Litecoin price smashed through the $80 resistance on May 3, on-chain analysis examines how $LTC whale investors could drive the rally further in the days ahead.

Litecoin Price Spikes 11% as amid Positive Macro Tailwinds

This week, Litecoin emerged one of the top gainers in the top 20 crypto market rankings as its price outperformed the rival mega cap Proof of Work (PoW) coins Bitcoin and Dogecoin.

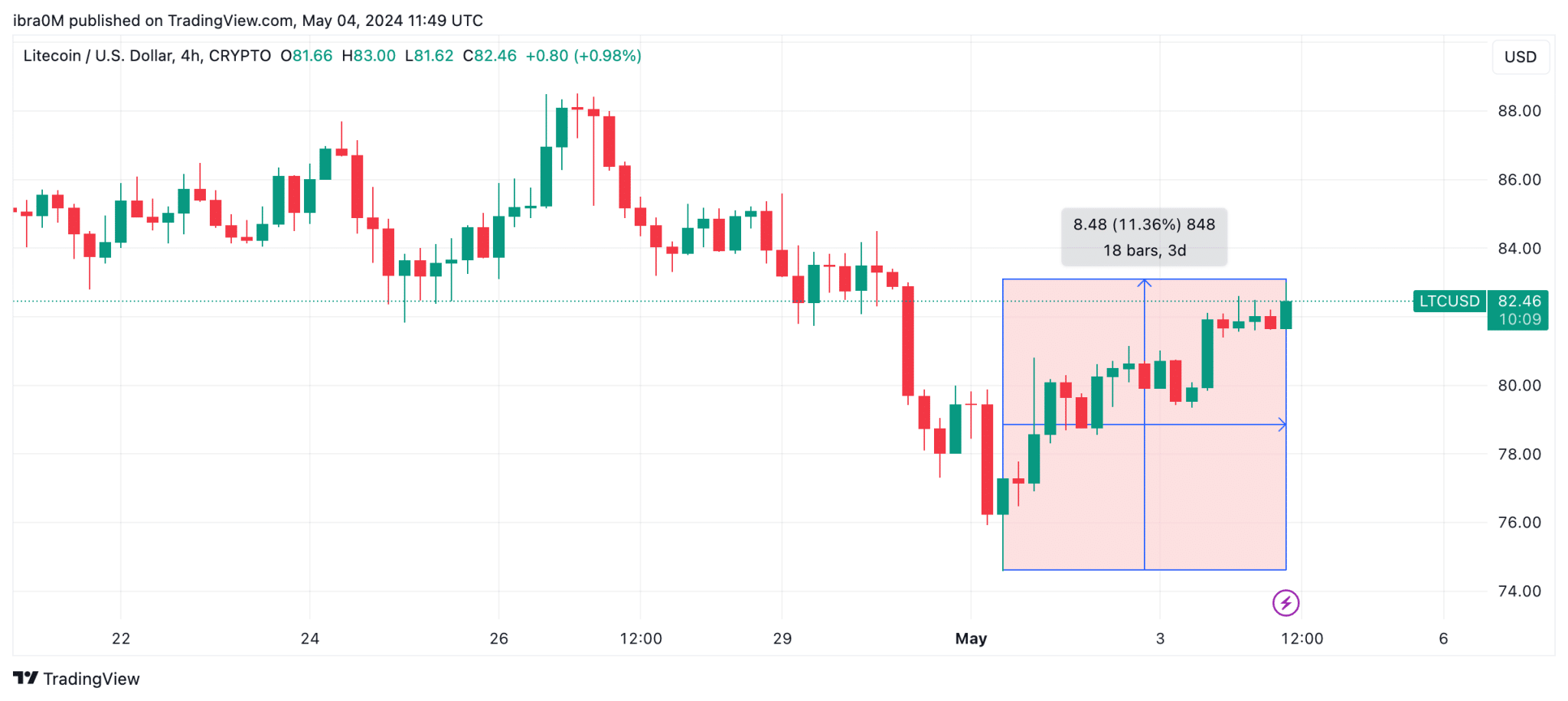

Litecoin price has now surged 11.3% within the first 5-days of May 2024, as depicted in the TradingView chart above.

