Dogecoin ($DOGE) appears poised to witness a decline in value as bullish pressure begins to wane.

The increased volatility observed in the coin’s market puts it at risk of significant price swings. Especially downward, as demand for the meme coin declines.

Dogecoin Holders Cannot Hide Their Pessimism

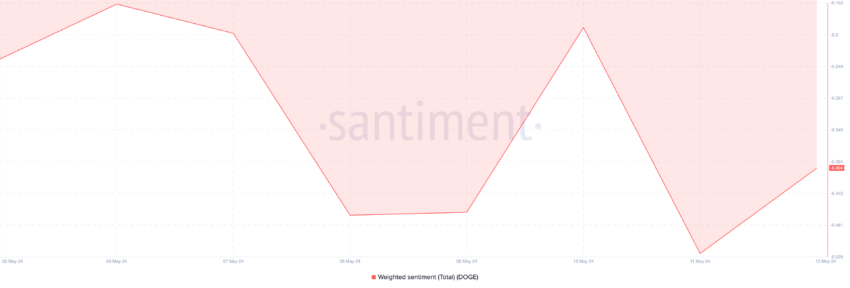

While $DOGE’s price has risen by 7% in the past 24 hours, it continues to be trailed by negative weighted sentiment. As of this writing, the coin’s Weighted Sentiment returned a value of -0.404. This metric has returned a negative value since May 5.

An asset’s Weighted Sentiment measures the overall market sentiment surrounding it. The metric improves upon the simple positive and negative sentiments by considering the importance of each sentiment mentioned.

When it returns a negative value, the asset’s market is overwhelmed by negative sentiment. Its price is therefor expected to fall. Conversely, when the value is positive, the bulls are in control.

The bearish trend in the $DOGE market is confirmed by the fact that its futures market open interest across exchanges has trended downward since May 8. At $9.83 billion at press time, it has since fallen by 7%.

Read More: Dogecoin ($DOGE) Price Prediction 2024/2025/2030

$DOGE’s futures open interest refers to the total number of its futures contracts that have yet to be settled or closed. When it declines in this manner, it indicates an increase in the number of market participants exiting their trade positions without opening new ones.

$DOGE Price Prediction: A Decline Ahead

As of this writing, $DOGE is trading at the support level of $0.15. Its Parabolic SAR indicator, as observed on a weekly chart, rests above its price, hinting at the possibility of a breach below this level.

This indicator is used to identify potential trend direction and reversals. When its dotted lines are placed above an asset’s price, the market is said to be in decline. It indicates that the asset’s price has been falling and may continue.

If these bearish projections hold, the meme coin’s value might dip under $0.1 to find support at $0.08.

The widening gap between the upper and lower bands of its Bollinger Bands indicator heightens the risk of this significant price swing, as it signals the growth in market volatility.

However, if the bulls regain control and $DOGE’s price swings in an uptrend, it may initiate a rally toward resistance at $0.17.

beincrypto.com

beincrypto.com