Following this week’s cryptocurrency market crash, digital assets currently display bearish technical indicators like a weak relative strength index (RSI). However, two popular cryptocurrencies have a potential buy signal, with an extremely oversold status on May 1.

As reported by Finbold, long-position traders lost $400 million since April 30, as $250 billion in capitalization left the market. The crash impacted Bitcoin (BTC) and Ethereum (ETH) traders, mostly, but all cryptocurrencies suffered meaningful losses.

Previously, crypto traders registered $100 million in total liquidations within a 4-hour time frame, which started the major sell-off. As a result, the average RSI dropped to a weak status below 34 index points, suggesting an overall bearish momentum.

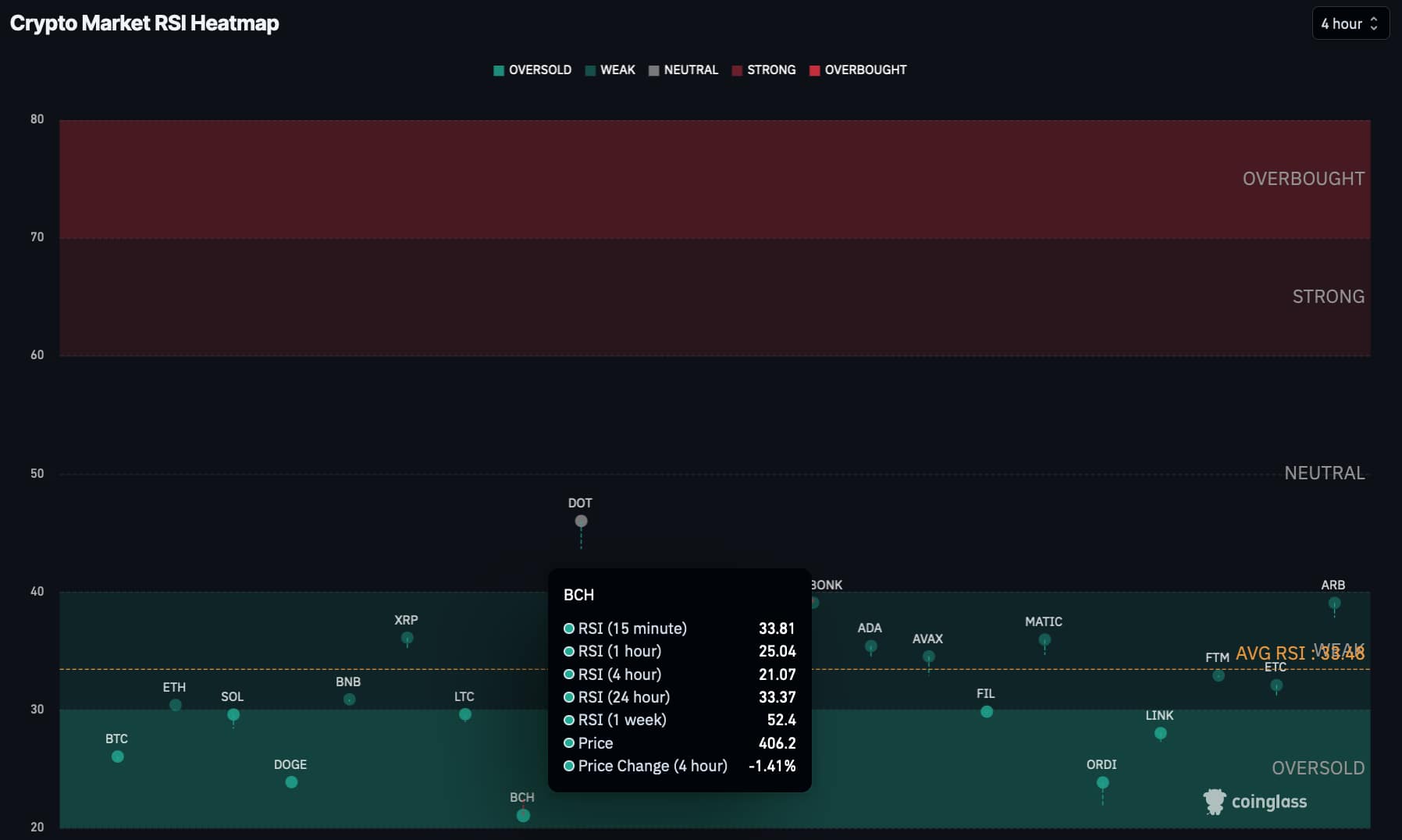

Conversely, while some traders panic sell, others may see a buy signal opportunity for cryptocurrencies with discount prices. In particular, Finbold identified Bitcoin Cash (BCH) and Dogecoin (DOGE) as the two most oversold cryptocurrencies in CoinGlass‘s 4-hour chart.