Overall, the crypto market recovery this week has been attributed to bullish headwinds from macroeconomic indices reported by US authorities this week. When Fed announced a rate pause on Wednesday, it threatened to throw markets into another tailspin.

However, the underwhelming Non-Farm Payrolls report published on Friday appears to have reaffirmed investors’ expectations of an imminent rate cut.

Whales Investors Sparked Bullish Momentum with $8M $LTC Acquisition

While Litecoin price also benefited from the broader crypto market upswing on Friday, a closer look at the core $LTC trading data shows that the Litecoin rally, which began before the latest US macroeconomic metrics, has unique fundamental catalysts.

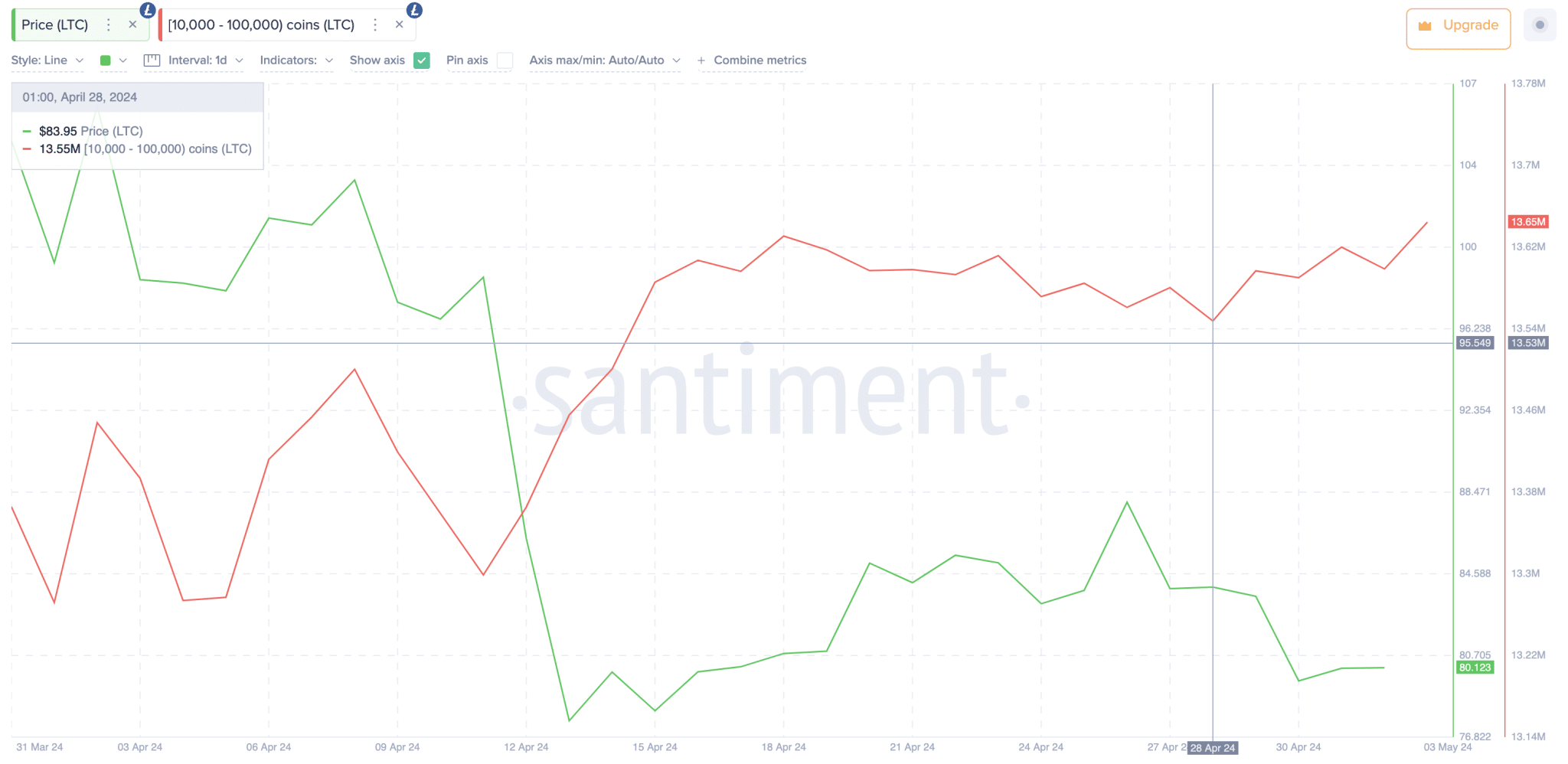

The Santiment chart below tracks real-time changes in balances of wallets holding at least 10,000 $LTC (~$800,000).

