Key Takeaways:

- Tron: Huge in Asian markets despite regulatory scrutiny, powered by Tether.

- Ethereum: Favored in Western markets for its compliance and innovation, powered by $USDC.

- Ethereum has a higher market capitalization, while Tron sees greater daily user activity, suggesting different levels of market engagement.

- The potential outcomes for Ethereum and Tron range from one dominating the market, both coexisting, or both being overtaken by a new blockchain.

Before the advent of radar and satellite navigation, sailors often relied on the flight of birds to determine the presence of nearby land masses. Similarly, in the blockchain markets, the “flight patterns” of stablecoins can often tell you quite a lot about the fortunes of a blockchain project.

As of this writing, Tron is leading Ethereum in $USDT supply, with $57 billion on Tron versus $50 billion on Ethereum. What might this mean for blockchain investors? Can Tron overtake its older, more popular rival as the premier Layer-1 smart contract blockchain?

In short, which token is the better buy in the long term – $ETH or $TRX?

In this guide, we analyze the fundamentals, history, and regional dynamics of both Tron and Ethereum to see if we can find a winner.

The Fundamentals

Behind bitcoin, Ethereum is the second largest crypto in the world, with a market cap of $386 billion. At just $10.6 billion, Tron is a distant 13th on the table overall (and 9th if you only look at L1 blockchains). Bitcoin towers above them all, with a market cap of $1.24 trillion.

Token Price and Supply

At the time of writing, $ETH was worth $3,169, an increase of 178% year over year and 1557% from its value in Q4 2020. Naturally, this price movement has made $ETH a popular option among investors for long-term holding.

$TRX presents a study in contrast in many ways. Since its launch in 2017, the token has never ventured above a peak of $0.23 in price. At the start of Q2 2024, 1 $TRX is worth $0.120, a 6000% increase since 2017 and 173% year-on-year.

Both $ETH and $TRX do not have any limits on the number of tokens that can be issued over time. In both blockchains, a set amount of tokens are regularly burnt off to regulate the available supply and maintain an upward price pressure.

Daily Active Users

On Daily Active Users, our favorite metric, Tron is comfortably ahead of its rivals. The network has around 1.9 million daily users. After crossing the one million milestone in 2022, the numbers have remained relatively stable, with noticeable spikes in 2023 and early 2024.

On Ethereum, the number of daily active users is only around 465,000. The graph looks relatively flat over the years, barring a few minor spikes here and there. Although there is a slow upward trend, it is pretty clear that holders of $ETH typically use the network less often than $TRX owners.

Network Fees

High gas fees have been a perennial problem for the Ethereum network. This has spawned the development of Layer-2 networks (L2s) and sidechains prioritizing lower transaction costs. L2s like Arbitrum and Optimism and sidechains like Polygon offer lower gas fees than the Ethereum mainnet.

Even in 2024, subject to network congestion and demand, gas fees on $ETH mainnet can range from less than a dollar to $70 or more. In contrast, transactions on the Tron network usually cost between $1 - $3, subject to network activity.

Further, Tron also offers free transactions. Users willing to stake $TRX on the network can enjoy transactions without gas fees. The limits can vary depending on the quantity of $TRX staked.

In 2024, Ethereum's annualized fees were around $2.75 billion, with a monthly fee of $226 million. Meanwhile, Tron reported annualized costs of $1.52 billion and monthly fees of $125 million.

Reputation and Regional Dynamics

Any discussion of the Tron network would be futile without a look at its controversial founder, Justin Sun. A fugitive from the Chinese government, Sun has been accused of everything from insider trading to market making, tax evasion, various forms of financial fraud, money laundering, and more.

Even sections of the Tron white paper were allegedly plagiarized from white papers written by Protocol Labs, another blockchain organization. Sun, who owns the Tron Foundation, was charged by the SEC in 2023 for fraud and violations of US securities laws related to the sale of $TRX tokens.

Undoubtedly, investor perception of Tron has been heavily influenced by the negative press generated by Justin Sun over the years. However, despite its early wobbles, Tron has gained traction in key markets outside the US and the EU.

