The crypto Solana, after registering a dip last week below $120, has returned to surpass the psychological threshold of $150, prompting analysts to hypothesize new price forecasts for the resumption of the bull market.

The latest upward movement brings a breath of optimism to the market.

Let’s see everything in detail below.

Summary

The crypto Solana returns above $150 and opens the door to bullish price predictions

The price of the Solana crypto has once again risen above 150 dollars, overturning last week’s predictions that declared the “Ethereum Killer” layer-1 currency dead.

Throughout the month of April SOL has lost about 40% of its value, dropping from $204 to $118 in the midst of one of the most violent retracements seen in the last 2 years.

However, the month of May opened in an extremely positive way, with the crypto seeing a 20% increase in just 6 days and bringing optimism back to the market.

At this point technical analysis suggests that a re-test in the $140 area is possible before a bullish restart, with the first target aiming for a recovery of approximately $170.

After surpassing this level, there will be a fight with local highs before aiming for the ATH located at $259 and entering price discovery.

In the case of a bearish scenario, although weakness can be seen on the Bitcoin chart, it is unlikely that Solana will drop below the price support of $120, where the December 25, 2023 peak and the respective lows of April 13 and May 1 converge.

Anyway, after the bulls’ reaction in recent days, forecasts are in favor of the cryptocurrency price rising in the medium term.

The graphic recovery of Solana has been accompanied by a 37% increase in spot trading volumes compared to the last 24 hours, driven by the influx of capital arriving on Bitcoin and Ethereum after the debut of the ETF in Hong Kong.

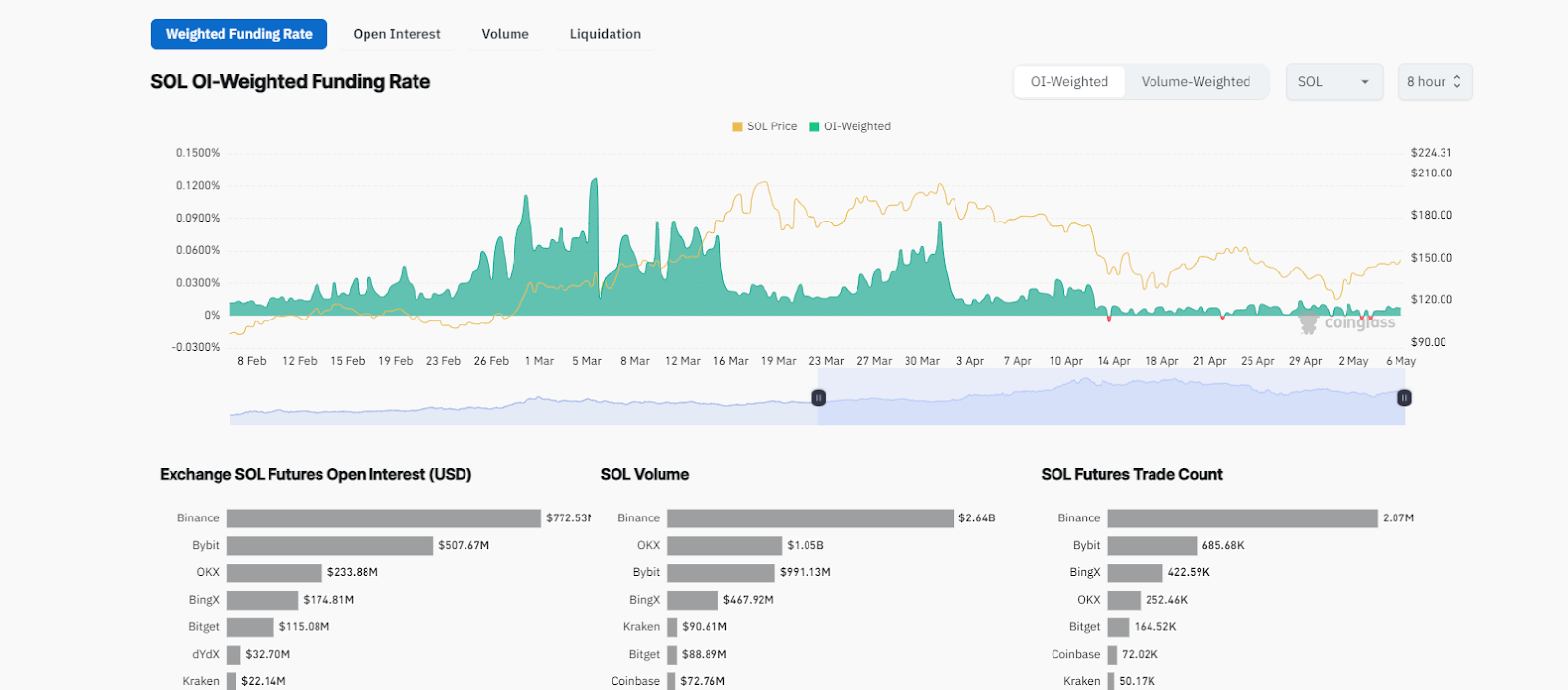

On the derivatives markets instead, Solana records a significant increase in the open interest metric, which indicates the sum of all open positions on the crypto, back above 1.6 billion dollars.

According to Coinglass, it emerges how the OP weighted on Solana’s funding rate (funding rate on futures), highlights the presence of an outlook reset by the wild speculation of the first quarter of the year.

