An insider achieved remarkable gains in just 15 hours, turning a modest initial investment of 3.89 $SOL ($600) into 999 $SOL ($153.56K). This swift increase was facilitated by withdrawing 3.89 $SOL from Binance and then spending 2.89 $SOL ($445) to buy 2.46 billion Minette tokens.

Starting at 3.89 $SOL($600), the insider turned it to 999 $SOL($153.56K) in just 15 hours and has $2.5M in unrealized profits.

— Lookonchain (@lookonchain) May 10, 2024

He withdrew 3.89 $SOL($600) from #Binance and spent 2.89 $SOL($445) to buy 2.46B #Minette at the same block where the developer added liquidity.

Then… pic.twitter.com/daxXb6h59P

According to Lookonchain, this transaction occurred in the same block where the developer added liquidity. The insider subsequently sold 1.04 billion Minette tokens for 998.7 $SOL ($153K), leaving them with a remaining 1.42 billion Minette tokens, currently valued at approximately $2.5 million in unrealized gains.

However, Minette’s rapid ascent comes with potential risks, especially since the developer of VibeCat (Minette’s parent entity) did not burn LP tokens. This lack of burned tokens raises the specter of a potential rug pull, where the developer could manipulate liquidity to the detriment of investors. Moreover, concerns arise as insiders have significant quantities of Minette tokens, which they could offload en masse, further threatening the stability of the token’s value.

Solana Surges Over 8%

Solana’s native currency, SOL, has catapulted over 8% in the past 24 hours, cementing its status as one of the day’s most exceptional altcoins. As of this publication, the token is priced at $153.38 across primary exchanges.

In comparison, Ethereum (ETH) experienced a more subdued climb of 1.87% within the same timeframe yet still boasts a valuation of $363 billion, significantly overshadowing Solana’s market capitalization.

SOL/USD 24-Hour Chart (Source: CoinStats)

Presently, SOL’s market cap has reached $68 billion, an intraday ascent of 7.93%. However, a 6.34% decline in trading volume over the past 24 hours, now totaling $2,139,966,369, paints a different picture. This contrast hints that while the market cap is on an upward trajectory, overall trading activity has waned, suggesting traders’ reduced interest despite the recent price upswing.