Two key developments were responsible for this:

- The addition of $USDT to the Tron blockchain as a TRC20 token

- Partnership with Binance to support the Tron network on the popular exchange

Tron enjoyed the early mover advantage in providing an easily accessible electronic payment system based around a stablecoin, with very low fees and instant transactions. This proved highly attractive in regions that suffered from the following situations:

- Lack of modern banking systems and high cross-border transaction fees (Asia, Africa)

- High levels of inflation that rendered the national currency unusable (Latin America)

- Western sanctions blocking international bank payments (Russia, Iran)

In these regions and China, the users have acute real-world payment needs that Tron effectively meets. Most do not care about Justin Sun's reputation; many users may not even know his existence.

US regulators have repeatedly targeted $USDT and Tron for non-compliance with financial regulations. However, they are both entrenched in the global market due to the early mover advantage—rival options like $USDC and Arbitrum arrived much later.

How Ethereum (and $USDC) Compares

Regarding reputation, Ethereum’s equivalent to Justin Sun – co-founder Vitalik Buterin – has had no major scandals or controversies associated with him. He is generally recognized as an innovator and pioneer of blockchain technologies.

Ethereum also has a relatively clean reputation, which has aided its adoption as a platform for crypto innovation and investment in Western markets. In tandem, Circle’s $USDC stablecoin has emerged as a popular alternative to $USDT due to its focus on compliance with US financial regulations.

The critical thing to note is that while $ETH is incredibly popular in the West, it is not widely used for real-world solutions like payments. Crypto is primarily seen as a tool for investment and wealth generation through holding or trading.

In contrast, Tron and $USDT have gained popularity in Asia, Latin America, Africa, and Russia as they offer viable alternatives where traditional banking and payment systems have failed.

Application Ecosystems

A quick look at Dappradar.com reveals a clear mismatch between the two networks. Ethereum has well over 4,000 apps, with over a dozen showing thousands of unique active wallets (UAWs). Here is a quick look at the top 5 dapps on Ethereum:

- Xterio: A gaming app with over 67k UAWs and transaction volumes of $716k in 24 hours

- Uniswap V3: A popular trading and AMM protocol with 32k UAWs and $2.7b transactions

- 1inch Network: A liquidity and DeFi aggregator with 9.4k UAWs and $225m transactions

- EigenLayer: A radical new restaking protocol with 8.8k UAWs and $392k transactions

- Uniswap V2: The predecessor to V3, with 7.87k UAWs and $137m transactions

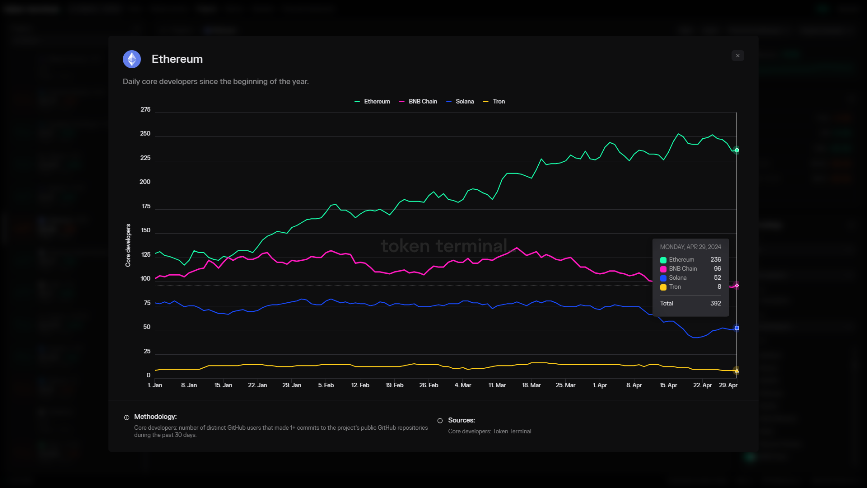

Further, Ethereum has over 236 core developers who made over 1.69k code commits in 30 days. According to DeveloperReport.com, the blockchain attracts the maximum number of active developers, with 2,392 as of December 2023.

Tron has more modest stats in comparison. Apart from 8 core developers, the blockchain reportedly has only 16 independent developers. The ecosystem is far from thriving, and developer activity seems dead mainly, although the platform has around 1380 apps and protocols.