From here on, the currency has the opportunity to resume a healthy upward trend, without an abuse of financial leverage by traders at this moment in the market.

As graph prediction, we can believe that the crypto will surpass the price of 200 dollars by the end of Q3 2024.

Volumes increasing on Solana DEX: surpassed Ethereum in the last 24 hours

A recent surprising data emerged that surprises the community of crypto enthusiasts, concerns the on-chain volume recorded by Solana DEXs in the last 24 hours.

It seems that what is supporting the price rally of the crypto and pushing traders to make bullish predictions in the short term is a sudden increase in trading volume in the decentralized markets of the blockchain in question.

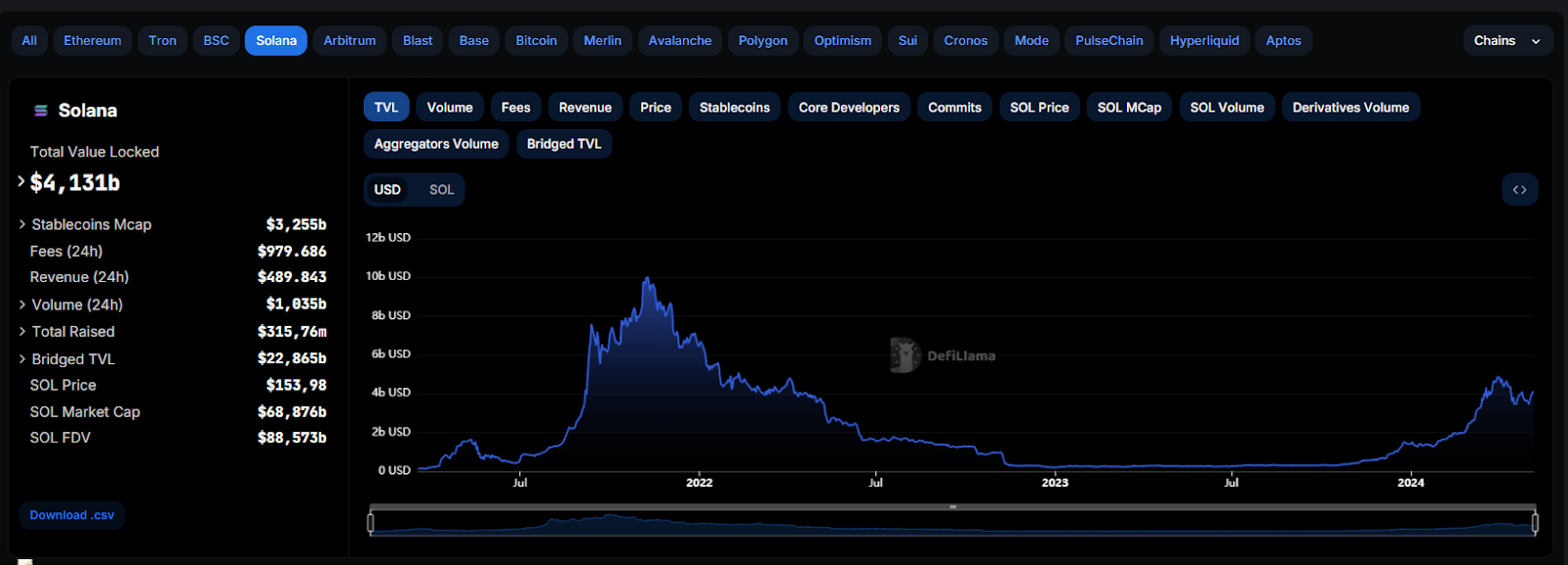

According to the data from DefilLama, then shared by several users on X as “DegenerateNews“, the cryptographic volumes on Solana have reached the threshold of 1 billion dollars, even surpassing what was recorded by Ethereum.

Orca and Raydium lead the ranking of the most used platforms, reporting traders for 300 million dollars each, with Meteoria and Phoenix following with both 140 million dollars in volumes.

BREAKING: @solana FLIPS @ethereum IN 24H DEX VOLUME pic.twitter.com/Z8BMR5PJOR

— DEGEN NEWS 🗞️ (@DegenerateNews) May 6, 2024

Although Solana has surpassed Ethereum in terms of volumes in the last day, it has not yet completed the so-called “flippening” in market capitalization.

Currently, ETH has a circulating market cap of 344 billion dollars while SOL stands at 62 billion dollars, about 5.5 times less than its biggest rival.

The superiority of ether as an investment asset is mainly dictated by a technology that is less recent compared to Solana’s, and by a blockchain that supports much more investment capital.

Despite Solana being known for speculation fever, the trend of memecoins, and the presence of a less expensive and more scalable infrastructure, the EVM terrain still seems to be the favorite for the development of decentralized platforms.

In fact, the richest dapps, as well as the most secure ones, are found on Ethereum, while Solana is exclusively an ecosystem for degens and sybils who clog the chain with hundreds of mini-transactions every day.

Anyway, experts’ forecasts suggest that the entire DeFi sector will grow significantly in the coming months, reaching a TVL of 200 billion dollars.

In a scenario like this, even Solana will be able to capture a slice of this market, potentially surpassing the maximum TVL value recorded, set at 10 billion dollars.

All in all, even though it will never be able to surpass Ethereum, it will still have a bright future.

en.cryptonomist.ch

en.cryptonomist.ch