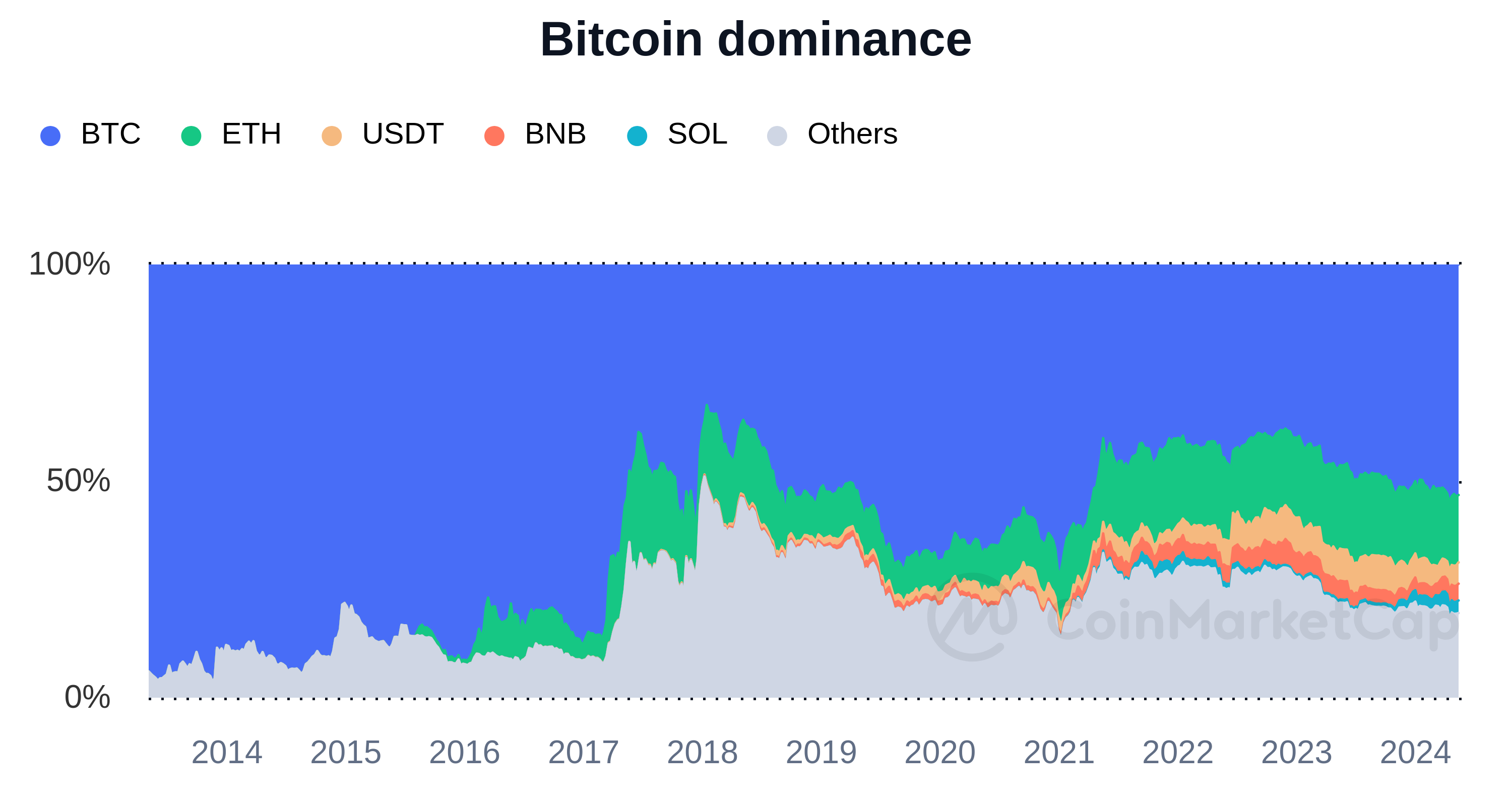

As of now, according to the TOTAL Index Group, crypto market capitalization is estimated at $2.213 trillion, of which Bitcoin (BTC) holds $1.22 trillion, which is over 55% of the entire figure. Ethereum (ETH) takes up just over $350 million, with the remaining $640 million and a bit distributed among all other altcoins.

u.today

u.today