SOL’s Bullish Mood Eyes Key Resistance Levels

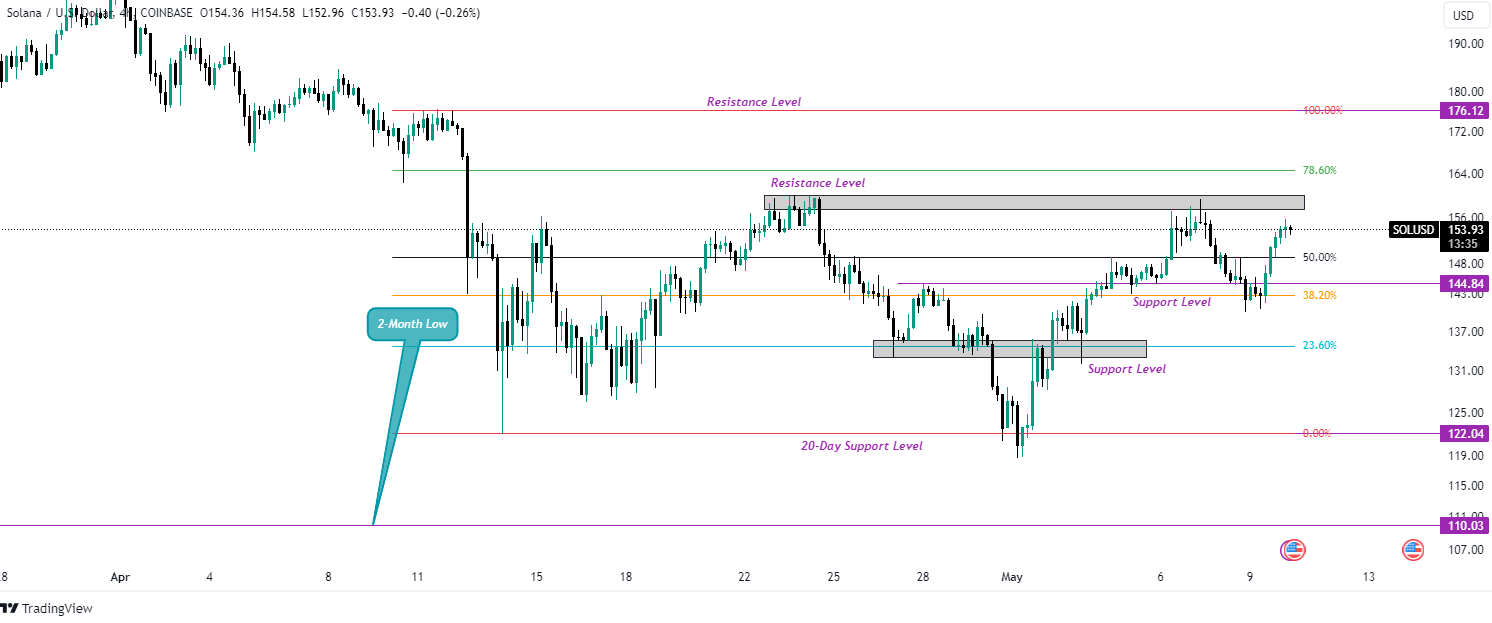

On the four-hour chart, the SOL token displays strong upward momentum as it nears the $159 resistance level. If this bullish trend continues in the short term, SOL could breach this resistance and head toward the next significant barrier at $176.12.

SOL/USD 4-Hour Chart (Source: Tradingview)

However, if the token reverses and breaches the 50% Fibonacci retracement level, prices may retest support at $144.84 before making another recovery attempt. If it fails to hold this level, the price could decline further, potentially reaching the $135 support zone, with the possibility of falling even lower.

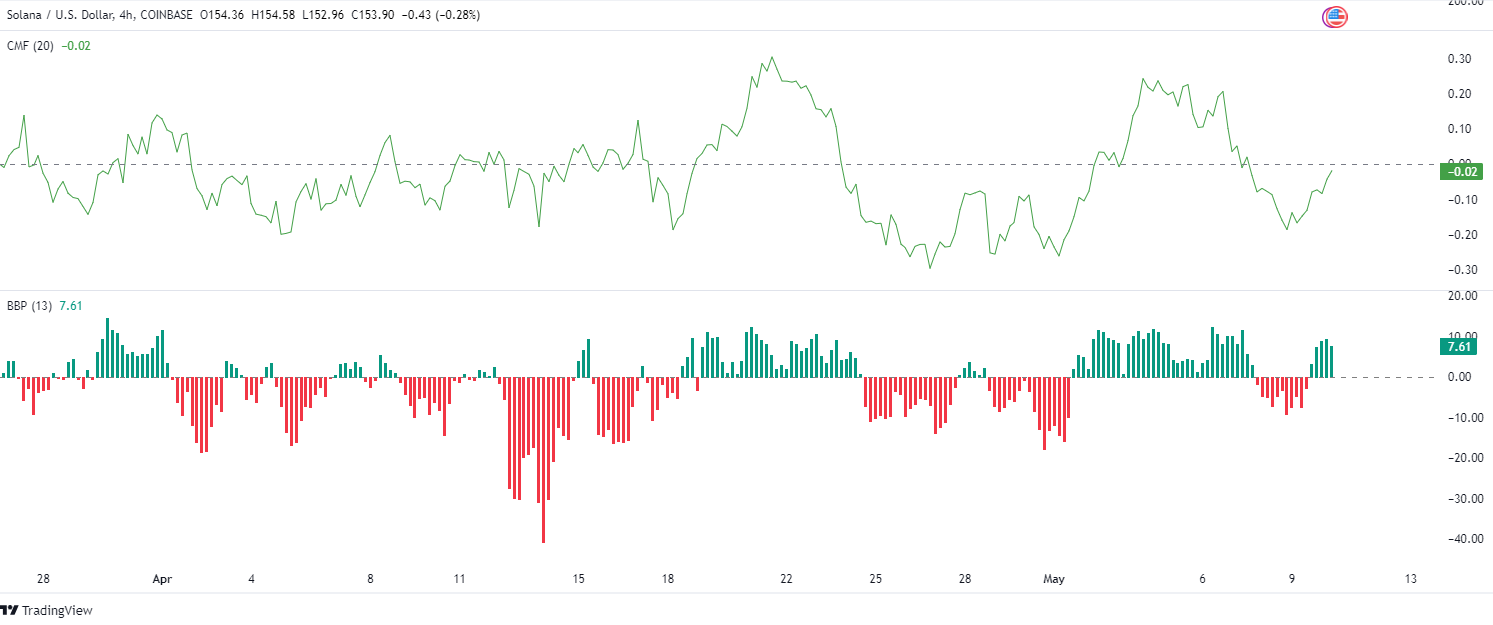

Technically, the Chaikin Money Flow (CMF) indicator currently rests at -0.02, revealing a significant infusion of capital into the market. This vigorous buying enthusiasm has the potential to bolster the price’s ascent, fortifying the bullish momentum.

SOL/USD 4-Hour Chart (Source: Tradingview)

In line with this, the Bull Bear Power indicator shows green bars widening above the zero line. This indicates that bullish momentum is gaining strength, reflecting a market dominated by buyers. If this pattern persists, the SOL token could break through resistance and continue climbing.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com