Bitcoin Cash (BCH): Most oversold crypto

First, Bitcoin Cash was the most oversold cryptocurrency at press time, with a 21.07 4-hour relative strength index. BCH holds a neutral 52.4 in the weekly time frame despite having a weak 24-hour RSI of 33.37.

As of this writing, the coin trades at $406.2, down 1.41% in the last four hours.

Finbold previously reported two other buy signals for Bitcoin Cash due to high negative funding rates and short-squeeze liquidations. The renowned Bitcoin competitor stood out as an alternative as BTC fees reached record highs above $100 per transaction.

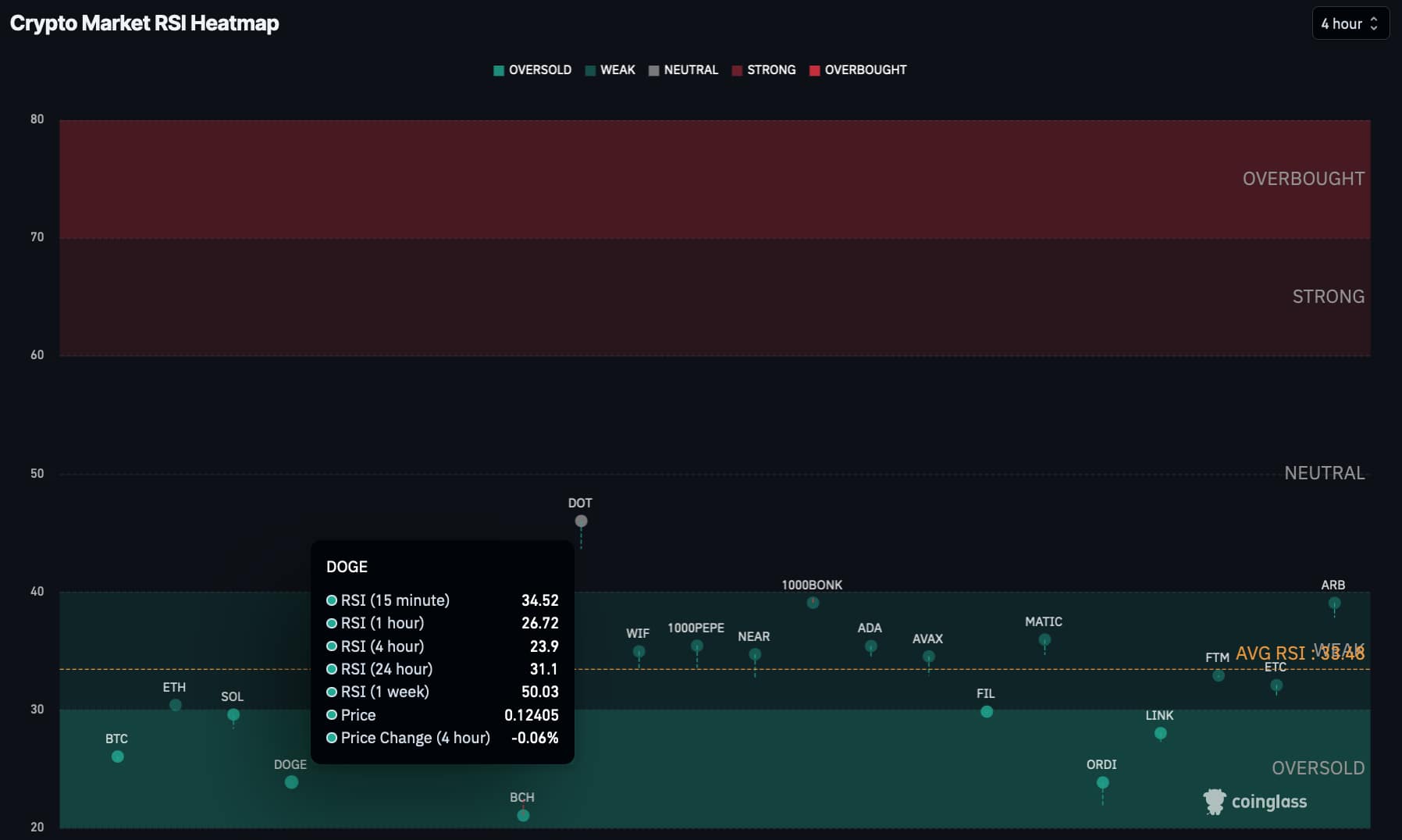

Buy signal for Dogecoin (DOGE)

Meanwhile, Dogecoin has the second-highest oversold signal among the top 100 cryptocurrencies in the 4-hour time frame. DOGE was trading at $0.12 at the time of publication, with a 23.9 RSI.

Like Bitcoin Cash, the leading meme coin has a neutral 50.03 and a weak 31.1 weekly and daily RSI, respectively.

Notably, having an oversold status does not guarantee short-term positive price action and is often seen as a bearish indicator. For now, cryptocurrency investors await a leading signal that could come from macroeconomic decisions from the Federal Reserve’s interest rate decision.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com