On the heels of news that FTX customers may reimbursed in full, FTX Token (FTT) registered an impressive run over the past day.

FTT is up by 35.6% in the past 24 hours and is trading at $2.16 at the time of writing. The asset’s market cap surged to $710 million, making it the 108th-largest cryptocurrency. Notably, the FTX Token price reached a six-week high of $2.27 at around 05:00 UTC, last seen in mid-March.

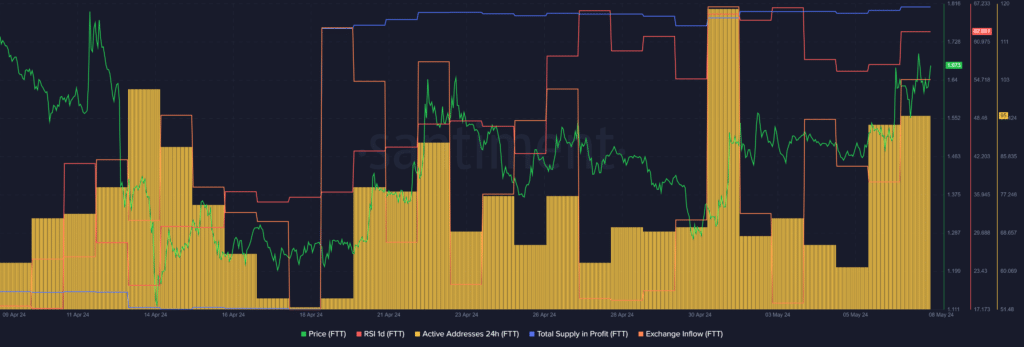

According to data provided by Santiment, the FTT Relative Strength Index (RSI) rose from 57 to 62 over the past 24 hours. The indicator shows the token is currently overheated and high price volatility would be expected.

An RSI of below the 50 mark could potentially put FTT on a gradual price hike.

It’s important to note that the FTX Token has no utility at the moment, and it could still be used to pay the creditors.

A recent report shows that the FTX exchange has billions of dollars more than needed to compensate for the losses it brought to over two million customers in November 2022.

Per data from Santiment, FTT has 95 active addresses over the past 24 hours. While this is a sharp incline from 61 daily active addresses over the past two days, there’s still a high chance of whale activity and manipulation.

Moreover, the FTT daily exchange inflow also increased by 75% in the past 24 hours, reaching 302,950 tokens, according to Santiment. At this point, some investors and traders could be looking for short-term profits due to the sudden increase in the exchange inflow.

Data from Santiment shows that 230 million out of the 328.8 million FTT circulating supply is currently in profit.