- PayNet Staking: A high-risk staking app with 743 UAWs

- Degree Crypto Staking: Another decentralized staking app with over 500 UAWs

- Tron NRG: A protocol that allows $TRX stakers to rent their energy, with 171 UAWs

- Bitget Swap: A trading wallet with 157 UAWs and $32.6k transactions in 24 hours

- JustLend DAO: A decentralized lending app with 119 UAWs and $277k transactions

These numbers show that Ethereum is way ahead of Tron in terms of ecosystem evolution and developer activity. The vast majority of Tron users are interested only in its $USDT payments feature, which is not bad. It has a niche use case that has gained traction in specific parts of the globe.

However, Ethereum is miles ahead when it comes to testing and developing new ways to use blockchain technology. If you are looking for innovative services and apps that could gain mainstream acceptance in the future, you are more likely to find those on Ethereum's ecosystem.

Scalability and Other Technical Aspects

Ethereum and Tron are highly scalable blockchains, unlike bitcoin, which relies on an energy-intensive proof-of-work consensus model. While Ethereum uses a basic proof-of-stake model, Tron relies on a delegated proof-of-stake consensus mechanism.

Ethereum, in particular, has a significant lead when working on scaling solutions. Dutzende of L2 chains and side chains are currently under development. Tron presently has one primary L2 under development linked to Bitcoin.

Transaction Speeds

Due to the delegated PoS, Tron can process transactions much faster than Ethereum, resulting in a claimed average speed of around 2000 transactions per second (TPS). The Ethereum 2.0 mainnet can only handle between 15 and 30 TPS.

This could change with the addition of newer features like sharding to Ethereum via future updates. Besides, the blockchain already offers faster transaction speeds through sidechains and L2s like Arbitrum (4000 TPS), Polygon (65,000 TPS) and Base (2000 TPS).

Programming Languages

Ethereum is more friendly towards developers as it supports a wide array of programming languages, including Python, Ruby, Rust, Dart, Delphi, Go, Java, and Javascript. In contrast, Tron has adopted a narrower approach, supporting only Python and Solidity.

Future Prospects: Coexistence or Competition?

Given the highly chaotic and relatively unregulated nature of cryptocurrency markets, making confident predictions about anything is difficult. On the future of the ongoing competition between Ethereum and Tron, we can see at least three ways in which it can play out:

Scenario 1: Winner Take All

Ethereum's more likely outcome here is a win. It has wider investor acceptance, and its main weakness is slow and expensive transactions. These issues can realistically be solved via future updates and L2s.

A Tron win is less likely for a multitude of reasons. Apart from the charges against Justin Sun, Tron is also under investigation for using its platform to evade sanctions in Russia and for dangerous activities like terrorism financing in the Middle East.

Scenario 2: Coexistence

Both Ethereum and Tron gravitate towards opposing extremes in the crypto world. Ethereum thrives in highly regulated and developed markets as it can attract and sustain more institutional investors. The SEC approved $ETH futures in 2023. Spot ETFs could follow suit, probably after another legal battle in the US courts.

Meanwhile, Tron seemingly thrives more in grey, unregulated financial markets and regions where financial inclusion faces significant challenges. As regulators in the West exert greater pressure on the blockchain industry, Tron and $USDT could focus more on markets in Asia, Latin America, and Russia.

Scenario 3: Another Blockchain Wins

In this scenario, either an existing or brand-new L1 could rise and disrupt the entire ecosystem, vanquishing Ethereum and Tron. We already have one such contender, Solana (SOL).

Solana already has faster and cheaper transactions and scalability. It is also the fifth most valuable crypto at the time of writing, with a market cap of $61 billion. It is arguably the top L1 contender that has a reasonable chance to overtake Ethereum in the next decade.

Investor Takeaway

Both $ETH and $TRX present interesting opportunities for crypto investors.

$ETH is the world’s second most popular crypto with exciting long-term holding prospects, decent staking APY, and significant institutional backing.

$TRX offers the chance to earn high APY through staking and the advantages of near-zero transaction fees. However, it is significantly more vulnerable to regulatory action.

These two cryptos have different evolutionary trajectories, audiences, and potential use cases.

Much depends on your risk appetite and jurisdiction. For US/EU investors who care about compliance and transparency, $ETH and $USDC are likely safer alternatives to $TRX and $USDT. But a savvy investor could always buy both.

bitcoinmarketjournal.com

bitcoinmarketjournal.com