Crypto and forex analyst World of Charts believes Shiba Inu could record a 120% spike amid an imminent solid bullish wave once it breaks out of consolidation.

With Shiba Inu up 10.94% this month, market sentiments have quickly switched from bearish to bullish, as investors expect a recovery of the massive 27.16% loss incurred in April. Notably, this marked Shiba Inu’s biggest losing month since May 2022, when it dropped 41.82% on the back of the Terra ecosystem collapse.

Amid the growing bullishness, World of Charts revealed in a recent analysis that $SHIB is currently consolidating within a bullish flag on the 8-hour chart. Shiba Inu formed this flag pattern when it dropped from the $0.00004567 yearly high on March 5, marking the start of its downward slope.

Shiba Inu Consolidates Within a Flag

Following this collapse, $SHIB entered into a bearish consolidation phase, witnessing intermittent declines and a string of lower lows and lower highs that eventually formed a downward channel. World of Charts highlighted this trend in his chart, stressing that this channel represents Shiba Inu’s bull flag.

$Shib

Consolidating In Bullish Flag In H8 Timeframe Incase Of Successful Breakout Expecting Solid Bullish Wave Expecting 100-120% Bullish Wave#Crypto #Shib pic.twitter.com/vfLClaexvu

— World Of Charts (@WorldOfCharts1) May 3, 2024

Typically, a bull flag is a consolidation pattern that emerges after a massive price upsurge. This flag represents a temporary pause to the ongoing rally before an imminent resumption. World of Charts’ analysis hinges on this premise, with the analyst projecting an upcoming breakout.

According to him, once $SHIB breaks above the downward sloping channel, investors should expect a further push toward previously lost highs, with an ultimate target of 120%. At Shiba Inu’s current price, a 120% upsurge would result in the reclamation of $0.00005434, leading to a new yearly peak.

$SHIB Witnesses Bullish Momentum

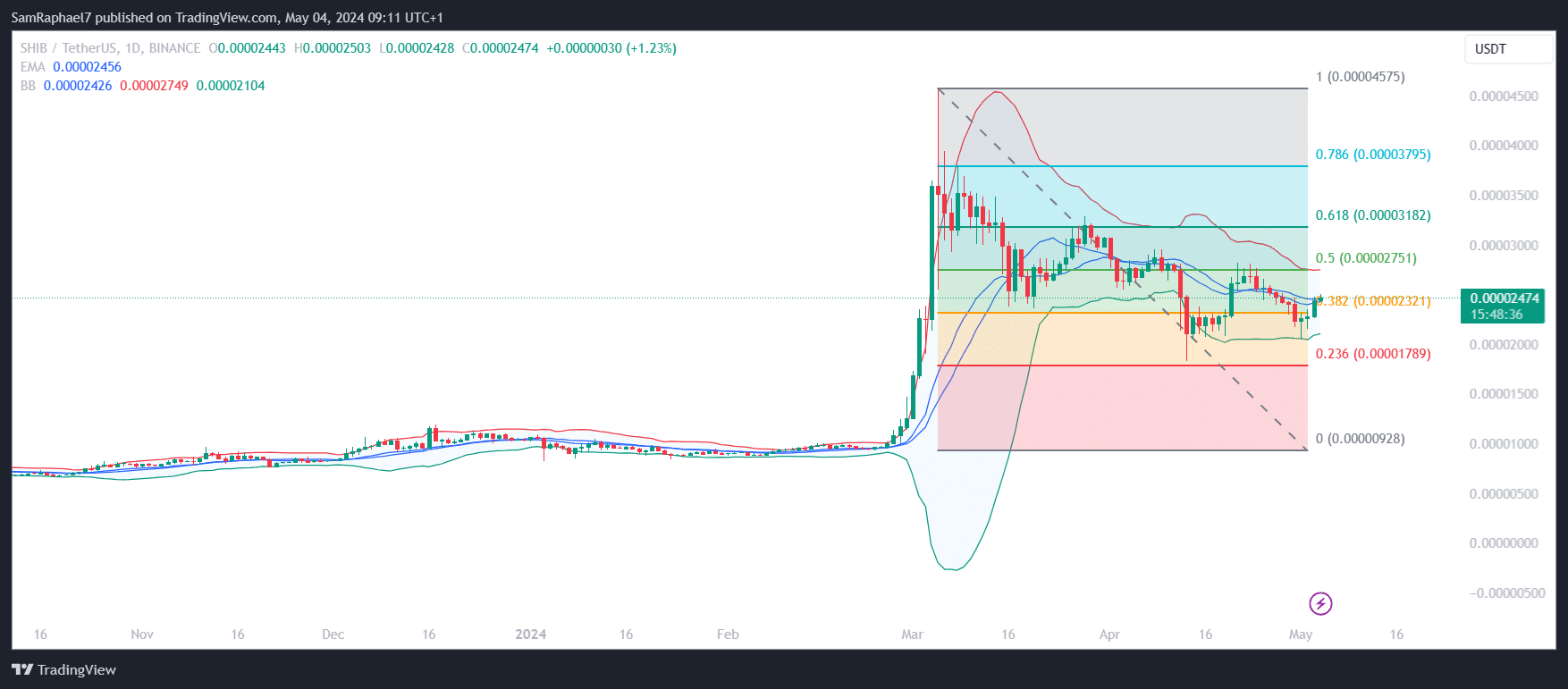

Meanwhile, $SHIB’s current momentum suggests that this breakout could be on the horizon amid the 2-digit monthly gain. The Bollinger Bands on the daily timeframe looks to be tightening, as observed from Feb. 25 to 26. This pattern, which led to the late February rally, could precede a similar price upsurge for $SHIB.

Shiba Inu’s immediate goal at the current position is to seal a comfortable spot above the 20-day EMA at $0.00002426, as it currently trades for $0.00002474. The bulls would need to push toward reclaiming the upper Bollinger Band at $0.00002753. This move would solidify the short-term bullish momentum.

Meanwhile, Coinglass data confirms that, while $SHIB has seen a 3.38% decline in derivatives volume, Open Interest has spiked by 13.3% to $64.83 million over the last 24 hours. This surge in Open Interest is accompanied by an increase in long positions, indicating growing confidence in Shiba Inu’s recovery.

thecryptobasic.com

thecryptobasic.com