The cryptocurrency market is heating up after weeks of uncertainties and significant losses. Amid a potential recovery, two cryptocurrencies stand out with notable strong momentum.

In early May, leveraged long-position traders lost $400 million in 24 hours due to market liquidations. This movement followed four weeks of either losses or neutral price action among decentralized finance (DeFi) assets.

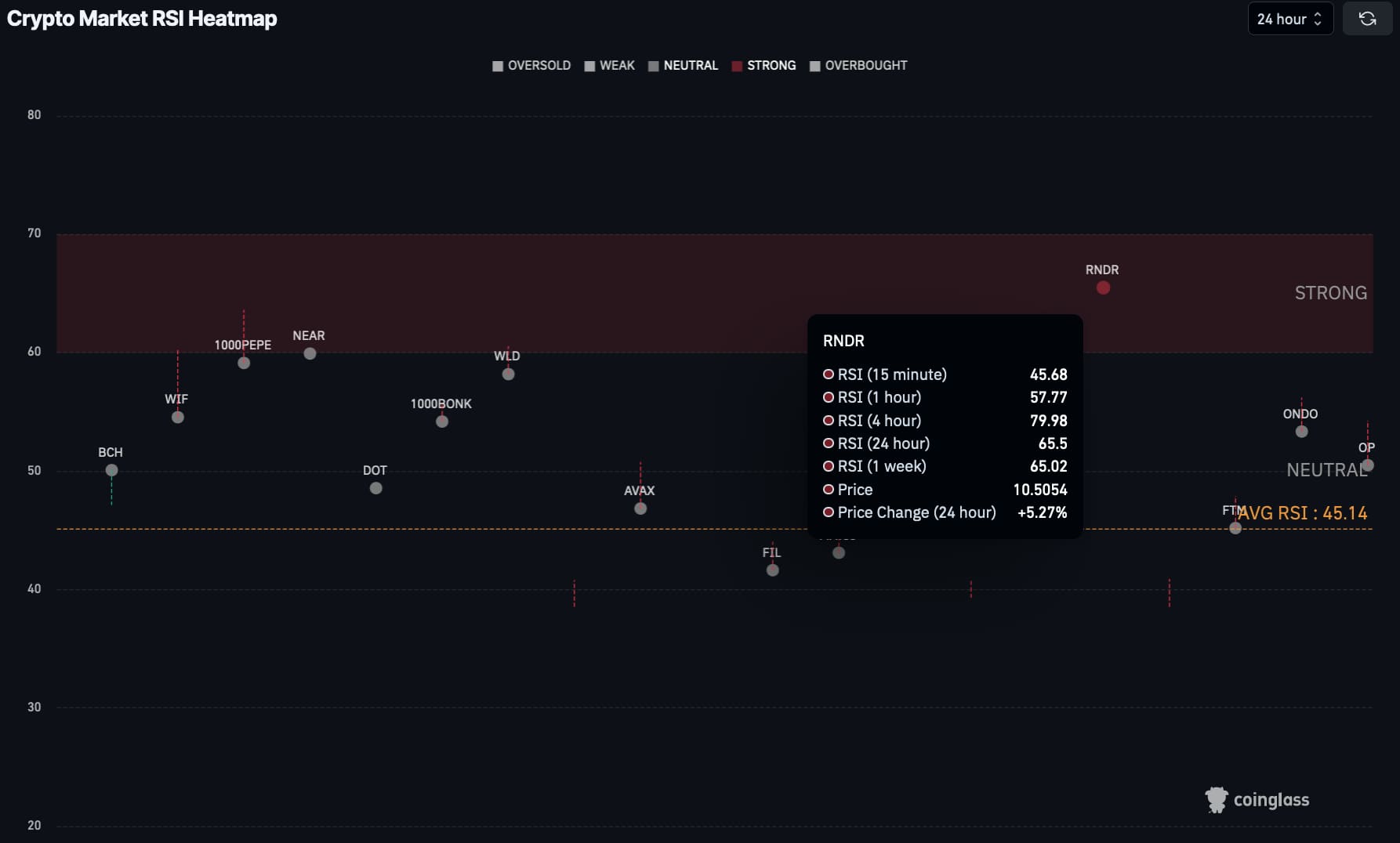

Finbold then recurred to the Relative Strength Index (RSI) heatmap from CoinGlass on May 7 to spot potential buy signals.

Overall, the average weekly RSI shows a neutral-50 landscape that could lead these assets in any direction. On the other hand, the average daily RSI navigates at 45 index points as a result of last week’s turmoil.

Buy signal: Near Protocol ($NEAR)

In this context, Near Protocol ($NEAR) has an interesting setup: a strong weekly RSI of 67.86 points and a strengthening daily RSI of 59.93, which is on the verge of the ‘strong’ level—at 60 index points.

As of this writing, $NEAR trades at $7.48, with a neutral performance in the last 24 hours. Notably, the Near Protocol is one of the most promising Web3 infrastructures in the crypto landscape.

If it passes the 60 index points, the promising Web3-native token will be the second strongest cryptocurrency in the 24-hour time frame among the cryptocurrencies with the largest capitalization. Crypto traders and investors could see this gain in momentum as a buy signal for $NEAR this week.

Strong momentum for the Render Network (RNDR)

Currently, the strongest cryptocurrency is Render Network (RNDR), according to CoinGlass‘s daily heatmap. RNDR was trading at $10.50 by press time, up 5.27% in the last 24 hours. Moreover, the token has a 65.5 daily RSI and promising fundamentals for its protocol.

Similarly, the weekly RSI also shows a strong momentum with the same 65 points, suggesting an uptrend continuation.

However, the market is volatile, and things can change quickly despite the potential buy signal for these two strong cryptocurrencies. Still, this selection has a long-term potential even if the short-term projection is not fulfilled. This is why cryptocurrency investors must do their due diligence and seek solid projects for solid capital allocation.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk

finbold.com

finbold.com