As of April 28, these Litecoin whales held cumulative balances of 13.55 million $LTC. But interestingly, while prices tumbled at the end of April, rather than join the sell-off, the whale investors increased their $LTC holdings, capitalizing on the price dip.

At the time of publication on May 4, the Litecoin whale cohort identified above now have balances of 13.65 million $LTC, which reflects an addition of 100,000 $LTC.

When valued at today’s $LTC prices, the whales have effectively invested $8.2 million in the last 7 days between April 28 and May 4, 2024.

First, a prolonged period of large purchases from whale investors enhances market depth and provides additional liquidity, allowing early profit-takers to exit without triggering major price downside.

Unsurprisingly, the whales’ buying trend has coincided with an 11.4% surge in Litecoin prices.

Litecoin Price Forecast: $90 Target in Focus

Having smashed the $80 resistance, $LTC price now looks likely to advance towards higher targets above $90 especially if the whales keep adding to their recent $8.2 million purchase.

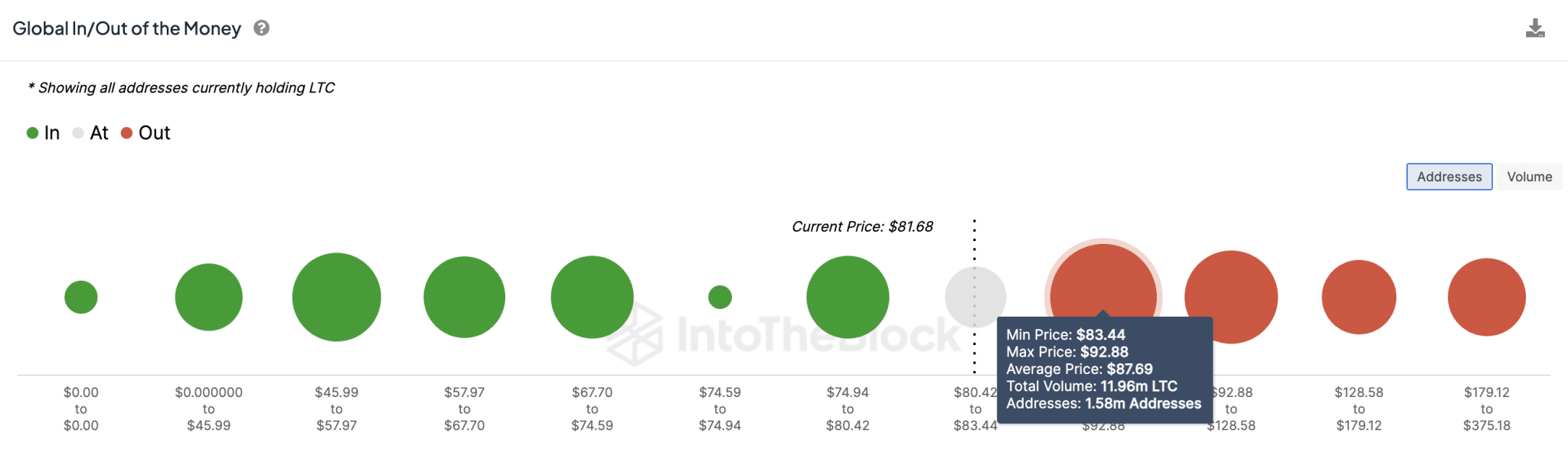

In terms of critical resistance levels, the IntoTheBlock data highlights that $LTC bulls could face a daunting sell wall at $87 territory. The chart below shows a cluster of 1.58 million addresses that acquired 11.96 million $LTC at the average price of $87.69 per coin.

But if those investors opt to hold out for more gains rather than exit early, Litecoin price could stage a decisive breakout above $90 as predicted.

On the contrary, if the market slides into another bearish reversal, the bulls can count on the looming buy wall at the $80 area for steady support in the near-term.

thecryptobasic.com

thecryptobasic.com